Bitcoin had an impressive performance in the first quarter of 2021, closing as the best quarter since the beginning of the year. This achievement came at a time when the US banking sector was facing a crisis, leading to increased demand for leading cryptocurrencies. The “Fear and Greed Index” updated its yearly maximum, pointing to optimism among investors.

The DeFi sector continued to receive liquidity flows as on-chain indicators suggest that the first cryptocurrency could maintain its rally. While speculators primarily took profits on centralized exchanges, hodlers held steadfast. The hash rate and mining difficulty for Bitcoin updated their highs, indicating the network’s robustness.

Investors also showed a strong interest in cryptocurrency derivatives, with options open interest (OI) hitting a historical maximum. The stablecoin segment faced significant changes due to the USDC depegging.

Overall, the cryptocurrency market had a remarkable performance during the quarter, with Bitcoin leading the way. The sector’s resilience in the face of the US banking crisis underscores the increasing importance of cryptocurrencies as a viable investment option.

Several industry figures, including Huobi, Coinbase, Justin Sun, and SushiSwap, have been charged by US regulators. Despite the negative initial reaction of the first cryptocurrency and the market as a whole (with the rate dropping to $20,000 on March 10), sentiment quickly turned bullish.

Furthermore, a banking crisis began in the United States, causing general macroeconomic instability. However, the cryptocurrency market showed significant growth, and capitalization returned to levels above $1 trillion. On March 30, Bitcoin set a local high above 29,000, further bolstering investor confidence.

By the end of the month, Bitcoin had grown by 22.96%, while Ethereum had grown by 13.46%. Both cryptocurrencies had a strong performance in the first quarter of 2023, with Bitcoin and Ethereum rising by 71.77% and 52.15%, respectively. The robust growth in the cryptocurrency market in the face of these challenges highlights its resilience and potential as a valuable investment option.

Market sentiment, correlations and volatility

March was a significant month for several cryptocurrency projects. One standout performer was the DEX Trader Joe (JOE) token based on Avalanche, whose trading volume increased significantly thanks to the integration of a new liquidity provision model. Additionally, the DEX added support for Arbitrum in December 2022, with DAO receiving a significant amount of ARB following the listing.

Other gainers of the month included Swipe (SXP) and Conflux (CFX), with the former announcing a rebrand to Solar, and the latter expanding its presence in the Asian region with new partnerships.

However, not all projects had a positive month. Terra Luna Classic (LUNC) suffered a loss due to the arrest of the founder of Terraform Labs, Do Kwon. Maker (MKR) and Fetch.ai (FET) also experienced declines.

During the month, the “Fear and Greed Index” updated its annual maximum, reaching 68 before the next Fed meeting. This level last occurred in November 2021 when Bitcoin approached the $20,000 mark for the first time. On March 12, the indicator reached a minimum of 33 due to the panic caused by the loss of parity against the US dollar by the stablecoin USD Coin (USDC).

Despite the problems in the banking sector and increased pressure on industry players from US regulators, the optimism of investors remained high. This may signal the start of a new bull run in the cryptocurrency market.

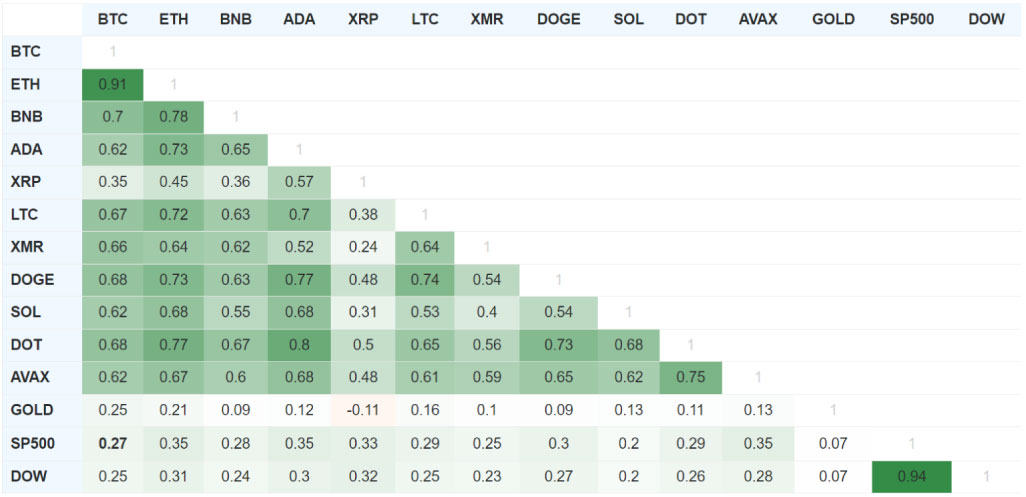

The relationship between bitcoin and the US stock market weakened in March. The correlation with the S&P 500 index fell to 0.27, with the Dow Jones indicator – 0.25. Meanwhile, the relationship between bitcoin and gold strengthened. The digital asset showed better dynamics than traditional financial instruments amid the banking crisis.

The average value of the index of historical intraday volatility of bitcoin (BVOL24H) was $3, higher than in February. The indicator reached its maximum on March 14 when bitcoin quotes rose above $26,000.

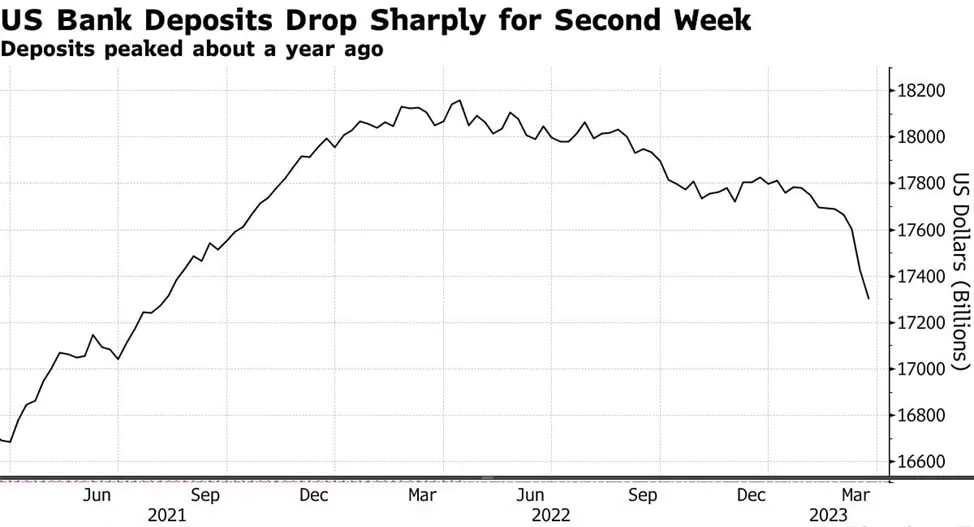

The banking crisis in the US subsided, but risks remain in the system. The sector’s declining deposits for nine straight weeks and depletion of FDIC reserves suggest ongoing concerns. However, Fed Vice Chairman for Banking Supervision William Barr, FDIC head Martin Greenberg, and US Treasury head Janet Yellen expressed confidence in the state of credit institutions.

The Federal Reserve allocated $64.4 billion as part of the BTFP, and in total for all programs to support the banking sector – $383 billion.

The Central Bank’s balance sheet grew by $304 billion over the past three weeks, recouping almost two-thirds of the reduction since April 2022 as part of Quantitative Tightening (QT).

The stability of market sentiment has made the scenario of the Fed increasing the key rate by 25 basis points relevant again, with the probability of this happening rising to 48.4%. During the height of banking turbulence, traders were more likely to reduce or keep this probability unchanged.

In March, the Fed had already raised the key rate range by 25 basis points to 4.75-5% per annum, and the future trajectory of rates will depend on the state of the banking sector and macroeconomic indicators such as inflation and employment. These indicators will be released on April 7.

The liquidity influx from the Fed into financial markets has resulted in the S&P and Nasdaq 100 closing the first quarter with growth rates of 7% and 20.5% respectively. Additionally, Bitcoin reached a price above $28,000.

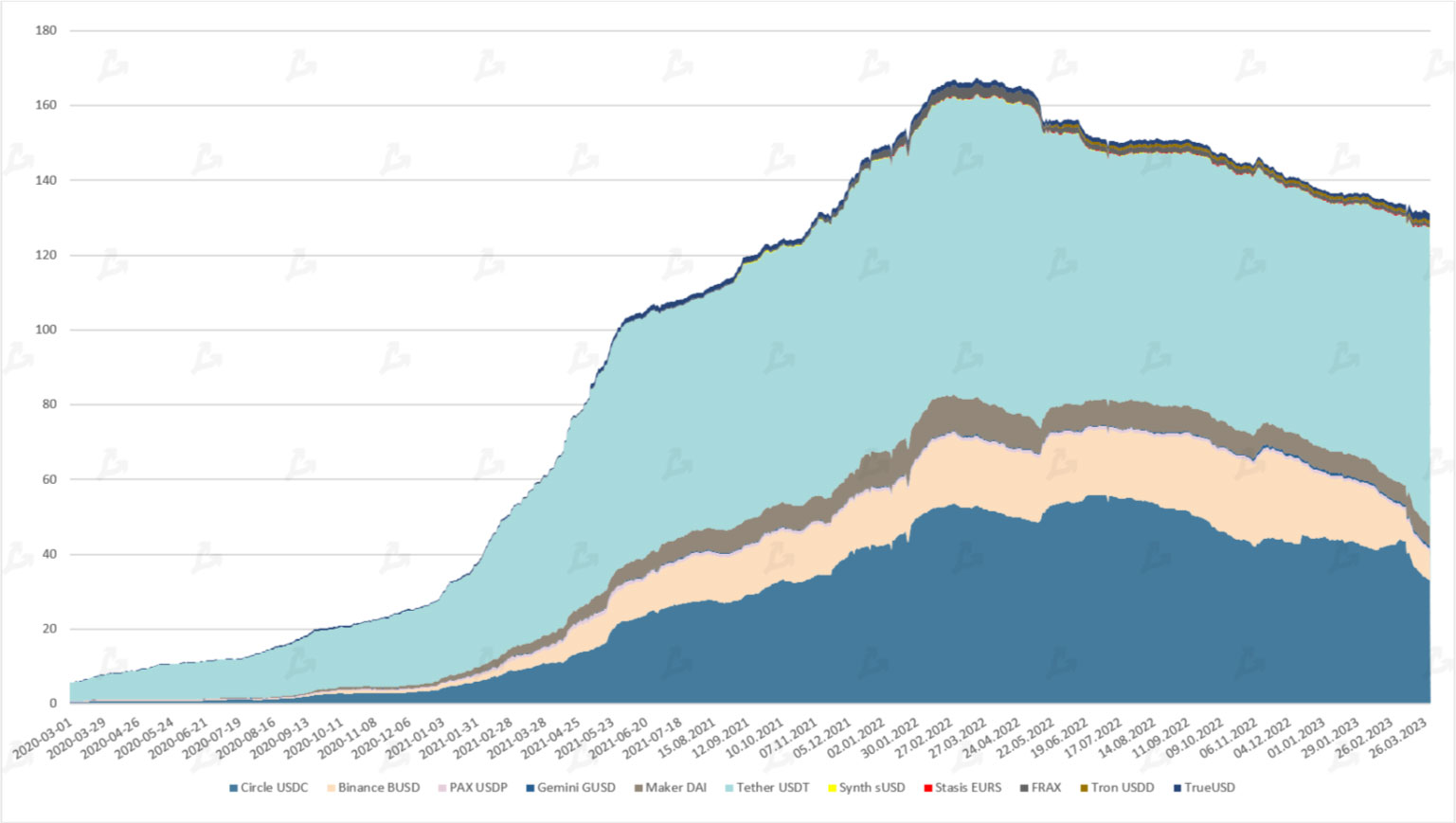

Stablecoin

In March, due to the banking crisis in the United States, the market capitalization of stablecoins dropped to $131 billion. USD Coin (USDC), the second-largest stablecoin by capitalization, lost its parity with the US dollar on March 11 due to Silicon Valley Bank’s (SVB) problems, which was closed due to bankruptcy. Circle, the issuer of USDC, had $3.3 billion in the bank, which was frozen. Despite Circle’s announcement of using corporate reserves and external capital to cover the loss, investors remained unconvinced.

The DeFi sector and other assets using USDC as collateral were affected, causing a ripple effect that also caused DAI and FRAX to lose their peg to the dollar. However, the US government intervened, announcing the bank’s sanitation, and USDC regained its target threshold of $1. Despite this resolution, USDC’s capitalization continued to decline, dropping by $9.1 billion by the end of March. Investors shifted their focus to Tether (USDT), whose capitalization increased by $8.7 billion.