Ethereum, the second-largest cryptocurrency by market capitalization, is gearing up for a significant upgrade known as Shanghai. Slated for release in March 2023, this upgrade is second only in importance to The Merge, which shifted Ethereum to a Proof-of-Stake (PoS) consensus algorithm.

One of the primary features of the Shanghai upgrade is the ability for users to withdraw ETH from the Beacon Chain deposit contract. This upgrade also includes several system improvements that are expected to enhance the platform’s performance and user experience.

However, some members of the Ethereum community are concerned that the upgrade could exert negative pressure on the price of Ether. They believe that the opening of the withdrawal option could lead to a significant decrease in demand for liquid staking services such as Lido, which could in turn affect the overall market.

The question remains: are these concerns warranted, and what impact will the Shanghai upgrade have on the price and prospects of Ethereum?

The upcoming Shanghai upgrade for Ethereum has generated a significant amount of optimism within the crypto community about the platform’s future prospects. This positive outlook is reflected in the increasing growth of the total value of staking assets and the rise in Total Value Locked (TVL) of services like Lido and Rocket Pool, along with the significant surge in prices of their utility tokens. These trends suggest that investors are confident about the future of Ethereum, particularly after the introduction of the Shanghai upgrade.

It’s worth noting that the withdrawal process following the upgrade will be dynamic, meaning that it will depend on several factors. As such, it’s unlikely that a large amount of ETH will flood the market overnight. Instead, the withdrawal process is expected to occur gradually over time, with users slowly moving their funds out of liquid staking services and other options. This gradual process should help to prevent any sudden shocks to the market.

Before depositing funds into a deposit contract, many stakers purchased Ethereum for more than the current market value. Therefore, it’s highly likely that most investors will not record any losses as a result of the upgrade. Additionally, many investors are likely to hold onto their ETH, given the long-term potential of the Ethereum platform and its utility tokens.

Shanghai on the horizon

On the horizon, there is an important upgrade for Ethereum known as the Shanghai upgrade. This upgrade involves implementing several Ethereum Improvement Proposals (EIPs), the most crucial of which is EIP-4895. This proposal will finally allow users to withdraw funds from staking, which was not previously possible since the launch of phase zero of the second version of the system in 2020.

In addition to EIP-4895, several other proposals are expected to be implemented during the hard fork, including EIP-3540, EIP-3670, EIP-4200, EIP-4750, and EIP-5450. These proposals focus on implementing the EOF format, which enables smart contract checks and changes during deployment.

However, if implementing EOF proves to be too difficult, it will be postponed until the fall of 2023 when another update is scheduled. This update will activate EIP-4844, which involves implementing “most” of the logic and formats from the dunksharding technology specification.

Recently, developers created a shadow fork of the Shanghai upgrade to test its impact on the mainnet. During testing, several issues arose due to an incorrect configuration of the Geth client. However, after fixing the issue, all nodes began to work together seamlessly.

On February 1, the Zhejiang testnet was launched to verify the withdrawal of ETH from the Beacon Chain deposit contract. A hard fork is expected to occur on the testnet sometime in February, where developers will have the opportunity to test the full functionality of the upgrade. Overall, the Shanghai upgrade is a significant step forward for the Ethereum platform, bringing with it many exciting possibilities and potential for continued growth and success in the future.

Liquid Staking Token Rally

With a major upgrade on the horizon, Lido Finance, a prominent liquid staking platform, is experiencing substantial growth in the value of its governance token. In January, LDO’s price surged by over 130%, driving its market capitalization beyond $2 billion. In terms of total value locked (TVL), Lido Finance has surpassed the MakerDAO platform, a veteran of the sector, to become the top-rated DeFi platform, according to DeFi Llama ratings.

Lido Finance offers a chance for users to earn rewards by staking cryptocurrencies such as Ethereum, Polygon, and Polkadot. Ethereum is the most popular coin utilized on the platform. Instead of being locked in the Beacon Chain, stakers receive stETH tokens that can be utilized in other DeFi protocols.

Lido Finance is a popular choice among retail investors who do not possess the necessary funds (32 ETH) or technical expertise to work as validators.

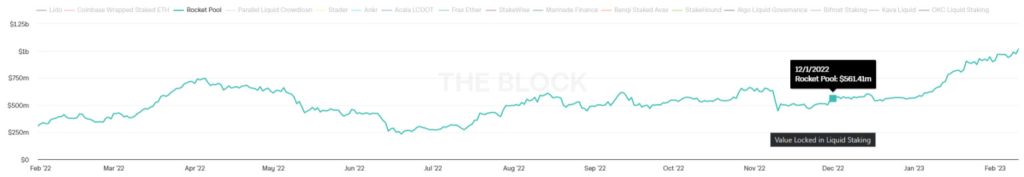

The value of the RPL token has surged by more than 100% in January. Rocket Pool, a decentralized protocol that connects stakers with node operators in a single system, is behind the token. Node operators are required to have 16 ETH (half the amount needed for Beacon Chain validators) and a small amount of RPL to participate in the process.

The rising prices of these cryptocurrencies suggest that the market is optimistic about the upcoming update, which is expected to enhance the liquidity of staking coins and eliminate uncertainty by providing users with the exact timing for withdrawing their funds. This update could intensify competition between platforms such as Lido Finance and Rocket Pool, a development that bodes well for the market.Начало формы

Impact on the price of ETH

Binance Academy analysts predict that the upcoming upgrade will affect the percentage of ETH in circulation that is in stake. This could have an impact on the balance of supply and demand for Ethereum, according to the analysts. Skeptics warn that the market may be flooded with an excess amount of ETH after the update, which could cause the cryptocurrency’s price to collapse. However, analysts at Swiss crypto bank Sygnum are optimistic that the upgrade will lead to increased demand for Ethereum staking and the emergence of new options and services.

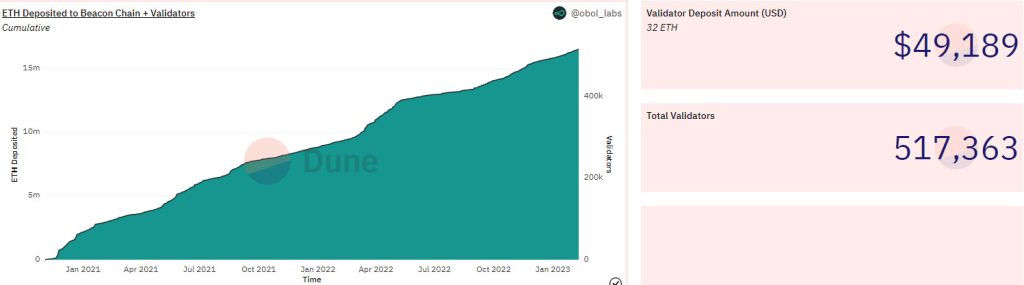

The Shanghai activation will enable investors to release locked ETH for the first time since 2020. However, experts believe that a massive withdrawal of funds is unlikely, as the withdrawal process is dynamic and takes time, depending on several factors. Unlike other PoS networks such as Cosmos, Ethereum’s withdrawal period for stakers is dynamic and based on the number of validators exiting at a given time.

There are two withdrawal options: partial, which involves funds over 32 ETH, and full, which allows validators to leave the network, unlocking their entire balance (32 ETH and rewards). Validators who choose the second option join a withdrawal queue, which determines how many users can withdraw assets during one epoch based on the total number of network participants.

Sygnum emphasizes that this limit ensures the stability of the system by controlling the number of validators that can exit at once, as validators are responsible for the security of the Ethereum network. Once validators pass the queue, they move on to the withdrawal period.

The experts from Sygnum explained that the length of the withdrawal period after the Shanghai upgrade will vary depending on the number of validators trying to withdraw funds at the same time, and it could take from several hours to weeks or even months. This mechanism makes a significant decrease in the price of Ethereum less likely, but the rate of the second largest cryptocurrency is difficult to predict after the upgrade.

The experts also pointed out several factors that will affect the supply and demand of Ethereum:

- A limit of 57,600 partial withdrawals per day will dampen selling pressure.

- The more full withdrawals, the longer the processing time, which will also reduce bearish pressure on the market.

- Long-term stakers may choose to hold onto their ETH instead of selling at a loss.

- Demand for liquid staking tokens will increase, as they can be used in DeFi products to generate additional income.

- The opening of withdrawals will improve liquidity, open up arbitrage opportunities, and reduce risks associated with derivatives like stETH and rETH.

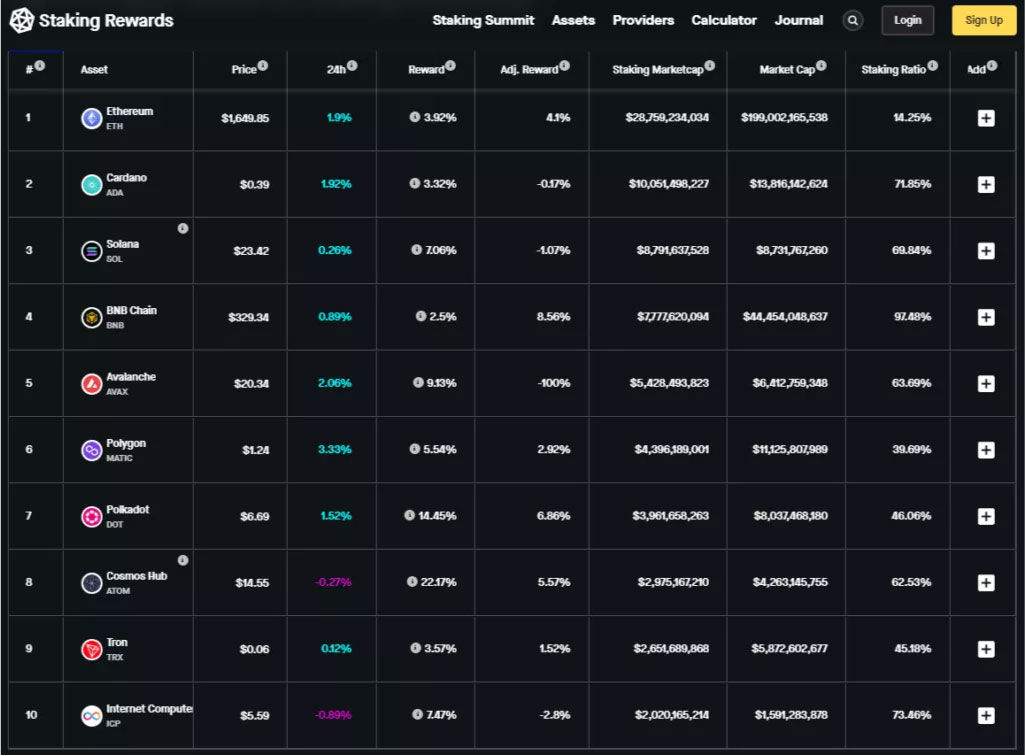

- After the upgrade and the emergence of new staking services, Ethereum’s Staking Ratio is expected to increase, bringing it closer to competing platforms like Solana or Cardano.

An analyst from Lookonchain has reassured investors that they should not be concerned about selling pressure on Ethereum following the Shanghai upgrade. The average purchase price of ETH locked in the Beacon Chain deposit contract is $2,260, which means that rational market participants will not sell their coins at a loss.

A researcher from Tripoli noted that withdrawals would require credentials prefixed with 0x01, and only about 20% of new validators do not set this prefix, which could lead to a traffic jam in the queue for partial output.

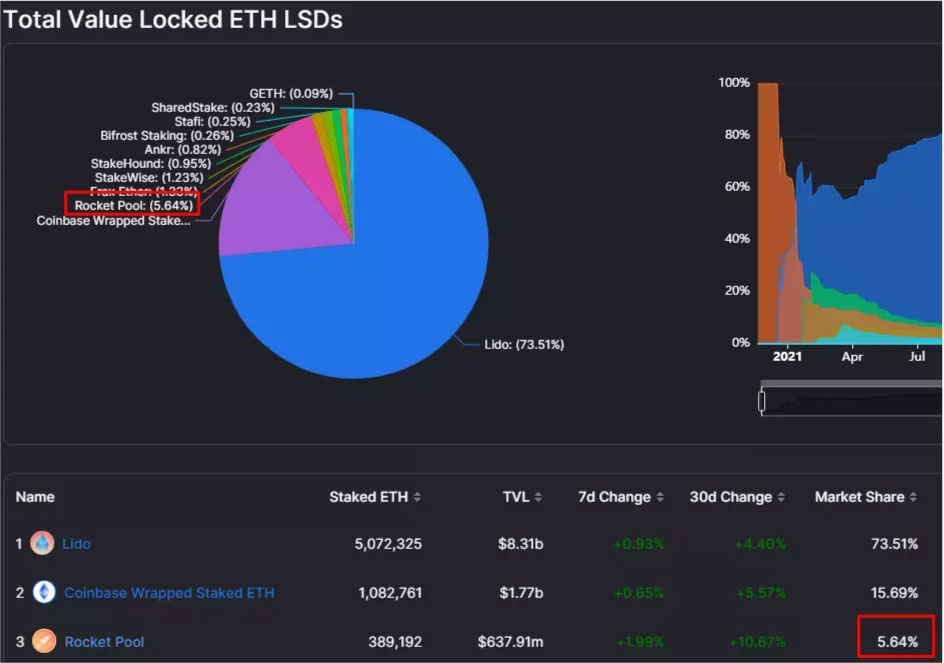

The Lido service has the most actively implementing data type and controls over 60% of all validators who have everything ready for automatic withdrawal. The expert believes that the initial surge in withdrawals is unlikely to have catastrophic consequences for the market since non-Lido validators will only sell a fraction of their reward.

In the most extreme scenario, approximately 110,000 ETH will be extracted on the first day after the activation of Shanghai as a result of partial withdrawal, excluding Lido validators with credential type 0x01.

Untapped Potential

The Ethereum market has a lot of untapped potential for staking, as only 14.25% of the market supply is currently involved in staking compared to other PoS blockchains like Cardano or Solana.

The upcoming Shanghai update in March is expected to increase the participation rate, as Ethereum staking becomes perceived as less risky. Additionally, the release of ETH by EIP-4895 is likely to go to DeFi protocols, which will increase the total value locked (TVL) and stimulate the recovery of the rest of the market.

Liquid staking protocols currently have ~6.87 million ETH worth $11.3 billion, compared to the Beacon Chain contract which has 16.64 million ETH worth $26 billion locked up.

This significant difference indicates potential for derivatives like stETH and the TVL of their respective platforms.

The update may also have a positive impact on the utility tokens of liquid staking protocols like LDO, RPL, ANKR, and SWISE.

The chart below shows that liquid staking services account for the largest share of assets (45.8%) in the Beacon Chain deposit contract.

Sygnum experts predict that the functionality of many platforms will expand, including MetaMask wallet. They also expect the volume of ETH in staking and the number of validators to continue growing, with Binance Academy analysts believing that the opening of the withdrawal option will make the ETH market more free and help achieve market equilibrium.

JPMorgan experts see the Shanghai factor as positive for Coinbase, estimating that 95% of their customers will express interest in Ethereum staking after the update. They predict that the new era will add $225-545 million to Coinbase’s annual Ethereum staking revenue, which is currently at $50 million.

Conclusions

The Shanghai update marks an important milestone in the advancement of Ethereum, the second-largest cryptocurrency by market capitalization. Nevertheless, there is still much work to be done to address the long-standing issue of scalability and make Ethereum a quantum-resistant network.

The opening of cashouts is expected to make ether staking more appealing, thanks to the improved liquidity of ETH. This could lead to increased activity in the ecosystem, as those who were previously hesitant to use services like Lido and Rocket Pool may now participate.

According to crypto investor and blogger Lark Davis, the number of holders of Ethereum has increased by 263% by the end of 2022, indicating positive prospects for the cryptocurrency and its upcoming updates. However, the price of Ethereum and related tokens after the Shanghai update is difficult to predict accurately, given the high volatility that accompanies significant upgrades.

Nevertheless, it is likely that Ethereum and many other cryptocurrencies will experience price growth alongside the broader market recovery, which will depend largely on the successful implementation of the forthcoming upgrade.