Bitcoin started 2023 briskly, but stalled in February

The start of 2023 has been a strong one for Bitcoin, as it has seen its most intense rally in two years with a whopping 43% increase. However, in recent times, the momentum seems to have slowed down. The bulls appear to be facing some challenges, as the price of Bitcoin stumbled after reaching resistance at $24,000. The rate dropped to a 7-day low at $22,700. Analysts have used various on-chain indicators such as network activity, coin movement on exchanges, and miner reserves to study the situation.

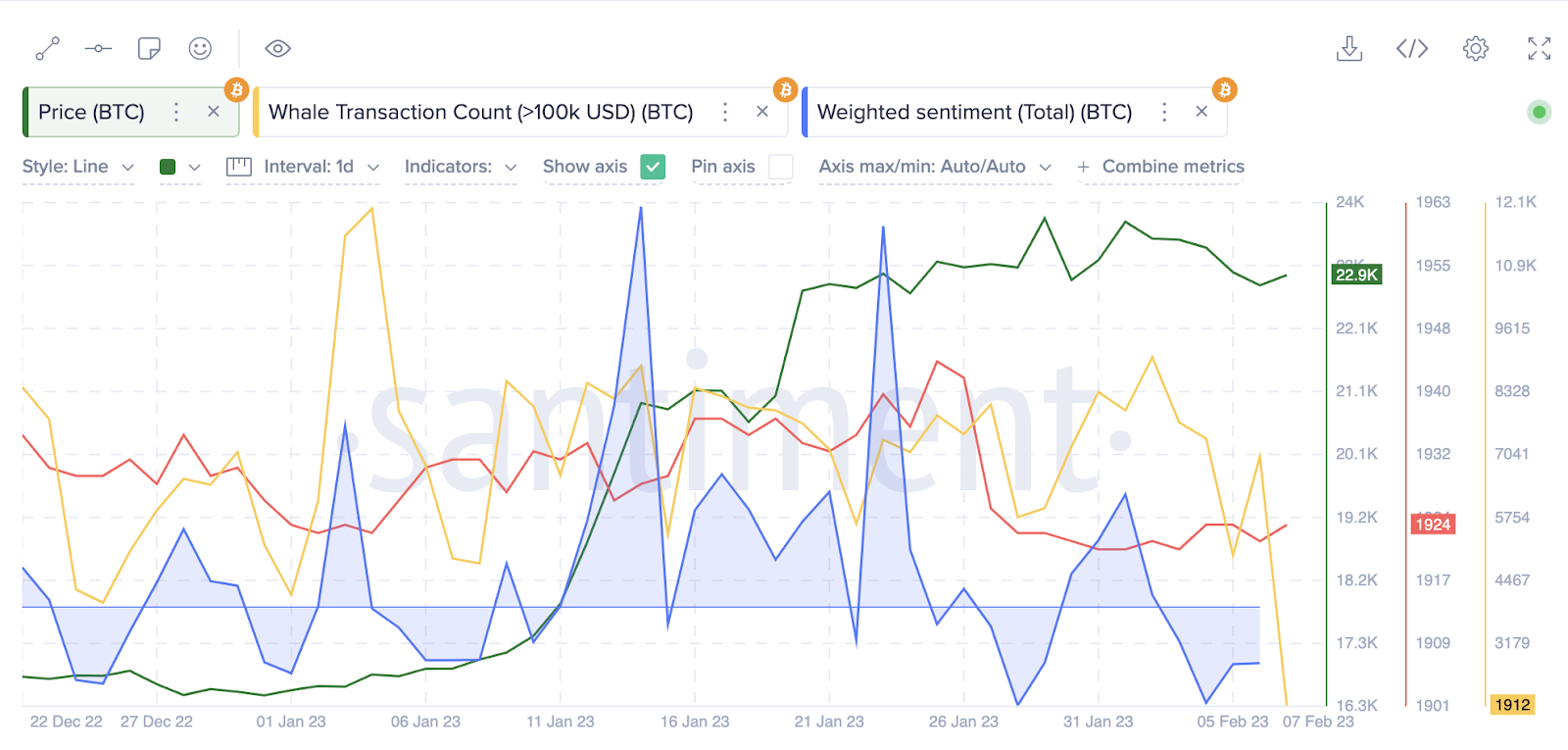

It appears that large investors are losing their interest in the network, as the number of Bitcoin transactions made by whales has dropped. This has resulted in decreased activity in the BTC network.

The decline in large transactions in the BTC network happened to coincide with a downward correction in the price of Bitcoin from the $23,800 region. On January 4th, the number of large transactions worth over $100,000 in the BTC network reached its highest level in 2023 at around 12,069. However, just a month later, this intraday indicator fell below 8,000. This trend has been attributed to the revival of investor interest in several hyped-up altcoins.

One such altcoin is SingularityNET (AGIX) blockchain token, which has made its way into the list of top performers this year. Additionally, blockchains based on the proof-of-stake consensus algorithm such as Cardano (ADA) and Polygon (MATIC) have attracted the attention of the whales away from Bitcoin.

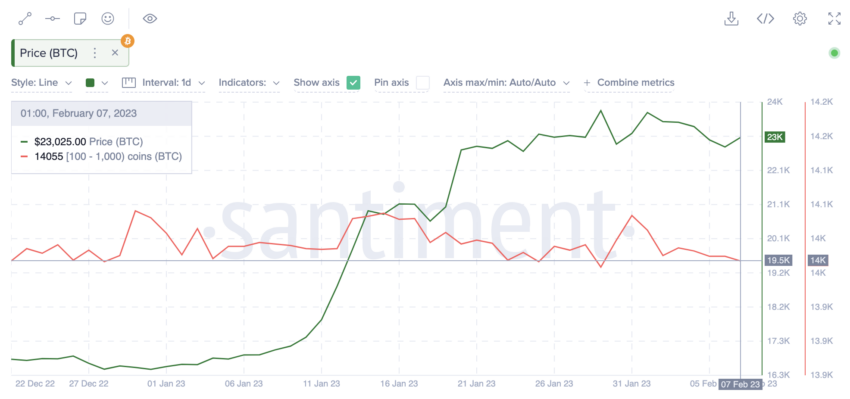

Another crucial on-chain metric is the sales made by whales, whose addresses hold between 100 to 1000 BTC. Historically, the activity of owners of these wallets has been closely tied to the dynamics of the Bitcoin exchange rate.

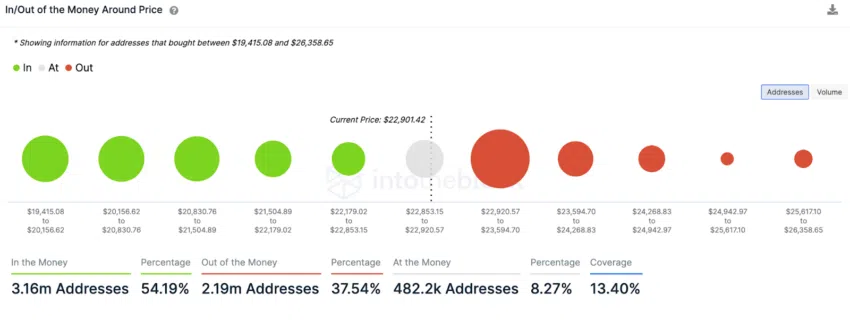

What are break-even levels?

Break-even levels refer to the price point at which an investment or a trade starts to generate profits. According to statistics on In the Money / Out of the Money positions, the immediate support for BTC is at $22,500, which is weaker compared to the resistance area at $23,500. This suggests that a drop to $22,500 is more probable than an increase in price. With a significant supply area around $23,300, a break below $22,800 could result in a significant price drawdown as holders look to cut their losses.

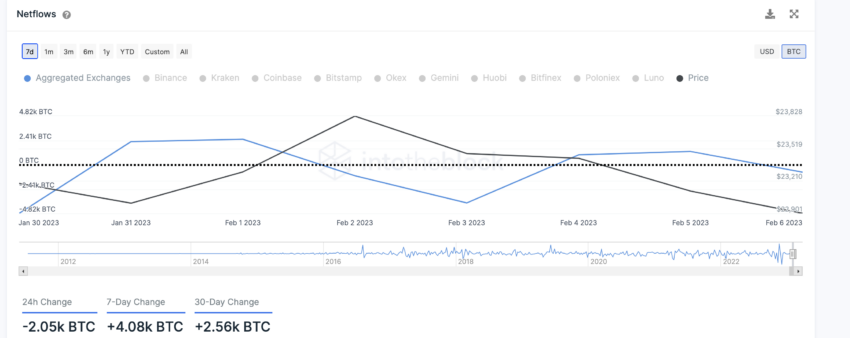

How are the markets performing?

The net movement of coins on the exchanges suggests a moderate bearish signal and reinforces the forecast for Bitcoin in February, which predicts that the BTC price may fall below $22,000. The number of Bitcoin holdings on crypto exchanges has increased by around 4,080 BTC in the past seven days and by 60% on a monthly basis. When the inflow of coins to trading platforms exceeds the withdrawal of funds from deposits, it indicates that the holders are likely to dispose of their assets in the near future.

Miners: A glimmer of hope.

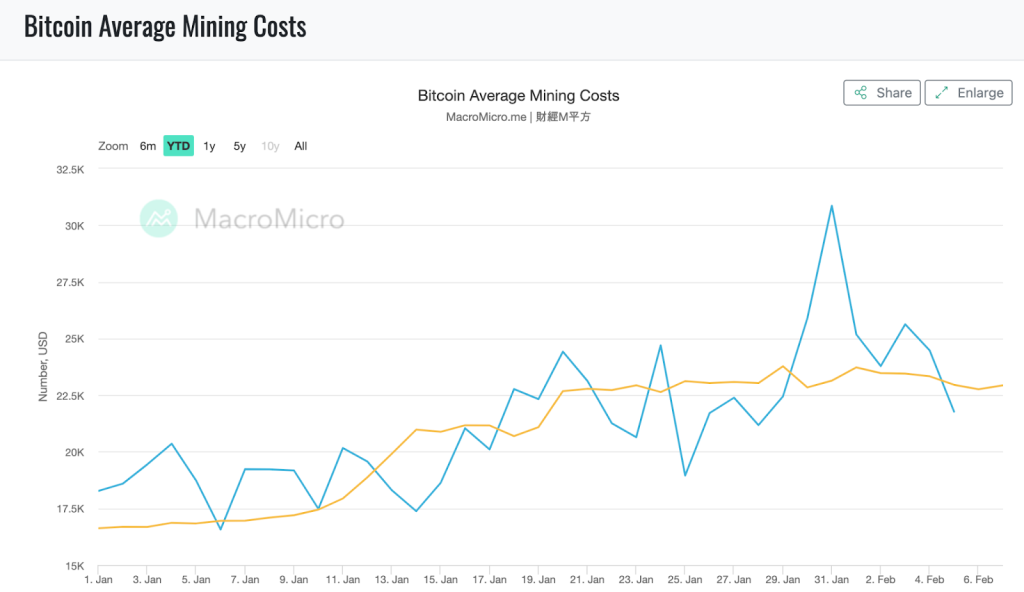

There’s some optimism coming from the mining sector. Many leading mining companies are now in the net profit zone as the price of BTC has surpassed the average cost per block to mine.

Historically, miners tend to accumulate block rewards when the price of a coin is higher than the transaction costs. If this trend continues, it could support Bitcoin. However, this factor alone may not be enough to trigger a full-fledged price rally. The release of the January report on consumer price inflation in the US on February 14 could also act as an additional growth catalyst.

On January 12, Bitcoin experienced a sharp rise following the release of similar inflation figures for December, which showed a slowdown in monthly inflation. If this occurs again, the markets may start speculating more actively about a possible reduction in interest rates by the Federal Reserve, which could benefit Bitcoin.