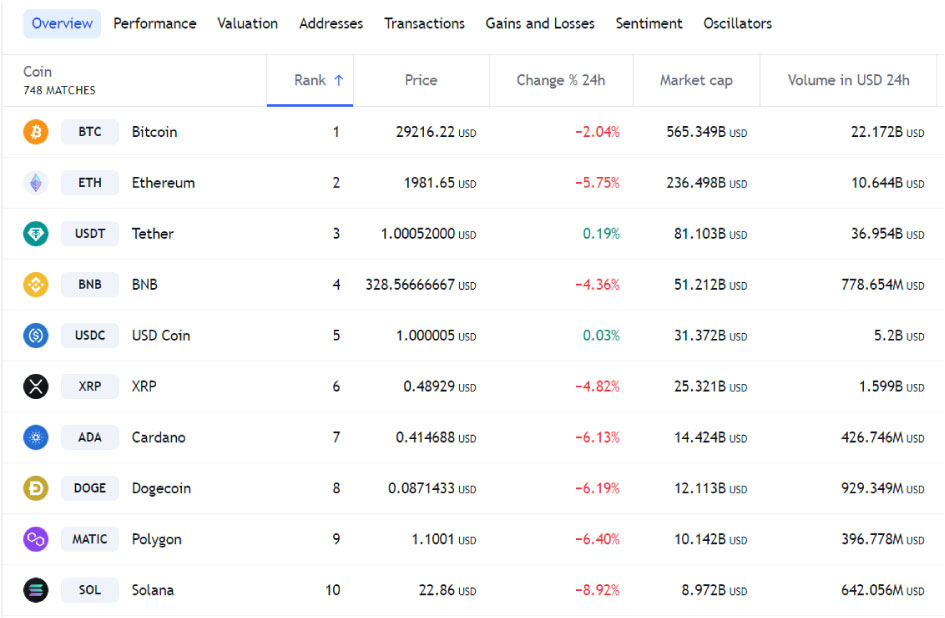

Bitcoin is currently trading below $30,000 as of April 19, with an estimated exchange rate of $29.2 thousand, which is noticeably lower than its recent peak of $31 thousand on April 14.

Other top cryptocurrencies are also experiencing similar trends.

This has raised concerns among investors that Bitcoin may have already reached its local price maximum and could now undergo a correction. However, most altcoins have shown positive returns in the past week and are expected to continue their upward momentum in the near future.

In addition to market dynamics, it’s crucial to consider fundamental factors such as the recent activation of the Shanghai upgrade on the Ethereum network and how it may impact the overall cryptocurrency market outlook.

Please note that the price of BTC has shown minimal fluctuations on a weekly basis, while several altcoins have exhibited significant growth during the same period.

This intriguing trend aligns with the typical behavior of digital assets during growth cycles. It usually begins with Bitcoin leading the market, followed by a cooling-off phase. During this phase, investors tend to shift their capital towards other altcoins, resulting in noticeable price surges. The smaller market capitalizations of these altcoins compared to BTC often lead to more pronounced and tangible price movements.

As a result, altcoins may potentially become the focal point of crypto investors in the near future, as this pattern has been observed in previous growth cycles.

Next move

As anticipated by many analysts, Bitcoin’s price dipping below the $30K mark was a predicted occurrence. This drop is viewed as a healthy correction of the uptrend that emerged last week.

Bitcoin has now returned to a zone where opening long positions is viable, as it has reached the lower limit of the channel and has the potential to rebound to $32,000. Although a potential rollback to $28,600 cannot be ruled out, it is unlikely to result in new local highs in the near future.

To instill confidence in investors and encourage cryptocurrency purchases, Bitcoin must swiftly surpass the $30,000 mark. Failure to establish support above this level may result in a deeper correction.

What’s unfolding in the realm of macroeconomics?

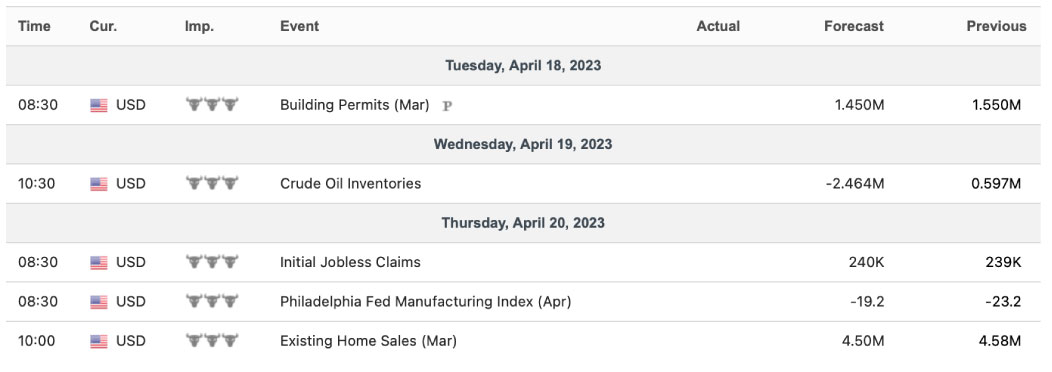

Following the events of the previous week, the release of data on unemployment and production indicators will be a crucial factor for the US economy in the upcoming days. This is particularly significant for major players such as Tesla, Netflix, and several banks, as market participants are keeping a keen eye on these developments in light of recent events.

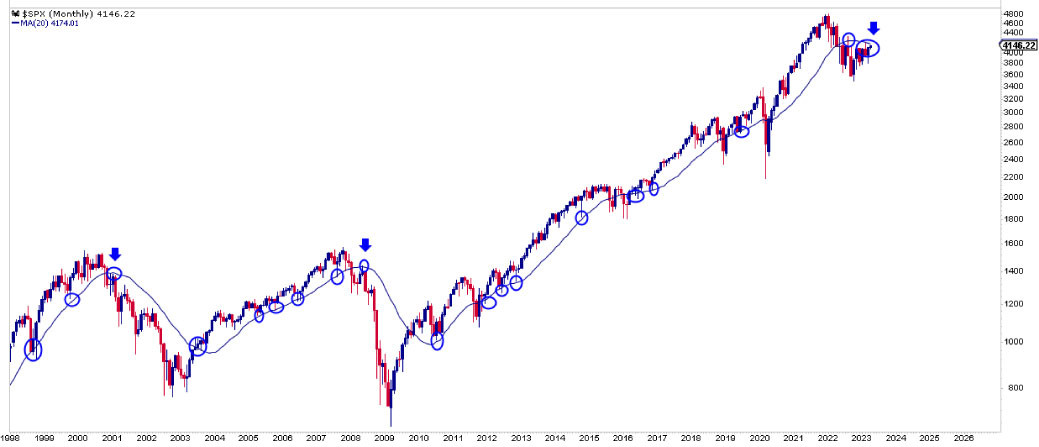

However, the outlook for the US stock market appears less optimistic. Sven Henrich, the CEO of NorthmanTrader, is skeptical about claims of stock bull runs having taken place. He argues that for this information to be substantiated, the S&P 500 index must consolidate above the average moving line on a 1-month timeframe, according to his analysis.

Bitcoin remains sensitive to significant downturns in the performance of major stock indices, as their steady growth holds significance for the broader crypto market.

In addition, the Bitcoin mining difficulty is anticipated to reach a new all-time high, with a projected increase of 1.51 percent. If this prediction materializes, it will mark the fifth consecutive increase, a trend not seen since February 2022.

Approaches of Cryptocurrency Investors

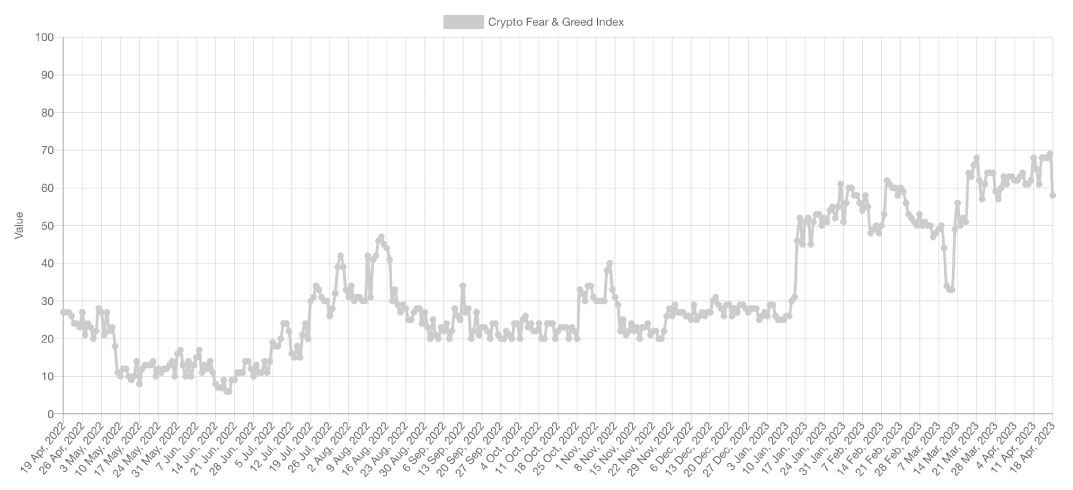

Cryptocurrency investors are currently experiencing a mixed sentiment in the market. While the price of Bitcoin is still below its historical high from November 2021, the fear and greed index, compiled by Alternative, has reached its highest level in a year and a half.

During a recent local bull run, the index surged to 69 out of 100 points, indicating significant greed among Bitcoin investors. Although the index has since dropped to 58 points, reflecting a slightly less euphoric sentiment, the rapid growth of BTC the day before has instilled optimism in many traders and investors.

However, this situation can be precarious, as historically, extreme euphoria often accompanies price peaks. Nevertheless, the events of 2021 have shown that there may still be room for growth in this indicator. It is important for crypto enthusiasts to remember that the coin industry is still emerging from a bearish trend and not yet completing a bullish cycle.

Despite the current cooling down phase in the digital asset market, the fundamental advantages of cryptocurrencies, such as limited maximum supply, deflation, reasonable transaction fees, and independence from central authorities, remain unchanged. Thus, it may not be too late to consider investing in coins and tokens, as they continue to offer users unique benefits.

Follow for more:

Telegram: https://bit.ly/3KbviBe

Twitter: https://bit.ly/3Zr6h9E

Website: https://bit.ly/3FWBaMc