On March 9th, the market is experiencing a downturn with both Bitcoin and other altcoins, such as Ethereum, seeing a decline.

However, despite a strong start to the year and a continuous rally in the first 45 days, Bitcoin has become increasingly volatile in recent weeks due to the SEC’s crackdown on crypto companies and the decision of Silvergate Capital’s parent company to wind up operations.

There are varying opinions among analysts regarding the future of Bitcoin’s value, with some predicting a return to the 20k mark while others remain optimistic.

Over the last 24 hours, Bitcoin’s value has fluctuated between $22,198 and $21,692, while in the past week, it peaked at $23,479.

Despite hopes for a resurgence in Bitcoin’s value, it has failed to break through the critical resistance zone of $22,250. Bearish market forces have persisted, causing the price to dip below the support level of $22,000.

This significant drop has led to even greater losses, with Bitcoin’s value plummeting to a new monthly low of approximately $21,692.

Market Fundamentals

During a Senate speech, Jerome Powell, the head of the US Federal Reserve, caused a market downturn in his usual fashion.

In his speech, Powell made several key points, including that policy easing is currently deemed undesirable, a further increase in the rate is necessary, peak rates will be higher than anticipated, and the rate will remain high for a certain period.

The immediate result of this negative outlook was a revision of the predicted rate hike for March. Experts now anticipate that the US Federal Reserve will increase rates by 0.5% instead of the previously expected 0.25%.

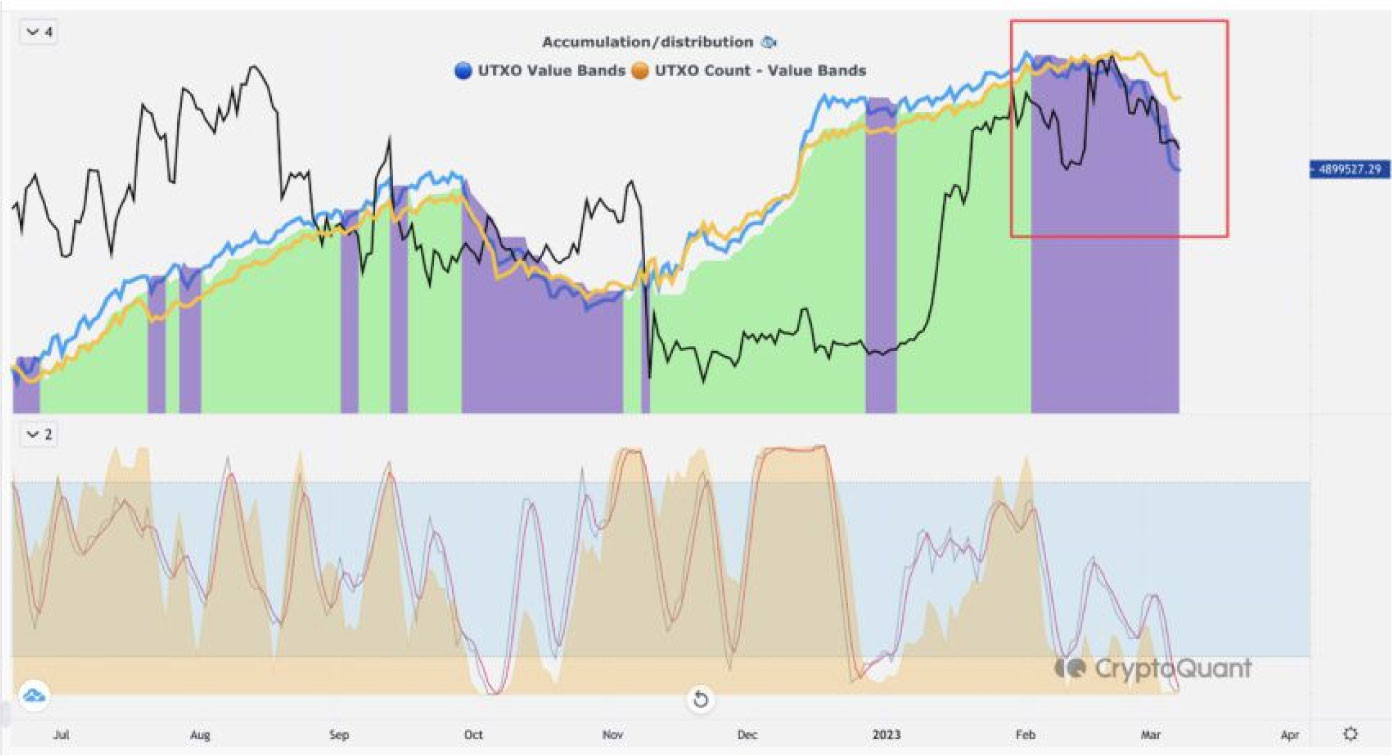

The recent decline in BTC’s value can be partly attributed to short-term holders of the UTXO cohort (10-100), who began actively selling their holdings from February 3rd. This group of investors holds 10 to 100 BTC in their wallets and now controls 25% of all bitcoins. The corresponding metric on the chart appears in purple.

The coins sold by this traders are being acquired by larger players in the UTXO (100-1K) and UTXO (1K-10K) cohorts, who currently hold 45% of all bitcoins and are in the accumulation stage.

It is important to note that the BTC market is still in the early stages of a bull cycle, and a local correction is a typical occurrence. As long as there are no major shocks to the market, we can anticipate a gradual increase in the value of the leading cryptocurrency.

Therefore, while the recent dip in BTC’s value may cause some concern among investors, the situation is not alarming overall. In fact, the devaluation of bitcoin may present an opportunity for long-term investors looking to accumulate BTC.

Market events

On March 10, the US will release a report on employment for the previous month, which will be significant for investors as it is the last report before the Fed meeting on March 22. Investors are anticipating the Fed’s strategy, specifically regarding their plans for the interest rate decision on March 22, which may indicate tighter monetary policy due to rising inflation.

The non-farm payrolls (NFP) employment data will be crucial, with investors expecting to see a figure of 200,000 new jobs created after 517,000 in January. Weak data could negatively affect both stock and cryptocurrency markets. Additionally, the unemployment rate data will be released, and it is projected to remain at 3.4 percent. A decrease in unemployment could strengthen the dollar and hinder Bitcoin’s price growth.

If Bitcoin can maintain its current price range, it may avoid a strong and prolonged bearish trend. Historically, March has not been a favorable month for Bitcoin, and this trend is expected to continue.