As the world continues to embrace the digital revolution, blockchain technology remains at the forefront of innovation, enabling groundbreaking applications and financial opportunities. One of the most prominent players in the blockchain space is Bitcoin, which recently hit a remarkable milestone with its Ordinal inscriptions nearing 19 million. This article delves into the latest trends surrounding Bitcoin’s Ordinal inscriptions and explores the recent performance of nonfungible tokens (NFTs) on the blockchain.

Bitcoin’s Ordinal Inscriptions Approach 19 million

As of July 22, 2023, the number of Ordinal inscriptions on the Bitcoin blockchain reached approximately 18,599,837, signaling a remarkable upward trend since December 16, 2022. For 218 consecutive days, the inscriptions have continued to grow, marking the enduring interest and adoption of the blockchain technology.

The composition of these inscriptions is intriguing. Statistics reveal that 78.5% of all inscriptions are in plain text form or character sets, while an additional 13.5% are plain text inscriptions. This combination brings the total of plain text and character set inscriptions to a staggering 92%. The remaining inscriptions consist of various media types, including images, GIF files, animations, applications, and more, showcasing the diverse use cases of the Bitcoin blockchain.

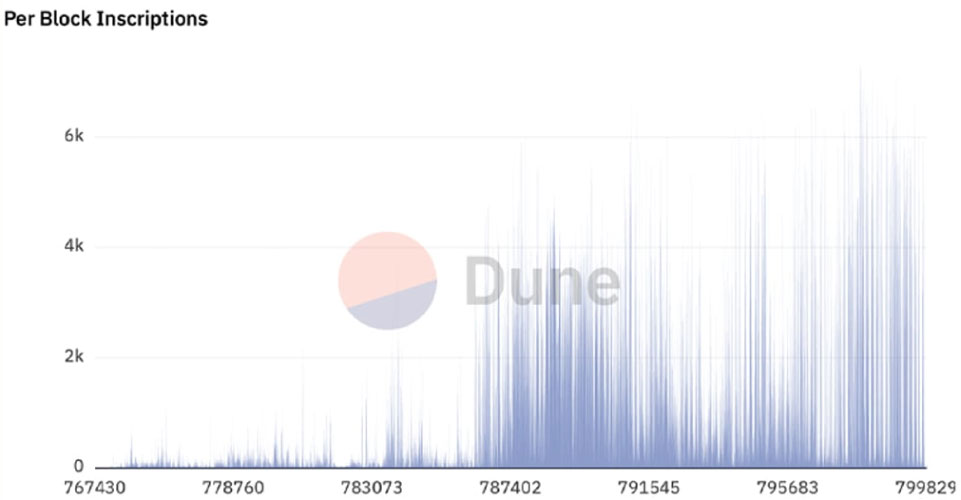

The number of inscriptions per block has been on an upward trajectory, with notable spikes in daily inscriptions on May 7, 2023 (400,091 inscriptions), July 9 (385,920 inscriptions), July 16 (385,604 inscriptions), and July 18 (323,964 inscriptions). Furthermore, July witnessed a significant increase in the number of inscriptions per block, with certain blocks surpassing 5,000 inscriptions, such as block height 797,976 and block height 798,795.

Fees and Transaction Backlog

As Ordinal inscriptions have surged, miners have earned approximately 1,847.66 BTC in fees, amounting to around $55.29 million. However, it’s worth noting that despite the continuing drive to inscribe, the fees have not followed the same upward trajectory. Data suggests that people are paying less to confirm nearly the same number of inscriptions compared to May, leading to a stagnant fee growth.

The situation is further complicated by the presence of over 300,000 unconfirmed transactions on the Bitcoin blockchain as of block height 799,832. Low-priority transactions come with a cost of 71 cents, while high-priority transactions require the sender to pay around $1.88 or 0.000063 BTC. Both financial transactions and Ordinal inscriptions contribute to this backlog of transactions, raising questions about scalability and efficiency.

NFT Sales on the Bitcoin Blockchain

In the realm of NFTs, a form of digital assets representing ownership of unique items, Bitcoin’s blockchain has seen notable activity. Metrics indicate that over the past 30 days, NFT sales on the platform amounted to an impressive $98.85 million.

However, it’s essential to put this figure into perspective. While the Bitcoin blockchain ranks second among 22 different blockchain networks in terms of NFT sales, the recent performance shows a decline of more than 13% compared to the previous month. Only two bitcoin-based NFT collections managed to secure spots in the top 10 for 30-day sales.

The “Uncategorized Ordinals” NFT collection stood out as the second-largest contributor to the past month’s sales, generating a substantial $41 million. This highlights the potential of NFTs within the Bitcoin ecosystem, but also signals that other blockchain networks are currently experiencing higher growth rates in this niche market.

Conclusion

The continuous rise of Bitcoin’s Ordinal inscriptions on the blockchain showcases the enduring interest and potential of blockchain technology. However, challenges in transaction fees and backlog management persist, necessitating further developments and optimizations.

In the world of NFTs, the Bitcoin blockchain has shown promise but faces competition from other platforms with higher growth rates. As the landscape evolves, it will be exciting to witness how blockchain technology, Bitcoin, and NFTs continue to shape the future of finance, art, and digital ownership.

Follow for more:

Telegram: https://bit.ly/3KbviBe

Twitter: https://bit.ly/3Zr6h9E

Website: https://bit.ly/3FWBaMc