Market sentiment, correlations and volatility

In February, the leading cryptocurrencies experienced a period of consolidation following substantial growth at the beginning of the year. By the end of the month, Bitcoin and Ethereum had only shown slight increases of 0.03% and 1.26%, respectively.

During this time, there were several notable developments among the most active projects (with a capitalization of over $200 million).

For example, the Conflux Network (CFX) protocol entered into a partnership with China Telecom to develop a Web3 SIM card (BSIM), while the L2 protocol in the Bitcoin Stacks (STX) network experienced impressive growth due to the NFT Odinals hype.

Additionally, the token for the Liquity landing platform saw significant improvement in its position following its listing on Binance, growing by over 50%.

On the other hand, some projects experienced setbacks during this period. The token for the M2E project STEPN (GMT) did not benefit from an additional airdrop among owners of the most expensive sneakers.

Meanwhile, after significant growth in January, the Aptos project token (APT) experienced a correction towards the end of the month. This same trend was observed in the Gala (GALA) GameFi protocol, which rounds out the top three.

Throughout February, the “Fear and Greed Index” predominantly remained in the “greed” zone. In the middle of the month, Bitcoin prices reached $25,000, leading the indicator to update its annual maximum at around 62.

The indicator’s minimum value was 48, while the average value was 53.3. These trends suggest that investors remained optimistic despite the Federal Reserve’s decision to increase the key rate and rising inflation in the US.

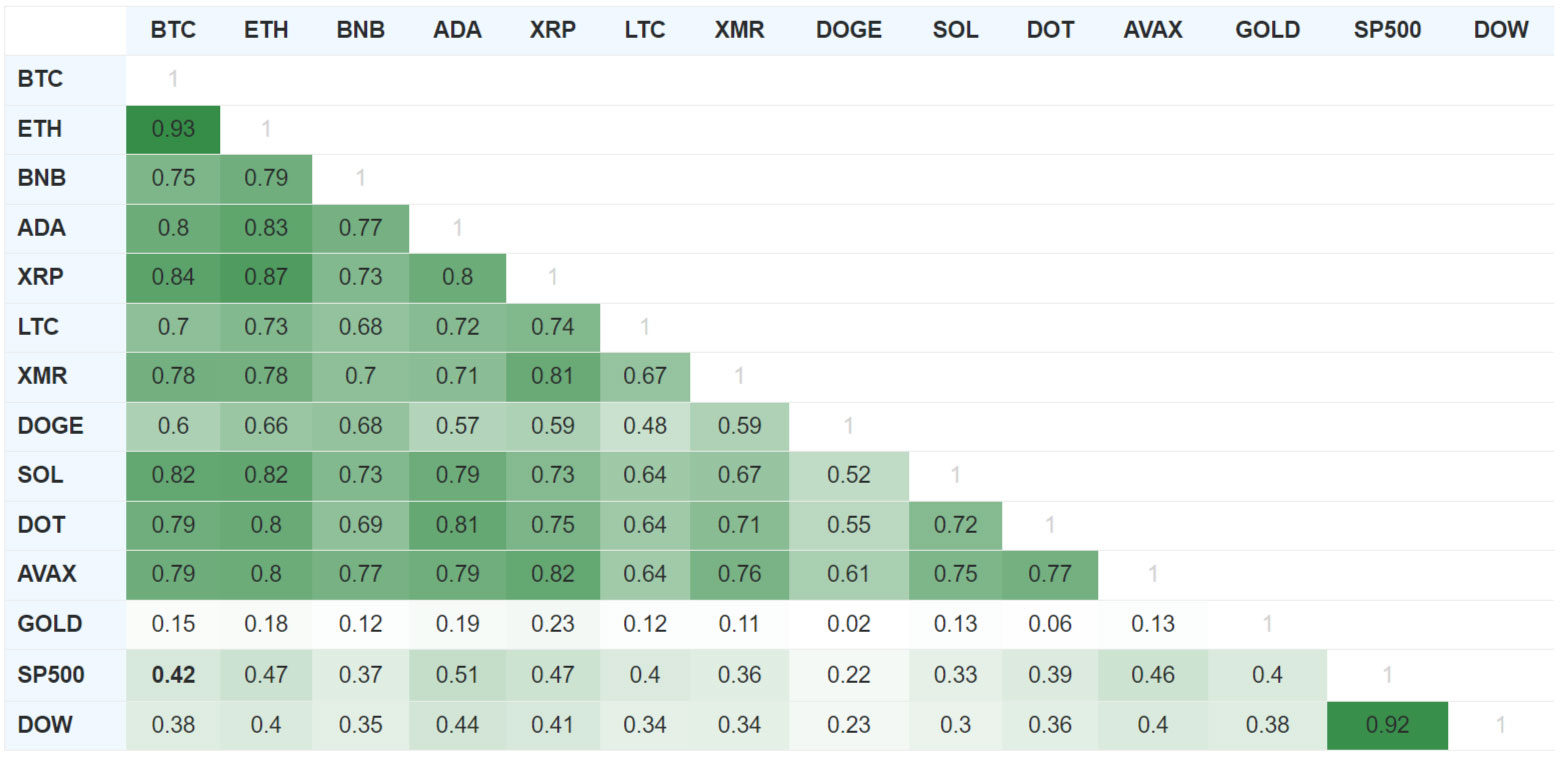

During February, the correlation between Bitcoin and the US stock market saw a slight increase. The correlation between Bitcoin and the S&P 500 index reached 0.42, while the correlation with the Dow Jones indicator was 0.38.

Bitcoin prices and gold prices moved in the same direction, but their correlation remained at a relatively low level.

The average value of the Bitcoin historical intraday volatility index (BVOL24H) over the last month was $2.1, slightly higher than in January. On February 17, when Bitcoin prices tested the $25,000 level, the indicator reached its peak at $3.5.

Macroeconomic context

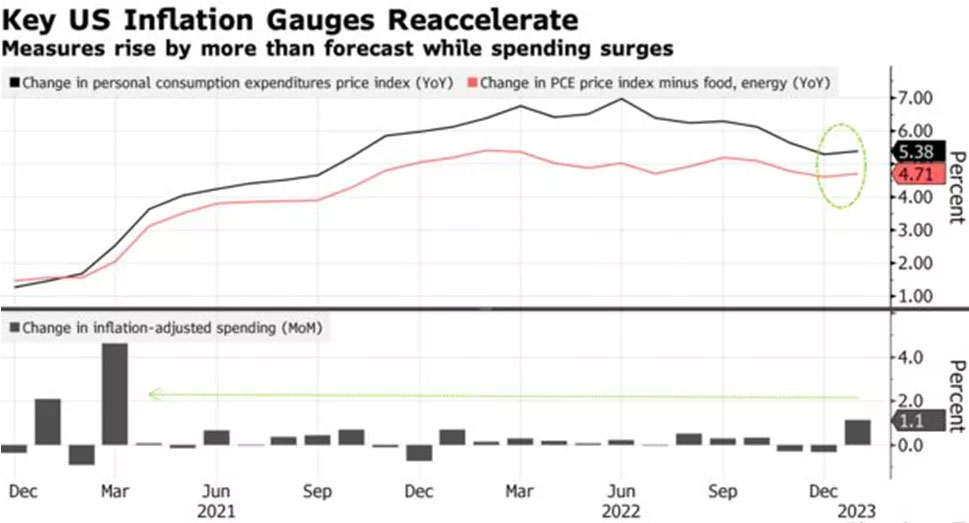

In January, US consumer spending inflation increased from 5.3% y/y to 5.4%, surpassing the expected 4.9% y/y, while the core inflation rose from 4.6% to 4.7%, in line with the forecast of 4.6%. Additionally, the CPI increased by 6.4%, slightly higher than the expected 6.2% (with a predicted slowdown from 6.5% to 6.2%), and the core CPI rose by 5.6%, within the predicted range of 5.7% to 5.5%. The latest PPI data also indicated a gradual easing of the inflationary background.

In terms of employment, the US economy added 517,000 jobs in January, exceeding the forecasted 188,000, and the previous two months saw an increase of 71,000. Unemployment dropped to 3.4%, the lowest since 1969, while annual wage growth slowed down to 4.4%, compared to the expected 4.3%. Retail sales also jumped by 3%, higher than the predicted 2%.

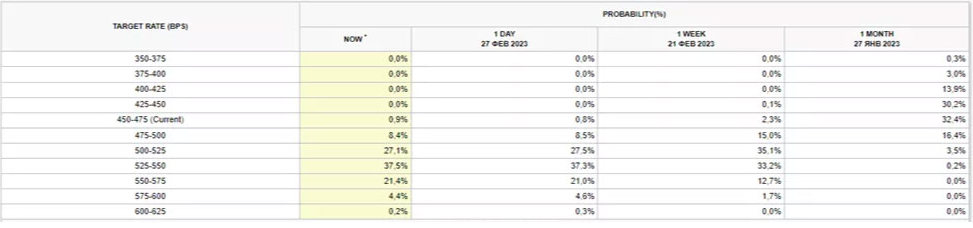

Fed officials, including Fed chief Jerome Powell, have emphasized the need for further action, including raising the key rate and holding it at a high level for an extended period. This has led to a revision of expectations regarding the ceiling of the key rate and the timing of the Fed’s transition to monetary easing.

Investors have also revised their expectations regarding the Fed’s next moves. Previously, the market was uncertain about the rate exceeding 5.25% and returning to the current level in December, with a 76.5% probability. However, now there is a chance that the rate may peak at around 5.75% with a probability of 42.8% and a range of 5.25-5.5% by year-end with a 73.7% probability.

On-chain Data

As of February 28, 2023, the number of addresses holding a balance of 1,000 BTC or more (equivalent to over $23.7 million) has decreased to levels last seen in mid-2019, with only 2006 “whale” addresses remaining. This is comparable to the figure of 2005 recorded on July 30, 2019. In February 2021, the number of addresses in this category reached a peak near 2500, but despite Bitcoin’s rally to an all-time high of $69,000, the number has since declined.

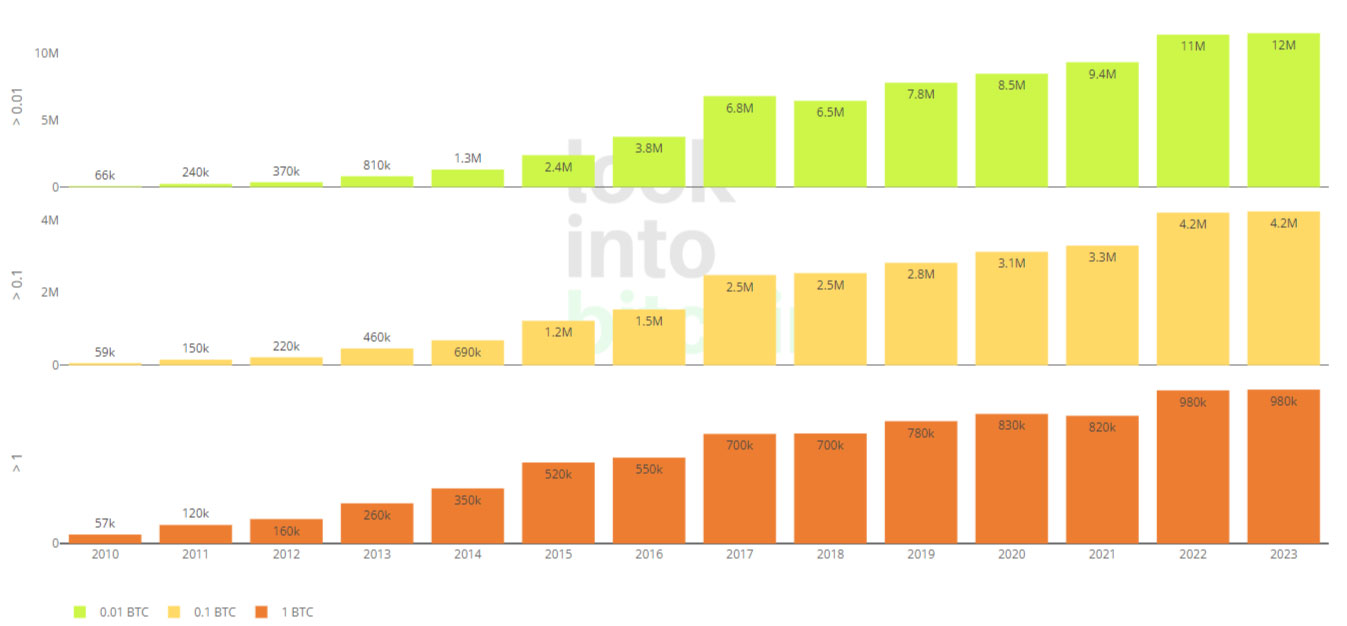

On the other hand, for relatively small addresses with a balance of >0.1 BTC and >1 BTC, the situation is more positive, as these categories have seen little to no decline.

This suggests that there is a gradual increase in the number of cryptocurrency investors who are keen to accumulate digital assets, despite the volatility and changing market cycles.

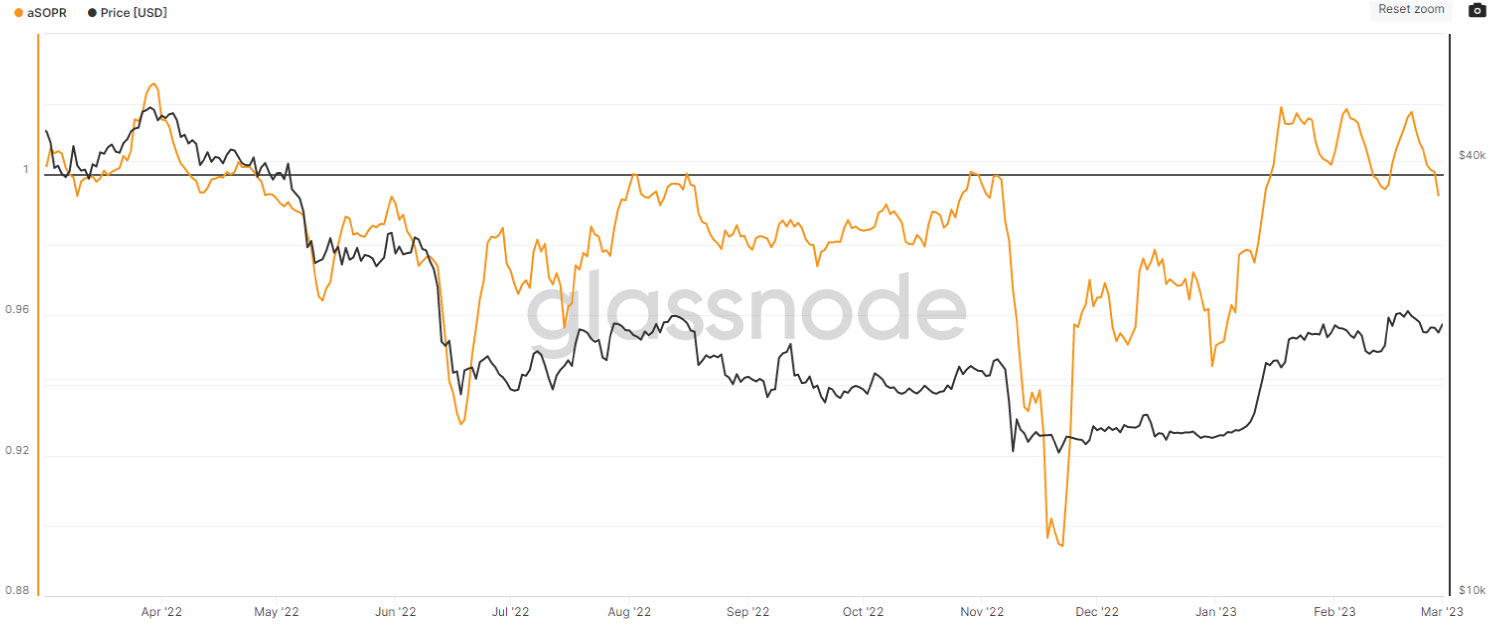

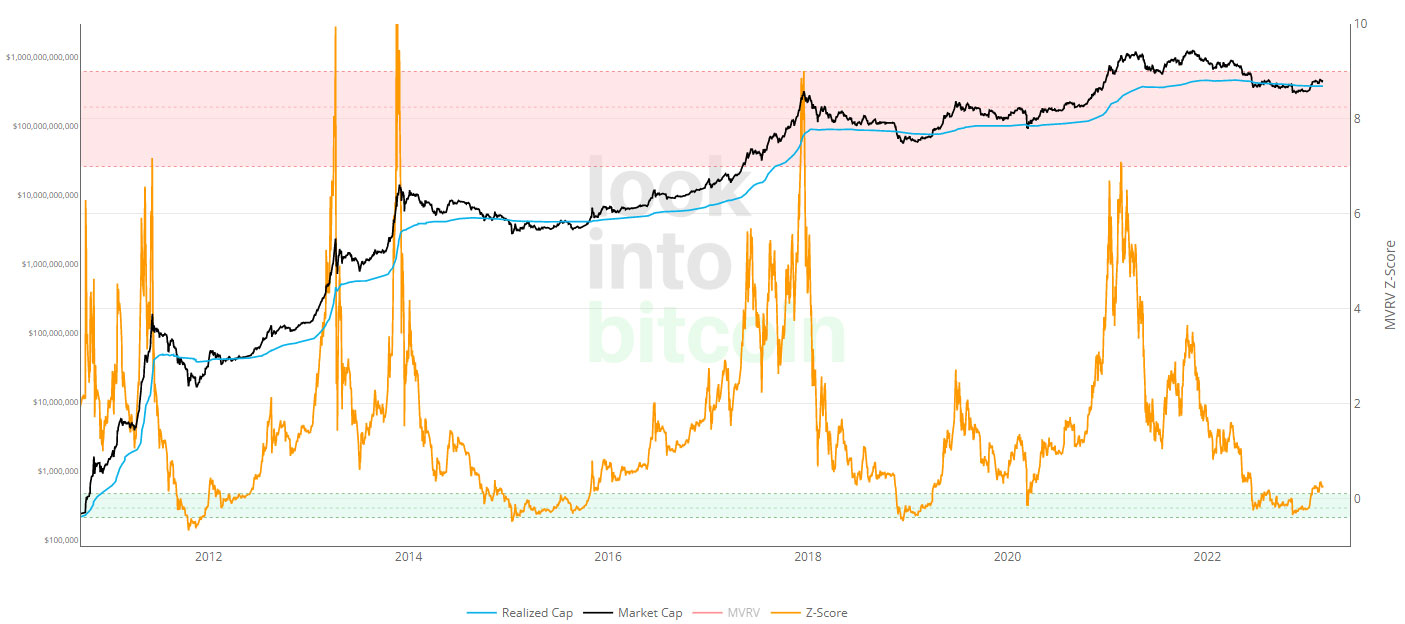

Throughout February, the aSOPR indicator remained above 1, signaling a positive change in market sentiment and the tendency of many investors to take profits.

Analysts believe that brief dips in the metric below a certain threshold present a favorable opportunity to buy assets at lower prices. Additionally, the MVRV Z-Score indicator recently exited the oversold “green zone,” suggesting potential for further bitcoin price growth and overall market recovery.

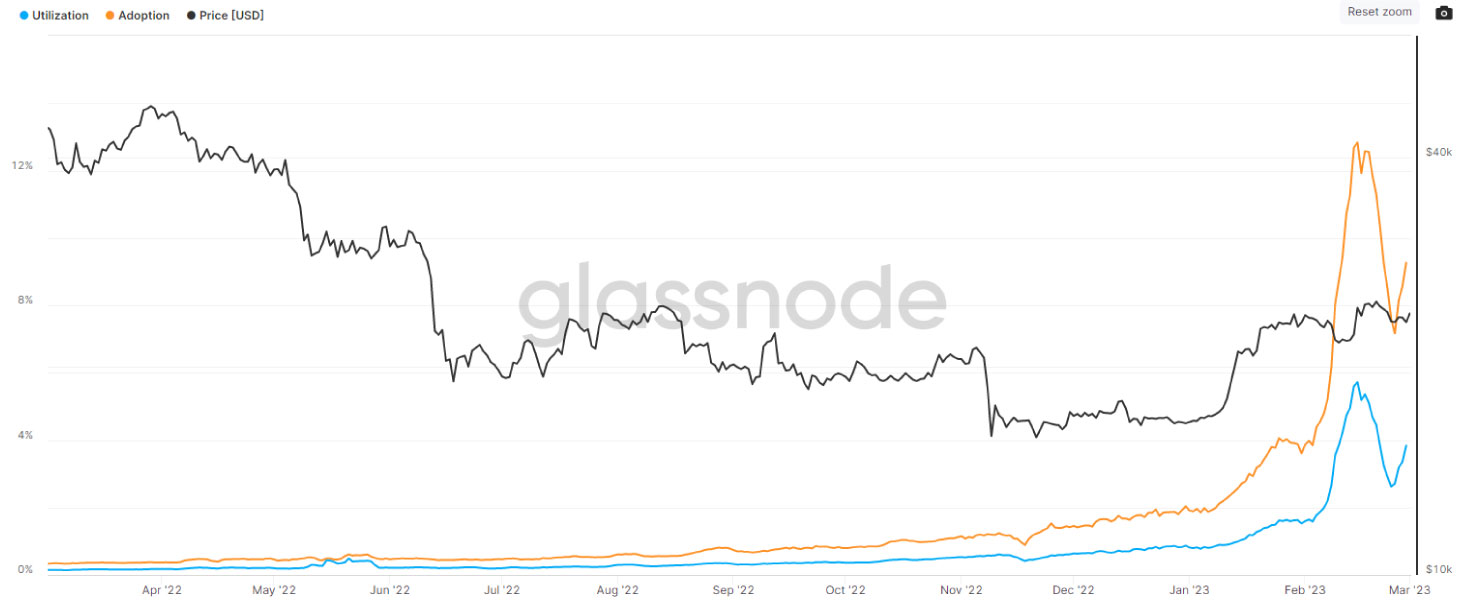

In February, there was a rapid increase in the percentage of Taproot signatures in the bitcoin blockchain, reaching over 12% on February 15th, followed by a slight decline.

This trend is largely attributed to the Ordinals project, which enables the placement of “digital artifacts” in the digital gold network. Furthermore, the number of bitcoin-NFTs surpassed 228,000. Meanwhile, the total amount of digital gold on centralized exchange balance sheets decreased to levels not seen since March 2018.

This trend towards the outflow of funds from centralized platforms increased significantly in 2022, fueled by the market crash of Terra and FTX, and the widespread “infection” of the market. The steady decline in this metric indicates that many investors are favoring more secure non-custodial wallets.

Mining, Hashrate, Fees

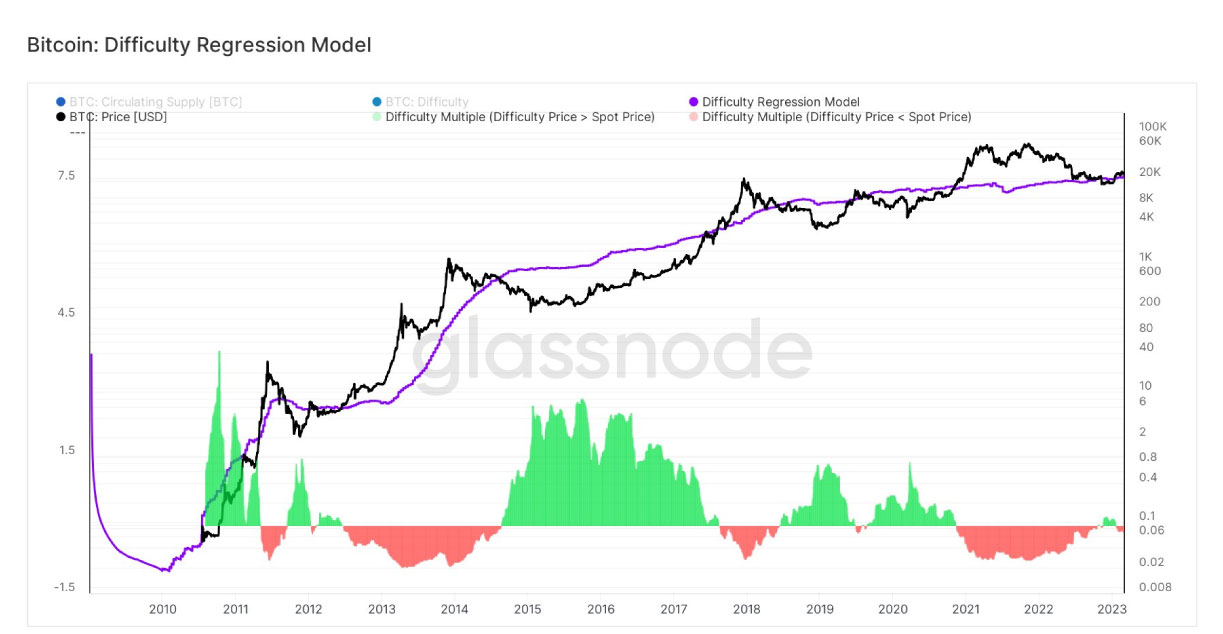

The bitcoin hash rate (7 MA) experienced a 6.73% increase in February, reaching a new high of about 319.4 Eh/s, as the market gradually recovers. This upward trend reflects the confidence of industry players in the long-term outlook for mining and bitcoin as the leading cryptocurrency.

Additionally, the hash rate-related mining difficulty for bitcoin has also surged to a new historical high of approximately 43.05 T, a 9.95% increase from the last recalculation. Despite the growing difficulty, the bitcoin hash price continued to recover and hit $0.079 in mid-February, equivalent to the values seen at the beginning of October 2022.

According to researchers using a difficulty regression model, the estimated cost of bitcoin mining is $21,100. As a result, miners are actively returning to mining and increasing the hashrate, given that the market price of bitcoin is above this threshold.

In February, the total earnings of bitcoin miners saw a small increase compared to January, rising only by 4%. This can be attributed to the sluggish growth rate of the leading cryptocurrency’s price and the fact that February is a shorter month.

However, there was a rise in the proportion of commissions in the miners’ earnings, which rose to 2.28% from the previous month’s figure of 1.38%. The reason for this could be the increased on-chain activity driven by Ordinals transactions. This has resulted in the Bitcoin mempool being congested again, with blocks being nearly full.

NFT

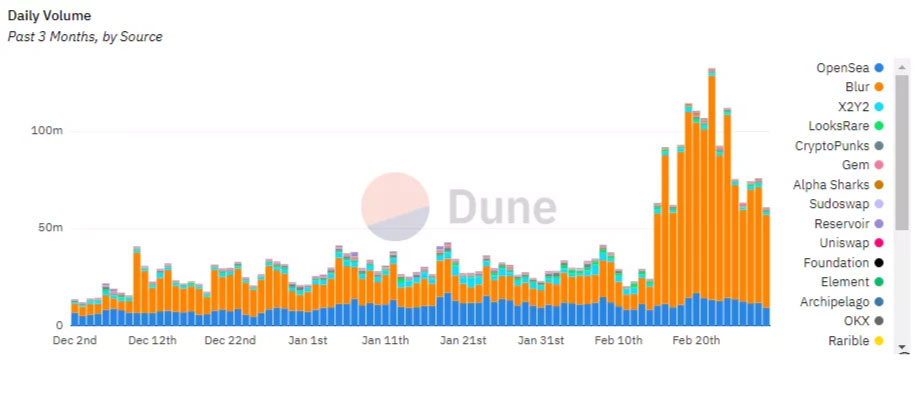

Amidst the ongoing competition between OpenSea, a major player in the NFT market, and newcomer Blur, trading volume on NFT marketplaces has seen a rebound. The reason for this is the generous airdrop of the native BLUR token by Blur in February, which attracted user attention and caused the token to be listed on most leading platforms except for Binance.

According to reports, Blur is currently in the process of raising funds at a valuation of $1 billion. In February, Blur’s trading volume reached $1.21 billion, compared to $333 million for OpenSea.

The newcomer also announced an additional distribution of 300 million tokens, and its CEO, who has yet to be revealed, called for a boycott of OpenSea. As a result, the once-dominant marketplace was forced to change its royalty collection model.

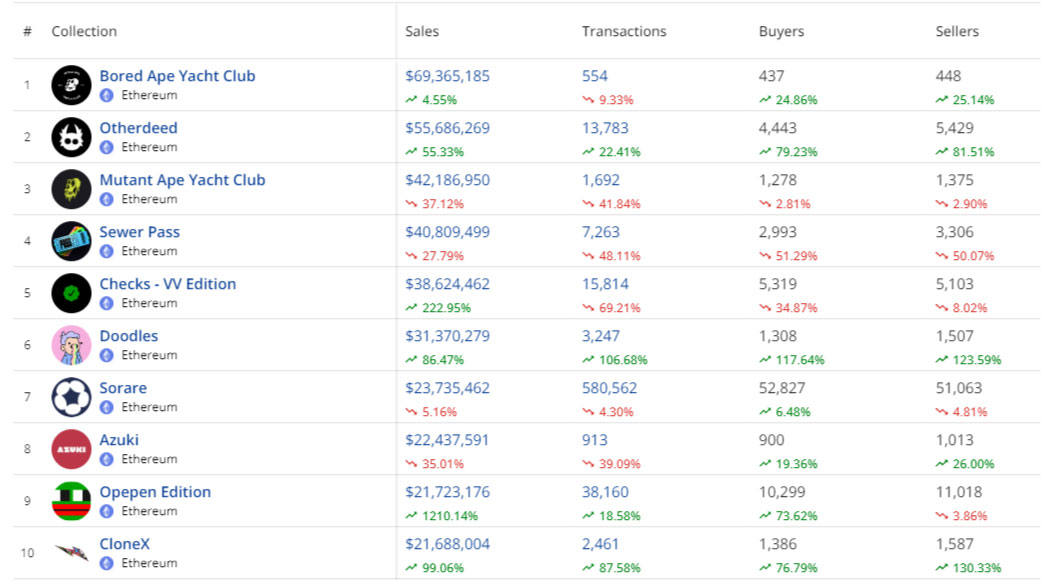

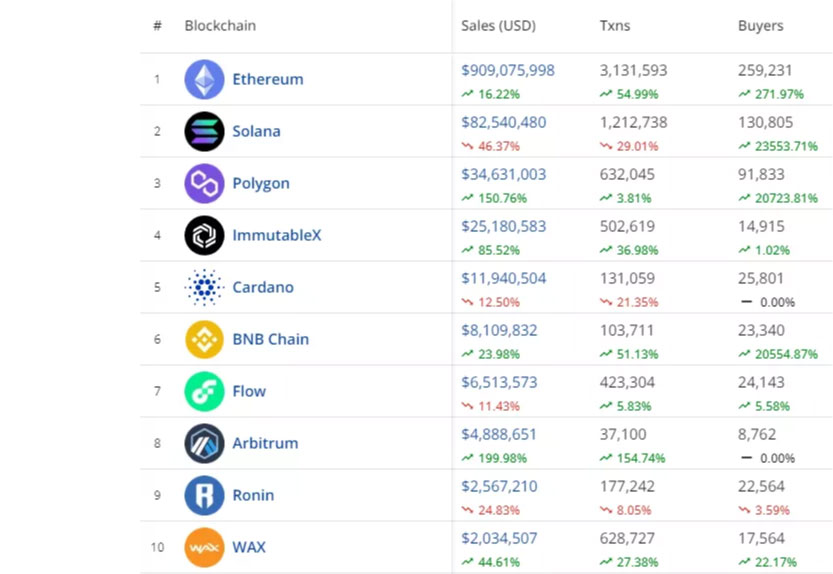

Amid the resurgence of the NFT market, there are new leading collections emerging, but users continue to show interest in the established premium collections. This has resulted in a significant increase in the volume and number of transactions, with Ethereum retaining its position as the top blockchain.

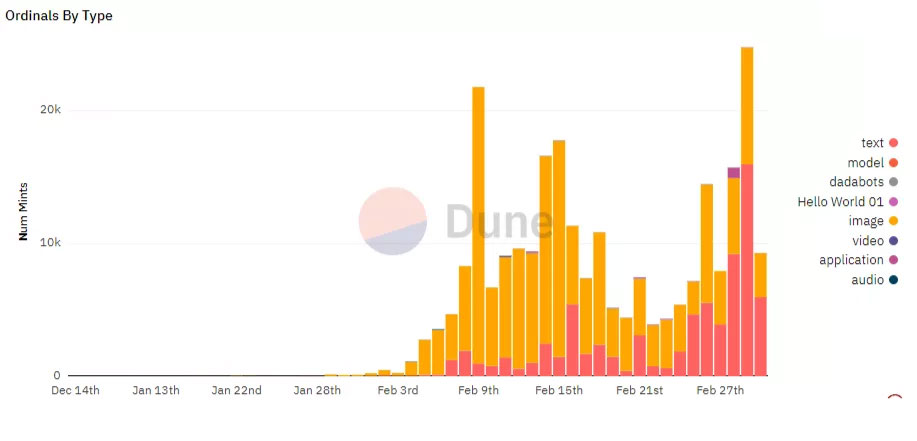

One noteworthy development in February was the launch of the Ordinals protocol, which enables NFTs to be created on the bitcoin blockchain. The introduction of this feature has been viewed as an “attack on the network” by supporters of bitcoin.

With Ordinals, it is possible to write up to 4 MB of information in a bitcoin block, which has led to increased network activity, mempool congestion, and higher fees. The average block size has also increased from a consistent 1.5-2.0 MB to 3.0-3.5 MB.

By the end of the month, the total number of NFTs on the bitcoin blockchain had surpassed 250,000, and the Ordinals protocol had been forked on the Litecoin network.

By the end of the month, the total number of NFTs on the bitcoin blockchain had surpassed 250,000, and the Ordinals protocol had been forked on the Litecoin network.

The Activity of Major Players

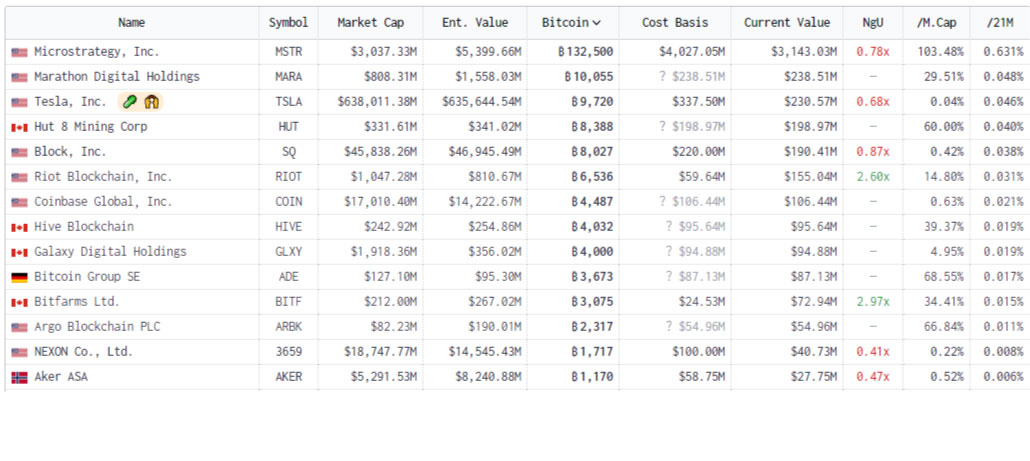

In February, there was no change in the digital holdings of most public companies, and one of the biggest holders of bitcoin, MicroStrategy, did not make any new purchases or announcements. During the month, the software analytics developer reported a net loss of $249.7 million in Q4 2022, which was affected by the declining value of its bitcoins.

MicroStrategy sold 704 BTC during the reporting period, but still owns 132,500 BTC, which lost $197.6 million in value. However, MicroStrategy managed to raise $46.6 million by selling its securities since September 2022.

MicroStrategy sold 704 BTC during the reporting period, but still owns 132,500 BTC, which lost $197.6 million in value. However, MicroStrategy managed to raise $46.6 million by selling its securities since September 2022.

In addition, Marathon Digital sold 1,500 BTC in January to cover some costs, and its CEO, Fred Thiel, announced that more digital gold would be sold this year to finance monthly operating expenses.