The current market price of Ethereum (ETH) is hovering around $1570. If the price manages to consolidate above the critical level of $1670, it could be an encouraging sign for bullish investors.

On January 31, the developers of Ethereum made an exciting announcement regarding the launch of the Zhejiang test network. The primary purpose of this network is to facilitate the testing of the withdrawal functionality of staked coins on Beacon Chain. Surprisingly, this announcement did not result in any significant market reaction for ETH.

However, according to the latest market statistics, the whales – investors who hold significant amounts of ETH – seem to be losing interest in Ethereum. Additionally, more and more futures market participants are betting on a potential decline in the price of ETH in the coming weeks.

Despite this, the situation could change quickly if the Zhejiang network testing and the subsequent Shanghai update launch without any significant technical issues. Such developments could boost market confidence in Ethereum and potentially attract renewed interest from investors.

As of February 7, a major milestone was achieved for Ethereum as the first successful simulation of withdrawing ETH from staking was executed on the testnet. This development marks a significant step forward in the adoption and practical implementation of staking on the Ethereum blockchain. The successful activation of the Capella fork during the 1350 era was instrumental in making this progress possible.

Ethereum has reached a critical level

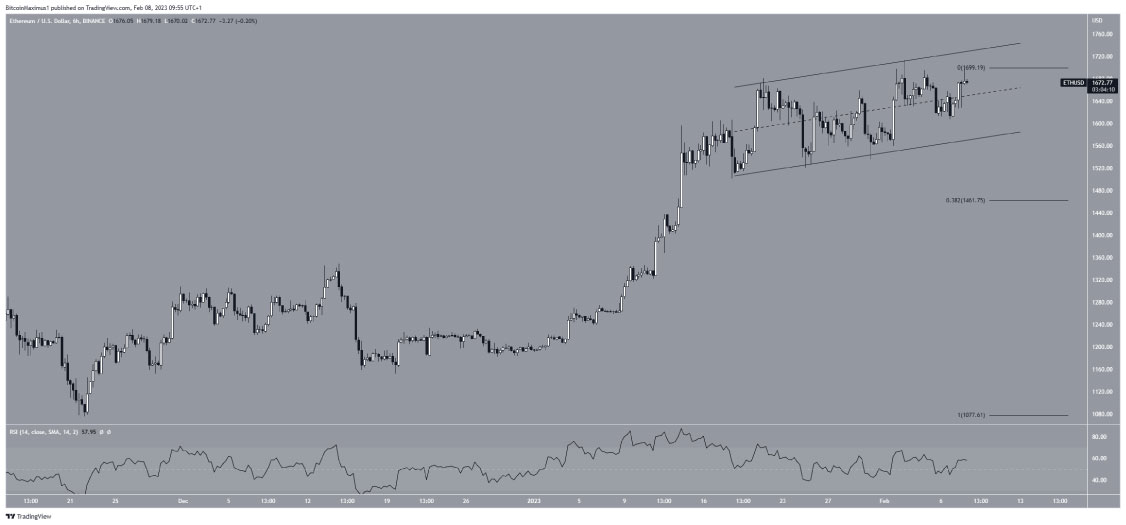

Based on the technical analysis, Ethereum (ETH) managed to break through the descending resistance line on January 11, and has since shown remarkable strength in its upward trajectory. This bullish trend culminated on February 2, when the price reached a peak of $1,712.

However, the price action encountered a hurdle in the form of a shooting star candlestick pattern, testing the critical resistance level of $1664. This level is significant because it coincides with the Fibo 0.618 retracement level and horizontal resistance. Nevertheless, Ethereum demonstrated resilience and made a bullish attempt to break through, forming a strong candlestick on February 7.

The daily Relative Strength Index (RSI) is indicating promising signs, suggesting that the price of ETH has broken out of the bearish divergence trendline. In this scenario, there is a high probability of a confident recovery above the $1664 resistance level, paving the way for further growth towards $2000. However, a potential pullback from this resistance level could lead to a drawdown towards the nearest Fibo support level at $1461.

The fate of ETH may be decided in the near future

The fate of Ethereum remains uncertain in the short-term, as the price action appears to be at a critical juncture. Since January 18, the price has been trading inside an ascending parallel channel on the 6-hour chart. While this type of pattern is typically bearish, the fact that ETH is currently at the top of the channel suggests a possible bullish breakout.

The ascending parallel channel coincides with a key resistance area on the daily chart, further highlighting the importance of this short-term pattern. The price action outside of this channel could determine the direction of Ethereum’s longer-term trend in the near future.

As a result, the movement of ETH is currently unclear, and it remains to be seen whether the price will experience a bullish or bearish breakout from the current pattern. In the event of a bullish breakout, the price could surge towards its all-time high around $2,000. Conversely, a bearish breakout may lead to a retest of the nearest Fibo support level at $1,461.

In the longer term, however, many investors and analysts remain bullish on the prospects of Ethereum. The continued development of Ethereum 2.0, the growth of decentralized finance (DeFi) applications, and the increasing adoption of blockchain technology all bode well for the future demand and use cases of ETH. As such, despite the uncertainty in the short-term, many believe that Ethereum has the potential to become a major player in the crypto and blockchain space.