Cryptocurrency market kicked off the week with a burst of volatility, impacting major players like Bitcoin (BTC), Ether (ETH), and Solana (SOL). As the trading day unfolded, red dominated the charts, leading to fluctuations that caught the attention of investors.

Bitcoin’s Rollercoaster Ride

Bitcoin took a hit, experiencing a 5% drop within a 24-hour period, plunging to $42,000 before bouncing back to $42,500. Despite the setback, BTC maintained a bullish trend, breaking the $40,000 resistance and steadily climbing above $42,000.

On the hourly chart of the BTC/USD pair, a notable development was the break below a crucial bullish trend line with support near $43,500. The market’s resilience was challenged, leaving analysts to closely monitor whether Bitcoin could maintain its positive momentum or succumb to further downward pressure.

The ascent even reached above $44,000, but the $45,000 resistance proved elusive. The failure to breach this level triggered a sharp correction, with a significant downside risk. Key support levels at $40,500 and $40,000 emerged, and if breached, the price could potentially dip to $38,500.

Liquidation Frenzy and Cryptocurrency Market Corrections

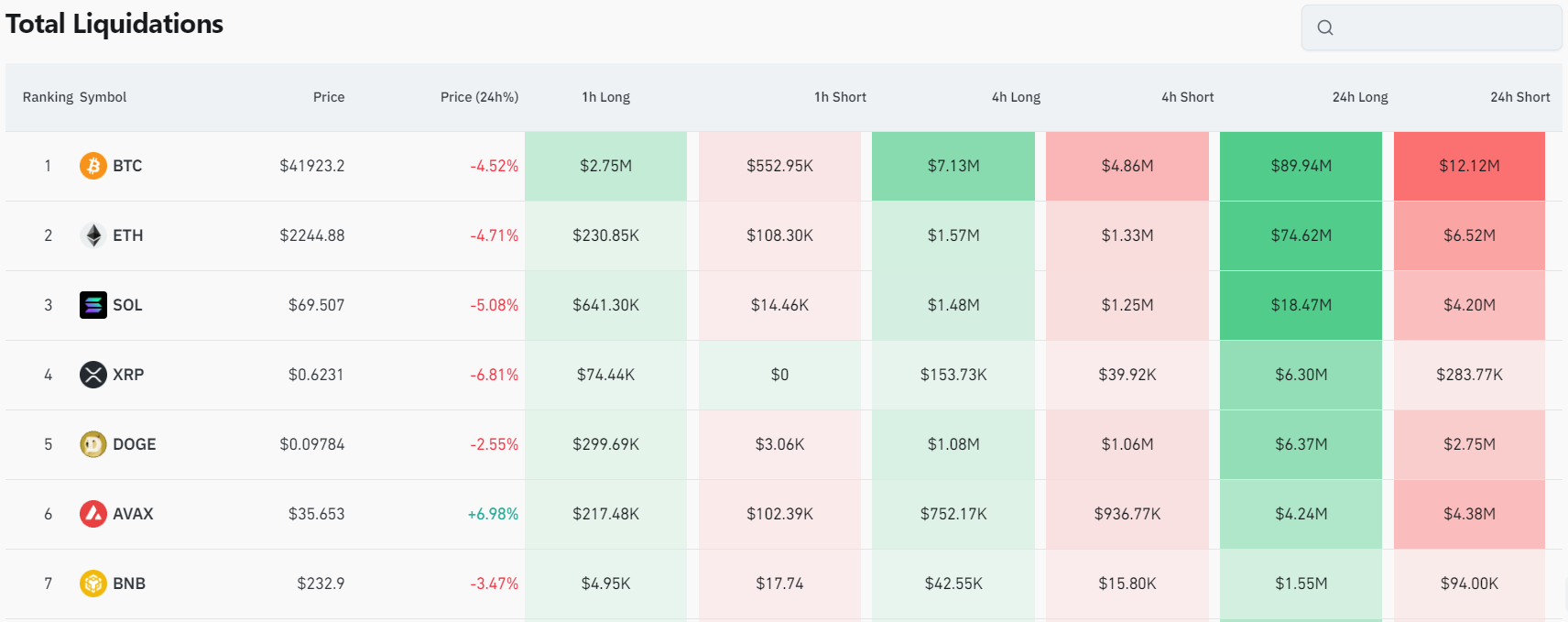

The tumultuous day in the cryptocurrency market was marked by substantial liquidations, totaling over $335 million in the last 12 hours. Long positions bore the brunt, with $300 million wiped out. Bitcoin and Ether led the liquidation heatmap, witnessing over $90 million and $75 million in liquidated positions, respectively.

As the market faces the prospect of corrections, analysts are eyeing a potential dip in Bitcoin prices to $39,700. The significance of this level is highlighted by the Bitcoin CME Gap at 39.7k—a phenomenon where a gap emerges at $39,700 due to price jumps on the Chicago Mercantile Exchange. Historical trends suggest that such gaps often get filled, indicating a potential return to this level.

Conclusion: Navigating the Cryptocurrency Market

The recent market turbulence serves as a reminder of the inherent volatility within the cryptocurrency space. While Bitcoin and other major altcoins showcase resilience, the uncertainty underscores the importance of cautious optimism. As investors and traders navigate these waves, the industry’s ability to weather such fluctuations continues to be a focal point, and the coming days will reveal whether the market can sustain its upward trajectory or succumb to the pressures of the rollercoaster ride.