This week, a total of seven cryptocurrency and DeFi platforms are gearing up for token unlocks. As we know, such events often result in supply dilution, which can put a downward pressure on token prices. It all begins with the 1inch exchange, which is scheduled to unlock its tokens on May 1. Although the amount of tokens being released is relatively small (only 21,429), it remains to be seen if there will be any noticeable impact on token prices.

Token unlocks are a common occurrence in the DeFi space, and they are often used as a mechanism to incentivize project participants and distribute tokens fairly. However, these events can also lead to short-term price fluctuations as investors and stakeholders sell off their tokens, leading to a temporary drop in the token’s value.

It’s worth noting that the long-term impact of token unlocks on a project’s success and sustainability is difficult to predict. While these events can create short-term volatility, they can also help to increase liquidity, encourage wider adoption, and foster community engagement.

Overall, token unlocks can be both an opportunity and a challenge for DeFi projects, and it’s essential to weigh the potential benefits and drawbacks before making investment decisions.

Unlocking of Tokens Scheduled for This Week

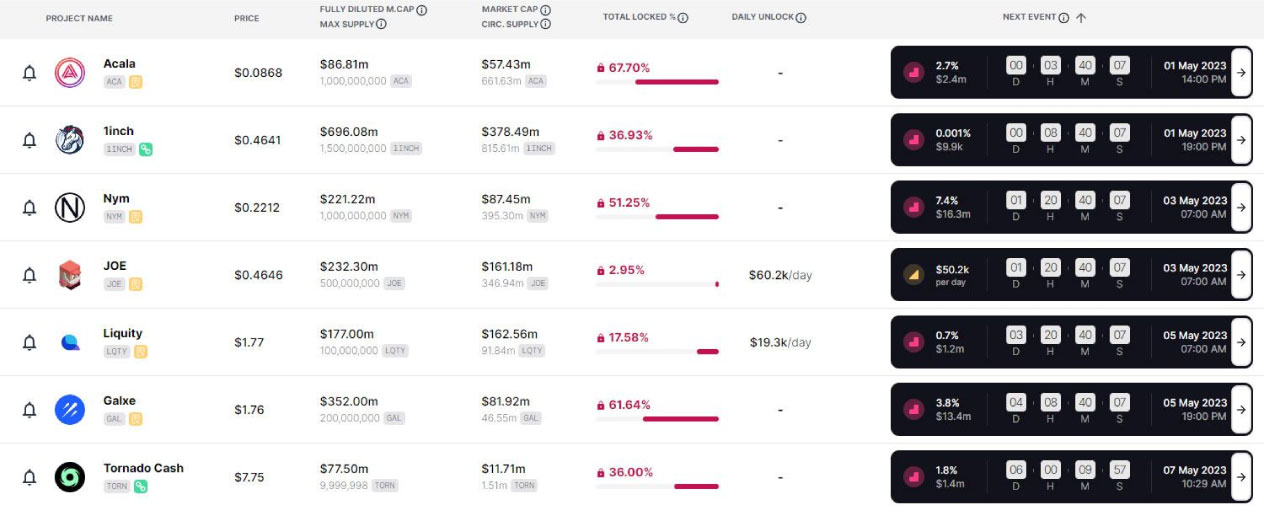

Currently, the value of the 1INCH token unlock is below $10,000, with around 37% of the total token supply remaining locked. The distribution of tokens is skewed towards team members and investors, with over 1.2 billion tokens being vested for them until December 2024.

On May 1, Acala will release around 27.4 million ACA tokens worth roughly $2.3 million, which represents 2.74% of the total supply. However, Acala’s tokenomics are more evenly distributed, with 34% allocated to crowd loan participants, 29% for strategic partners, and 12% for the reserve. The release schedule for ACA tokens runs until March 2028, and the current trading price is down 97% from its peak at $0.087.

Additionally, Nym will unlock nearly 7.4% of its total token supply on May 3, which is worth around $16.3 million and may result in downward pressure on token prices. The Trader Joe DEX also has a token release scheduled for May 3, with 108,000 JOE tokens. On May 5, Liquity (LQTY) and Galxe (GAL) will have token unlocks, while Tornado Cash will unlock 175,000 TORN tokens worth roughly $1.3 million on May 7.

The intent of token unlocks is to align incentives for DeFi project investors and stakeholders. However, in reality, this often causes short-term volatility and selling pressure.

Crypto Market Outlook

The crypto market has experienced a downturn during the Monday morning Asian trading session, with the total market capitalization decreasing by 1.7% to $1.23 trillion. BTC has fallen by 2% to $28,595, and ETH has lost 2.7% to reach $1,848. However, Binance’s BNB has bucked this trend and gained 4.4% to reach $335 at the time of writing, making it the only crypto asset in the top 20 to experience gains.

The market correction seems to be continuing, and DeFi projects with upcoming token supply releases this week could experience more significant losses. Token unlocks often create short-term selling pressure, and this, combined with the current market correction, could lead to further drops in token prices.

It’s important to note that market corrections are a regular occurrence in the crypto space, and they can be caused by a variety of factors such as regulatory announcements, market manipulation, or changes in investor sentiment. While they can be challenging to predict, it’s crucial for investors to stay informed and exercise caution during times of market volatility.

Follow for more:

Telegram: https://bit.ly/3KbviBe

Twitter: https://bit.ly/3Zr6h9E

Website: https://bit.ly/3FWBaMc