As we enter 2023, the Bitcoin market is experiencing steady growth, offering a respite from the previous bearish conditions. Many investors are now asking whether this trend will continue and lead to a significant rally in the coming months. Recent data suggests that such a rally may indeed be on the horizon, with cryptocurrency quotes surpassing the key MA 200 level, which is seen as a critical threshold separating bearish and bullish markets. Additionally, a number of on-chain indicators are pointing towards a potential trend reversal. Notably, Bitcoin’s correlation with the NASDAQ index has fallen to levels not seen since December 2021, which is a positive signal for the broader cryptocurrency market.

What do the indicators say?

In 2023, the price of Bitcoin has risen by approximately 40%, climbing from around $16,500 to roughly $23,100 as of 01/24/2023. Despite this growth, the digital currency is still far from its all-time high of approximately $69,000, reached on 11/10/2021.

Nonetheless, a number of positive developments in the market, as well as the performance of key indicators, are providing encouragement for investors.

Looking at the weekly chart, it’s clear that the crucial support level B has held up thus far in 2023. After rebounding from this level, the price has passed through zone A, which served as a long-standing support level for the volatile market before the collapse of FTX.

Some analysts caution that a return to the downtrend is still possible, but many indicators suggest that the path of least resistance is upward. The next significant target for Bitcoin is around the $25,000 mark.

Notably, the cryptocurrency’s price has recently surpassed the 200-day simple moving average for the first time since the end of December 2021, marking a potential shift towards a more bullish market.

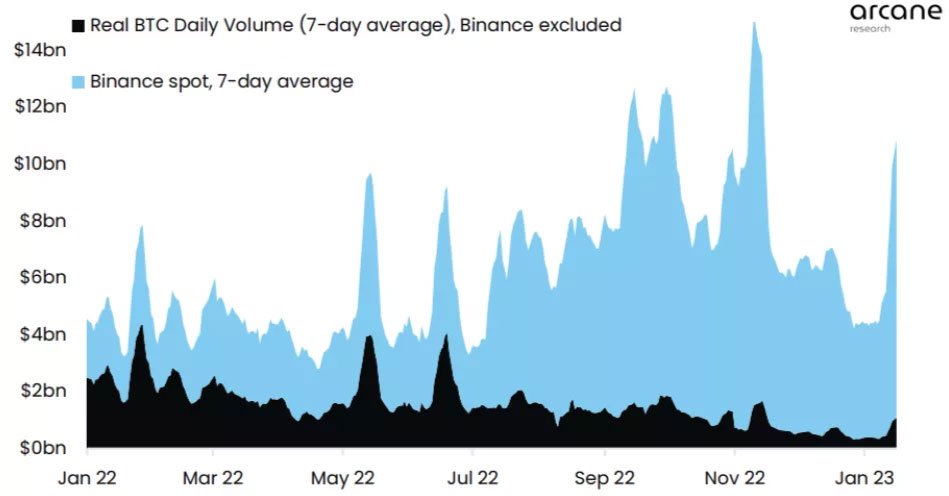

The recovery in Bitcoin prices during January was notable for the significant increase in trading volumes that accompanied it.

This development was an essential factor in supporting the overall growth of the cryptocurrency market, indicating that there was a considerable amount of investor interest in Bitcoin and other digital assets. This increased trading activity could signal a shift towards a more bullish market sentiment, suggesting that many investors are optimistic about the long-term prospects of the cryptocurrency market.

On-Chain Indicators

In November 2022, the price of Bitcoin broke through the bottom of the previous market cycle, leading many to believe that a recovery and new bullish trend were imminent. However, the collapse of Sam Bankman-Freed’s business empire, FTX, triggered a significant sell-off, with the price of Bitcoin falling to $15,476 in the BTC/USDT pair on Binance.

In the second half of the year, Cumulative Value Days Destroyed (CVDD) and balanced price indicators suggested that the cryptocurrency was likely to reach a cyclical bottom.

Following a period of consolidation, the market began to recover once again. Overall, these on-chain indicators point to a high degree of volatility and uncertainty in the cryptocurrency market, with prices fluctuating significantly in response to various economic and political factors.

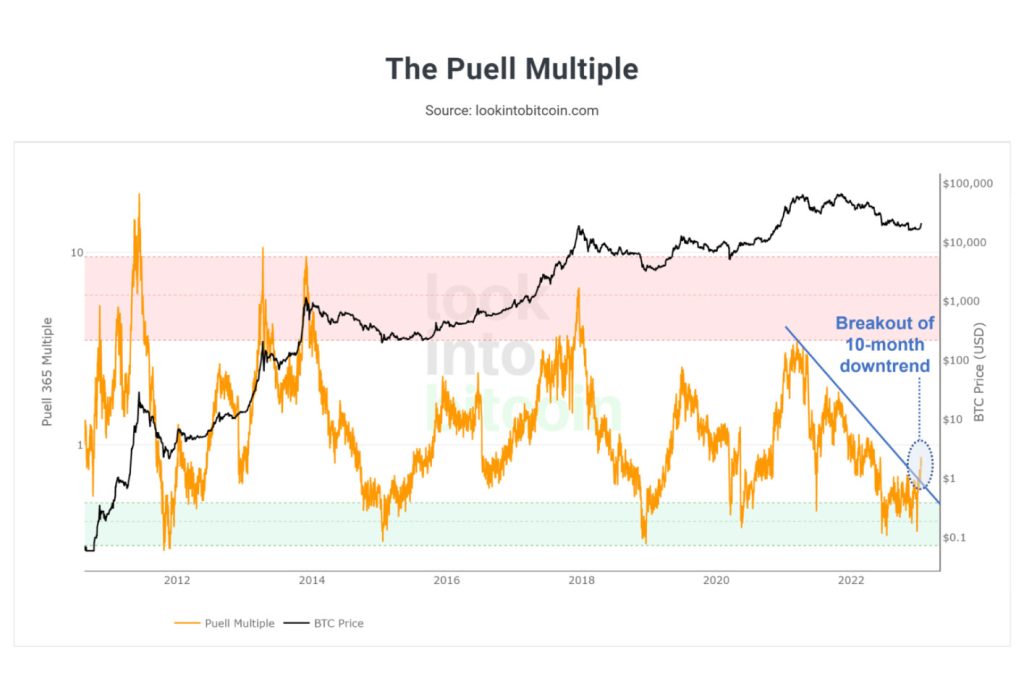

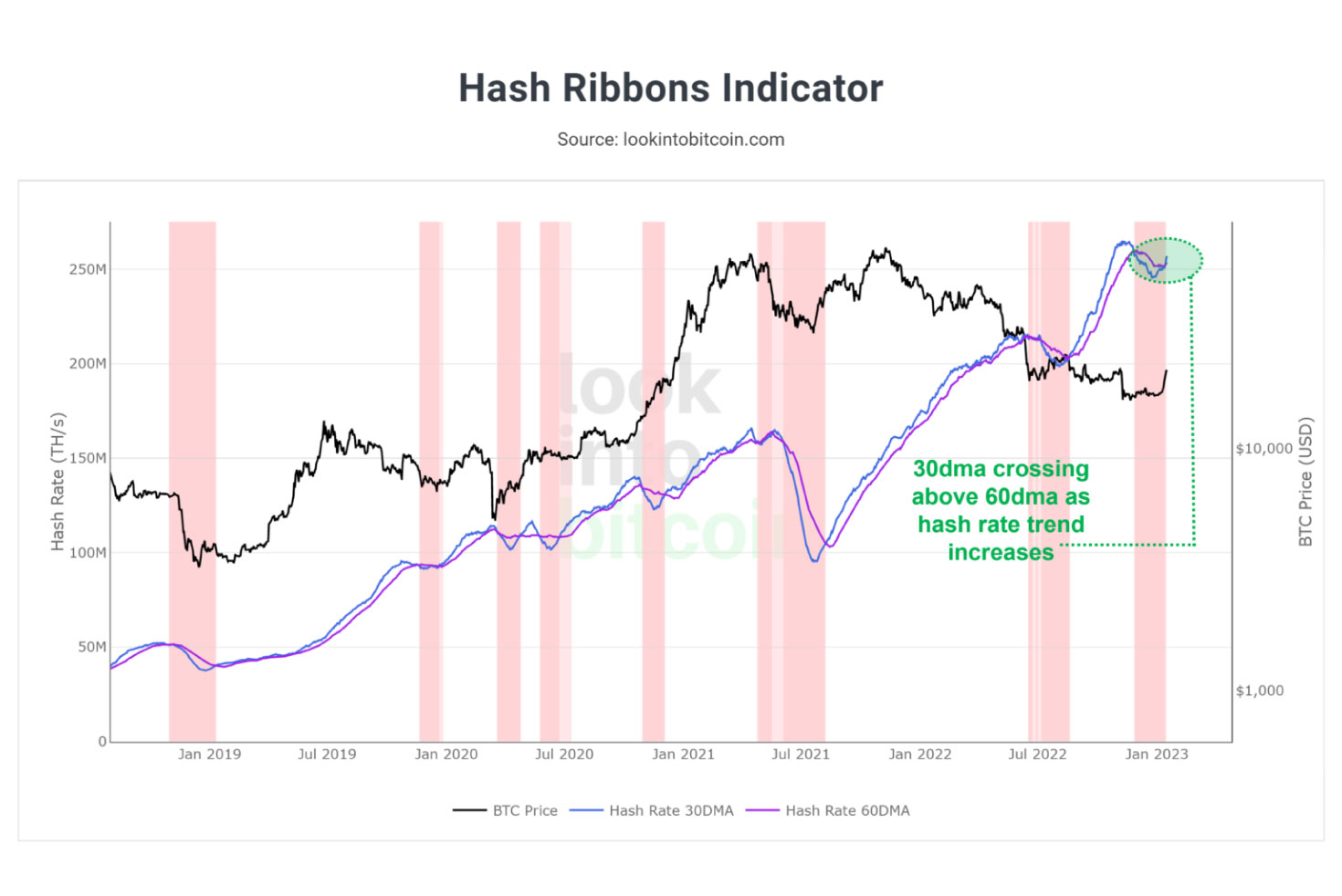

According to Philip Swift, every day that the price of Bitcoin rebounds from key support levels, the chances of a sustained rally increase. The past year has been particularly challenging for Bitcoin miners, as rising hashrates and difficulty levels at a falling price have forced many players to sell off their digital assets or exit the market altogether.

However, recent developments in key metrics such as the Pewell’s multiplier and Hash Ribbons indicate that the worst times for miners may be behind us, with a potential for the Bitcoin rally to continue.

These improvements have helped to boost investor confidence and improve market sentiment, reducing the potential for selling pressure and indicating that the bearish phase may be coming to an end.

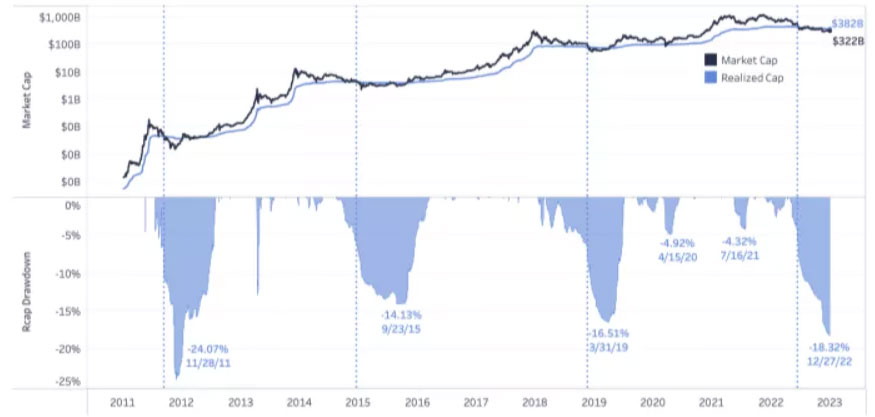

Furthermore, Bitcoin quotes have recently risen above the realized value, suggesting that the cryptocurrency may be primed for further growth in the coming months.

As FTX collapsed, market panic ensued and Bitcoin’s realized capitalization at the end of December dropped by 18.8% from its all-time high, marking the second biggest decline in history.

Bitcoin Magazine analysts view such dips as a chance for buyers to reap substantial long-term gains.

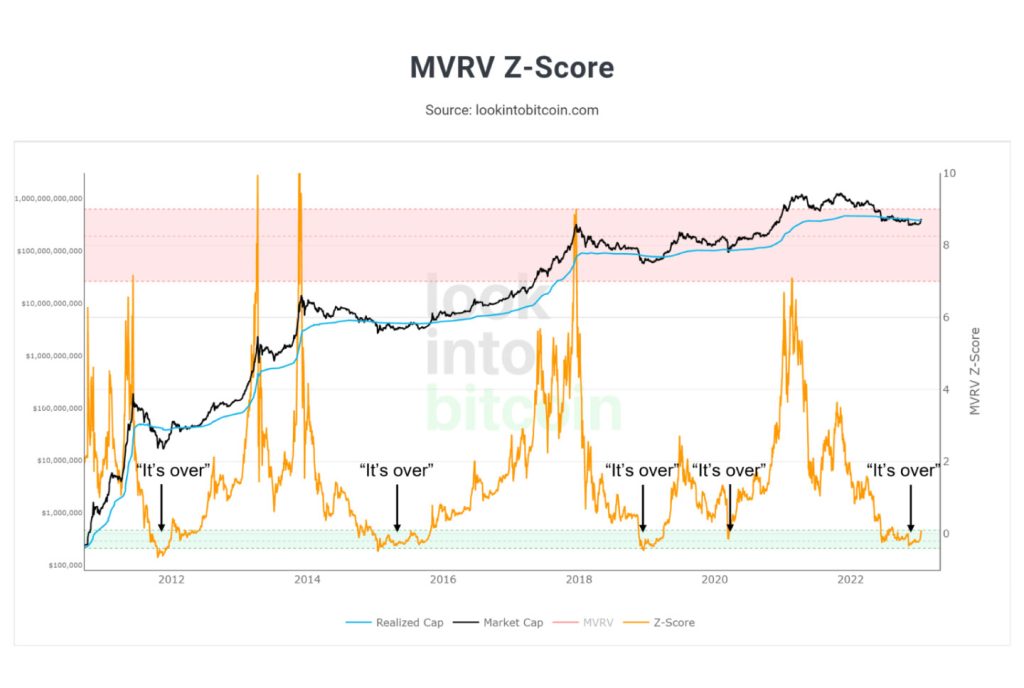

The MVRV Z-Score indicator’s orange line moving beyond the “green zone” also signals a possible bottoming out.

Confirmation of the market phase change thesis can be seen in the RHODL Ratio, a long-term indicator whose orange line is poised to exit the oversold zone, signaling the optimal period for Buy&Hold and/or DCA strategies.

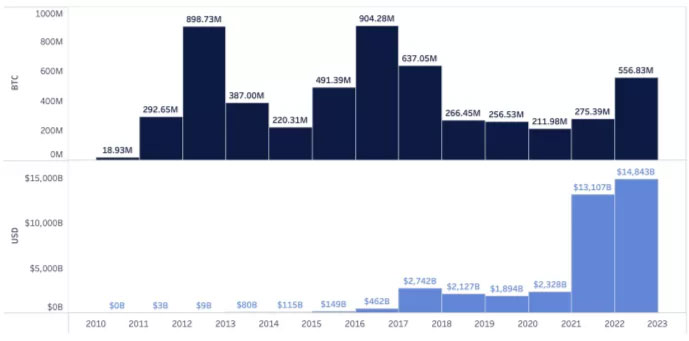

Despite the sustained price decline, on-chain activity remained robust with more than 556 million BTC worth nearly $15 trillion traversing the first cryptocurrency’s network in 2022, a 102% surge from the previous year.

Market Sentiment

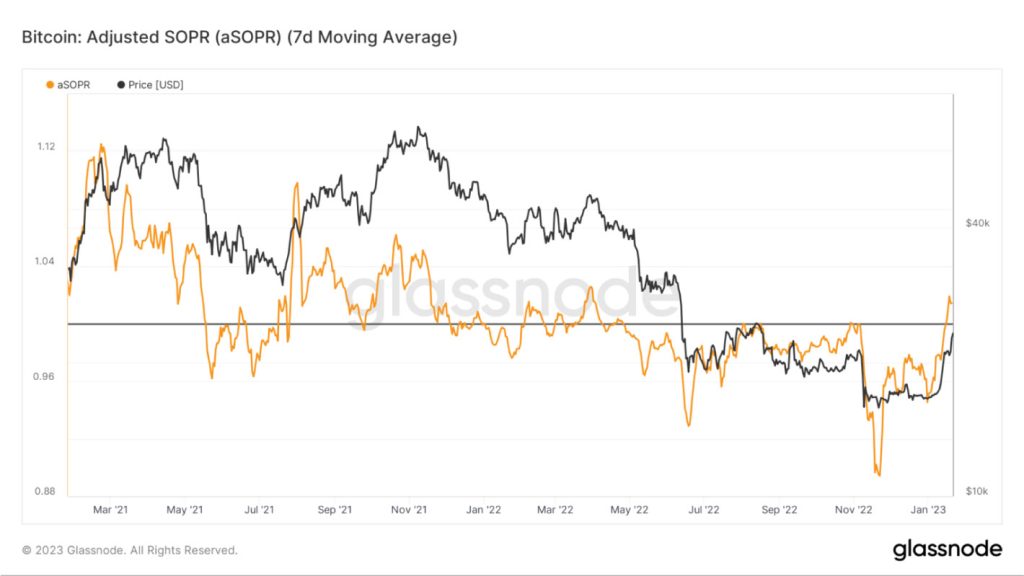

Notably, the aSOPR indicator surpassed the 1.0 level, a threshold it hadn’t breached since late April 2021, implying improving market sentiment and sufficient demand to absorb selling pressure due to profit-taking.

The investor sentiment in the cryptocurrency market is increasingly optimistic, as indicated by the “fear and greed index” for cryptocurrencies. After being stuck in the “fear” zone since April 2022, the index has finally shifted to neutral values, signaling renewed confidence among investors.

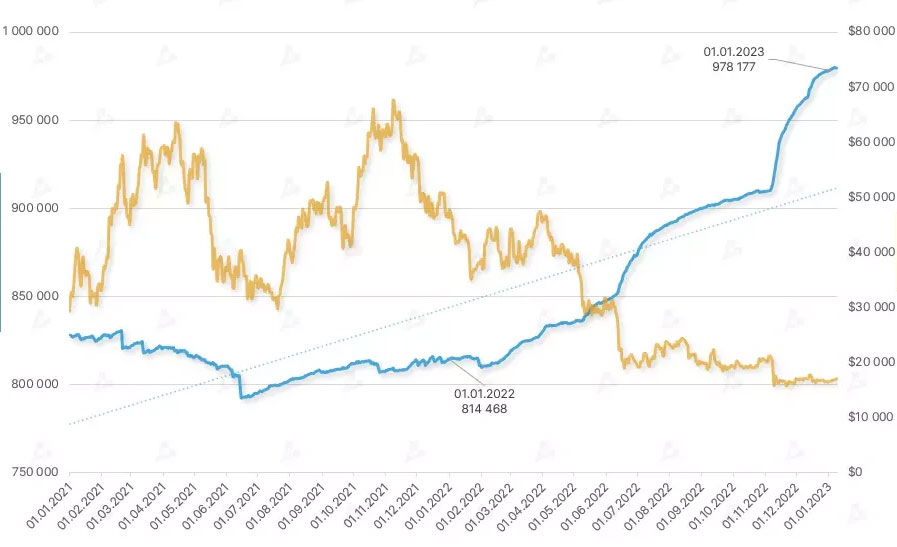

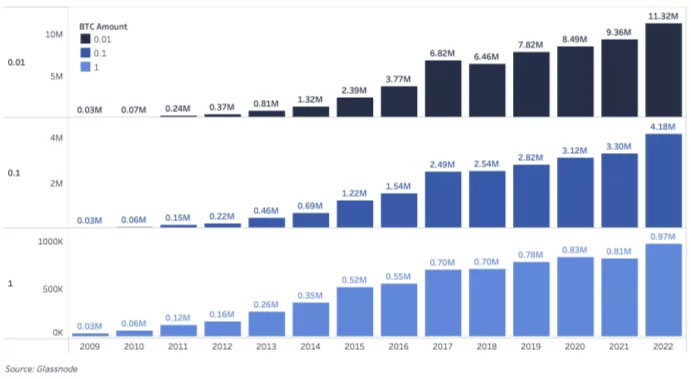

The growing number of bitcoin addresses holding a non-zero balance is a crucial fundamental factor reflecting the expansion of the cryptocurrency’s user base and the accumulation of coins by long-term believers. In 2022, the number of addresses with a balance of at least 1 BTC surged by 20%, an exponential rise that is edging closer to the one-million milestone.

Positive dynamics from year to year is also observed for smaller addresses, which have at least 0.01 BTC and 0.1 BTC.

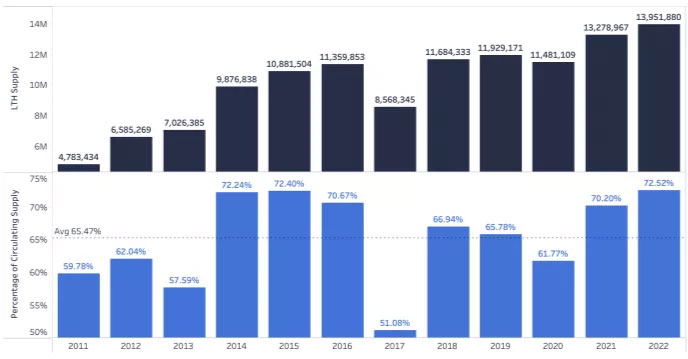

The number of bitcoins in hodlers’ wallets (coins older than 155 days are taken into account) has come close to 14 million BTC. This is ~72.5% of the total market supply of the first cryptocurrency.

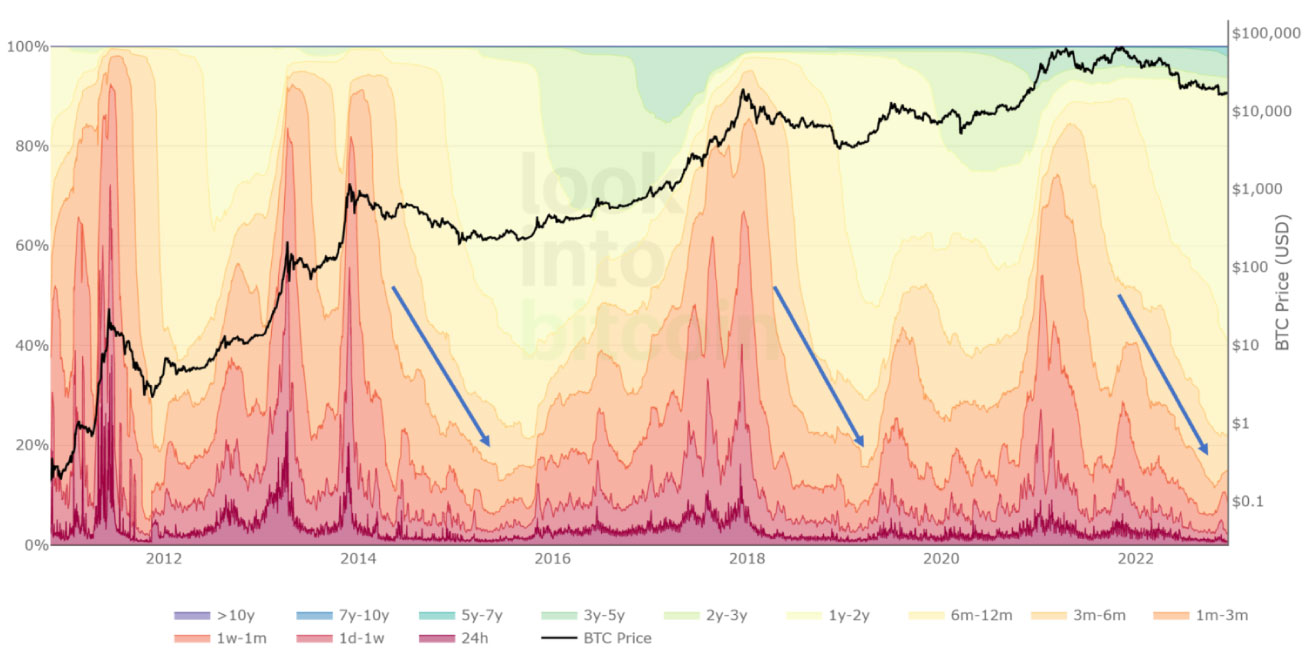

The realized price-weighted HODL waves of bitcoin indicate a complete “reboot” of the market after the peak reached at the end of 2021 (red and yellow bars). A similar “cooling” occurred at the bottom of past bearish phases.

Macrofactors

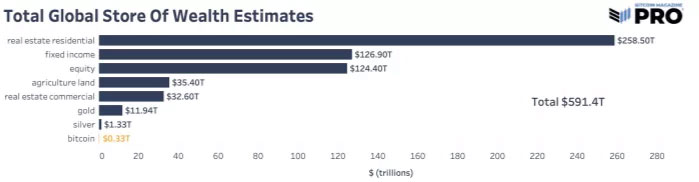

With limited supply and various other factors in play, the potential for massive global adoption of bitcoin could propel its price to unprecedented levels. The capitalization of the first cryptocurrency is currently less than $500 billion, significantly lower than other asset classes such as gold at nearly $12 trillion, fixed income instruments at approximately $127 trillion, and the residential real estate market at over $250 trillion.

Bitcoin’s price is not immune to the influence of macroeconomic and geopolitical factors, which have a significant impact on financial markets and growth prospects. The cryptocurrency’s rise during the coronavirus pandemic was fueled by massive liquidity injections, but as the US monetary policy tightened, growth gave way to a decline.

According to a Reuters survey of 90 economists, 61 of them predict that the Fed rate will reach a peak of 4.75% to 5% in March, and may remain steady for the rest of the year. Bitcoin’s price has been closely correlated with the US stock market for a long time, as it is sensitive to changes in the Fed’s rate.

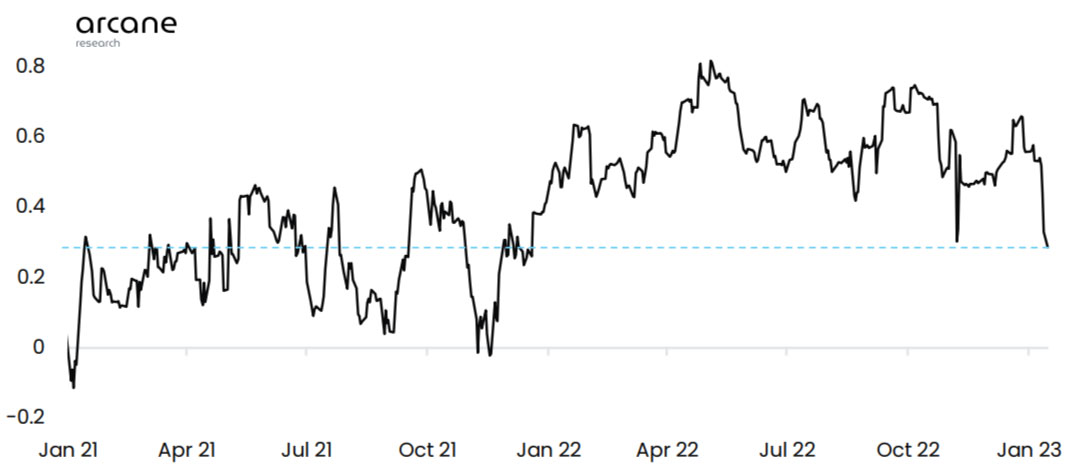

However, the correlation between Bitcoin and the NASDAQ index dropped to 0.29 in early 2023, the lowest value since December 2021. It is worth noting that if the share of global wealth held in bitcoin reaches 1%, the cryptocurrency’s price is expected to surpass $300,000, with a market capitalization of $5.9 trillion.

There is a possibility that Bitcoin may soon regain its reputation as a safe-haven asset, as it appears to be decoupling from the stock market. This narrative had been largely forgotten, but it could resurface in the crypto community.

What are the experts saying?

According to Bloomberg strategist Mike McGlone, Bitcoin is currently bottoming in a similar way to the 2019 bullish phase, with the key difference being the tightening of monetary policies around the world. While interest rates were being reduced four years ago, they are currently being increased, as McGlone noted. However, he remains optimistic about Bitcoin’s future and sees a bullish picture in the long run.

Senior analyst at Arcane Research, Vetle Lunde, also shares a positive outlook for Bitcoin, pointing out that the reduction in correlation is a good sign for the market. Meanwhile, Swift predicts an uptrend based on on-chain indicators and suggests that now may be the best time to accumulate Bitcoin before the start of a new bullish rally.

Conclusions

This review focuses on the current situation of Bitcoin, but it’s widely known that the growth of Bitcoin affects the rest of the market. Despite the falling price, the hashrate continues to grow, indicating the confidence of miners in the market’s future.

Hodlers remain steadfast, accumulating assets regardless of price changes, while on-chain indicators signal the end of the bearish phase and the start of a bullish rally. The increasing number of coins in various categories relative to small addresses is also a positive sign. It’s time to prepare for consolidation and a potential bullish rally.