Liquid staking services have become increasingly popular among investors, with the top two, Lido and Rocket Pool, capturing the majority of the market share among decentralized options. According to RBC Crypto, the rate of native tokens Lido (LDO) and Rocket Pool (RPL) has increased by 144% and 98%, respectively, since the beginning of the year, forming its own narrative on the crypto market and leading to a rise in the cost of tokens of their less widely known competitors.

Coinbase, the second largest cryptocurrency exchange, entered this market and quickly took the lead thanks to its own staking service and the associated Coinbase Wrapped Staked ETH (cbETH) token. In terms of the amount of ETH staking on their platforms, Lido and Rocket Pool hold 76% and 3.5% of the market, respectively, while Coinbase quickly gained 17% of the market.

Demand

The Beacon Chain parallel network was launched in the Ethereum ecosystem in December 2020. The main Ethereum blockchain was still using the Proof-of-Work (PoW) algorithm to process transactions, and the developers were just getting ready to switch the network to the Proof-of-Stake (PoS) algorithm, which did not require their involvement. Even before The Merge update on September 15 last year resulted in its literal “merger” with the main network, those who wished could place their ETH coins on the Beacon Chain network, which initially supported staking.

A minimum of 32 ETH in collateral and specialized equipment with fast and reliable Internet are required if you would like to actively participate in Ethereum staking. You can gain money in the form of a block reward when issuing new currencies and various additional sources of payments in ETH by joining the validators in this way. As more validators join the network, the return on stake diminishes. It is currently yielding 5.4% annually on a holding of 16.2 million ETH.

The crucial point is that, despite Ethereum’s successful switch to the PoS algorithm in September, people who have staked tokens thus far are unable to withdraw them. A similar chance will present itself with an upgrade titled Shanghai, which is anticipated to occur in March of this year. The inability to withdraw one’s own money has grown to be a potent catalyst for the expansion of liquid staking services.

Derivatives

Members of staking pools can invest any amount in them, and in proportion to that investment, they will receive staking revenue. Similar to this, mining pools combine the computing power of thousands of users’ devices.

The pool locks user funds until the Shanghai update by staking them in an Ethereum staking contract. Pool operators simultaneously issue a derivative token that is backed equally by the assets users have placed on the platform. Investors in the Lido pool earn stETH tokens, whilst donors to the Rocket Pool receive rETH. Also, they make money by betting in the pool.

The above tokens provide users with access to their underlying positions’ liquidity, enabling them to trade them or utilize them in a variety of Decentralized Finance (DeFi) protocol-based ways to make extra money.

The amount of ETH staked in pools has increased by over 2,000% from 265K ETH at the beginning of 2021 to over 6.9M ETH in January, which is equivalent to 5.6% of all coins in existence. This growth has been attributed to the introduction of Lido, Rocket Pool, Stakewise, a service from Coinbase, and other liquid staking operators.

Prices

Decentralized autonomous organizations (DAOs) were created by liquid staking services to manage and compensate players in various roles with their own tokens. Coinbase recently declared its intent to join the Rocket Pool project’s Oracle DAO. As a DAO member, Coinbase will be in charge of running Rocket Pool nodes, providing real-time ETH pricing data, and casting votes for protocol changes. Coinbase will be compensated with RPL tokens for these services.

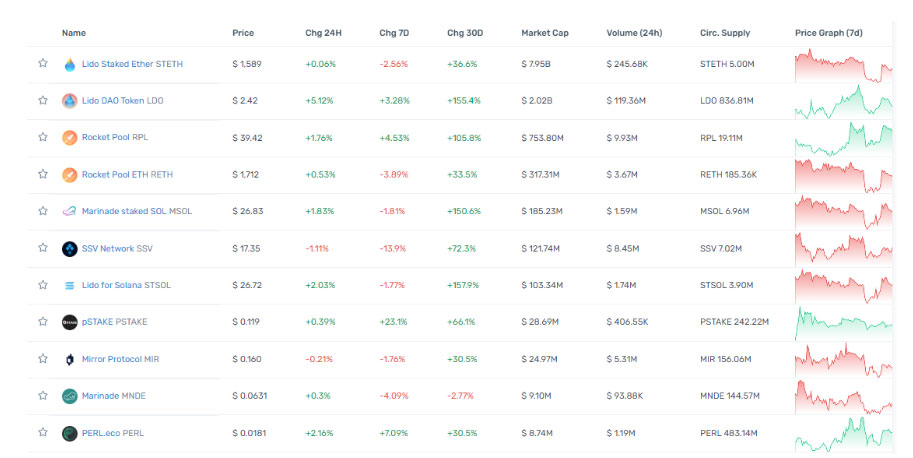

Since the beginning of the year, one of the most popular narratives on the crypto market has revolved around most capitalized leaders, even in relatively small services. In addition to owning Rocket Pool (RPL) and Lido DAO (LDO) tokens, price increases of tens of percent were seen in coins of Stake Wise (SWISE), Stafi (FIS), Stader (SD) projects, and other tokens classified as “Liquid staking” by aggregators. RPL’s listing on Binance Exchange resulted in an additional 30% increase in the token’s price.

With the Shanghai update allowing staking withdrawals, a significant influx of ETH coins into the market could potentially put pressure on their price. On the other hand, the ability to withdraw coins can attract new participants to staking, for whom this was a critical point, which will increase the amount of coins in staking and smooth out potential market pressure.

Ethereum has a relatively low staking ratio of around 14% when compared to the leading PoS cryptocurrencies. Solana has 71% of the existing coins staked, Cardano 72%, and BNB 97%. This implies that many more ETH holders could potentially join the ranks of network validators, either on their own or through pools.

Profit

Individuals who want to profit from staking Ethereum should be aware of the differences between centralized and decentralized platform functioning. Users who want to use centralized services must register and go through Know Your Customer (KYC) processes. Also, the platform is in charge of keeping funds, which has the same dangers as those present in conventional crypto exchanges.

You can stake assets using decentralized systems like Lido or Rocket Pool directly from your non-custodial wallets like Metamask or Ledger, which do not hold user keys. Yet, these platforms come with the same dangers as DeFi projects, such as hacker-friendly flaws in smart contracts.

Apart from Ethereum, popular platforms also offer liquid staking options for other cryptocurrencies. With their respective derivative tokens, stSOL, stMATIC, stDOT, and stKSM, Lido allows staking for Solana, Polygon, Polkadot, and Kusama, for instance.

If tokens are managed carefully, more advanced “yeild farming” techniques like DeFi protocols can help maximize returns. By contributing liquidity on decentralized exchanges (DEX), for instance by adding your stETH and an equivalent quantity of ETH to the stETH-ETH pool, you can get additional income. These services can be found on Uniswap, Sushiswap, Curve, and other platforms that are comparable. In decentralized lending systems like Aave or Compound, you can lend interest-bearing staking tokens or use them as security for loans.

Before to investing in such instruments, it is crucial to do one’s own analysis of tactics and protocols and be aware of the hazards involved, such as flaws in smart contracts or major swings in token prices.