Matt Damon explains why he did a Crypto.com ad, citing a difficult year for his Clean Water Foundation

Matt Damon recently shared the reason behind his appearance in the 2021 Crypto.com ad advertisement. In a recent interview with the Associated Press, the Hollywood icon said that the primary motive for becoming the face of the crypto firm’s marketing campaign was to get financial support for water.org, a clean water project he co-founded with philanthropist Gary White. Damon revealed that the organization had a down year, and he did the commercial to raise money for it.

The ad, titled “Fortune favors the brave,” saw Damon comparing crypto investors to astronauts, mountain climbers, and even the Wright Brothers, the famous American aviation pioneers. In his conversation with the Associated Press, Damon mentioned that he gave his entire salary from the ad to water.org because the organization was experiencing a difficult year. He also praised Crypto.com for donating $1 million to the nonprofit on their own. The donation was made with the primary goal of supporting water.org’s mission to bring clean water and sanitation to those in need.

The partnership between Damon and Crypto.com aimed to encourage the exchange’s users to support the cause of providing clean water and sanitation to people in need. Damon expressed his happiness to work with a like-minded partner committed to transforming lives through equity and access.

However, the commercial faced criticism on social media, with some calling it a “grotesque” and “embarrassing cash grab.” It took two months for the ad to trend on Twitter and be noticed by those outside of the crypto world.

In November 2021, shortly after the ad’s release, Crypto.com paid $700 million for the naming rights to the Los Angeles Staples Center, home to the NBA’s Lakers and Clippers. The marketing efforts gave the exchange some boost. Some critics even accused Damon of “advertising a Ponzi scheme.” Water.org did not immediately respond to Decrypt’s request for comment, and Crypto.com declined to comment on the matter.

(De)centralization in TON: who controls the majority of mined tokens?

The Open Network, which is Pavel Durov’s decentralized legacy, is experiencing significant growth with the DeFi ecosystem expanding its TVL and the Toncoin token holding its position in the top 30 market capitalization ratings.

However, Whiterabbit researchers have identified potential issues with the project. They have highlighted the risk of centralization due to a small number of ecosystem participants, associated with the TON Foundation, holding a majority of the utility tokens. About 86% of the total supply of Toncoin coins are held by a few whale addresses, which are closely connected to each other and the TON Foundation.

As a result, the researchers are concerned about the potential manipulation of the price of the utility token and see these developments as signs of the centralization of the TON project.

History of The Open Network

To gain a better understanding of the issue at hand, it’s important to delve into the context by exploring the complicated history of The Open Network. Initially developed by the Telegram team, the Proof-of-Stake-based blockchain is now backed by third-party developers. In December 2017, a former employee revealed that Telegram planned to hold an initial coin offering (ICO) for the Telegram Open Network (TON) project and its token, Gram.

With 180 million messenger users at the time and a booming crypto industry, Telegram decided to hold a closed token sale for professional investors who would receive Gram tokens after the launch of the TON network. The ICO attracted a great deal of excitement and raised more than the targeted $850 million from American, Asian, and Russian investors, including Roman Abramovich and Mikhail Abyzov.

TON was designed to be a platform for decentralized applications with smart contracts and a virtual machine, and it was meant to scale beyond the capabilities of Ethereum. An important aspect was the integration of the system and Gram into Telegram, which would give access to hundreds of millions of users and allow for payment for advertising in channels using tokens.

Although the creation of TON was done behind closed doors, third-party developers participated in it, and the Telegram team published the results in the public domain, enabling the project to be launched in 2020 without Telegram and Pavel Durov’s involvement. In the spring of 2019, the TON test network was launched, and by autumn, it was clear that TON was in its final stage.

However, on the eve of the launch, the SEC announced the adoption of “extraordinary measures and restrictions” in relation to two offshore companies associated with the TON token sale, claiming that Gram was sold illegally to investors, including 39 American residents.

The SEC secured a temporary injunction against the distribution of Gram, making the launch of TON impossible, and sued Telegram for selling unregistered securities. As a result, Pavel Durov announced the closure of the project, and his company did not challenge the injunction on the release of Gram.

New life TON

The Telegram Open Network had all its technical aspects ready in spring 2020, and the community announced the possibility of launching the network without Telegram’s participation. The “decentralized launch” was supported by the network’s leading validators. Even after TON’s closure, several independent teams continued working on the blockchain based on the project code.

In March 2021, Telegram representatives transferred the ton.org domain and GitHub repository to The Open Network community. The native token of the ecosystem – Toncoin – had an emission of 5 billion coins, with over 70,000 network accounts. The Open Network community stated that they will continue developing the underlying technology behind TON.

In December 2021, Pavel Durov publicly supported Toncoin developers, stating he was proud that “the technology is alive and growing,” and that Toncoin does not depend on the Telegram team. He wished the developers success and said that they had what it takes to build something big if combined with the right go-to-market strategy.

In November 2022, the Fragment platform began selling Telegram usernames for Toncoin. The first username, @auto, sold for 900,000 Toncoins or approximately $1.4 million. In February 2023, TON validators voted to suspend 194 wallets with a total balance of 1.08 billion Toncoin (worth over $2 billion) that had not been used for transactions since 2020.

The project aims to provide clarity on the amount of available Toncoin. The suspension will last for four years and only applies to addresses that participated in the initial allocation. The total volume of frozen coins amounts to 21.3% of the total supply of the crypto asset.

Additionally, in February 2023, TON developers announced their roadmap for the year, which includes launching a single protocol for interaction between ecosystem applications and wallets, improving network security and stability, supporting EVM signature verification, and improving TON wallet address formats. They also aim to introduce a mechanism for burning part of the commissions, facilitate cross-chain transfers between TON and Polygon, create a bridge for transferring bitcoins, ETH and BNB, and separate nodes into collators and validators to improve blockchain performance.

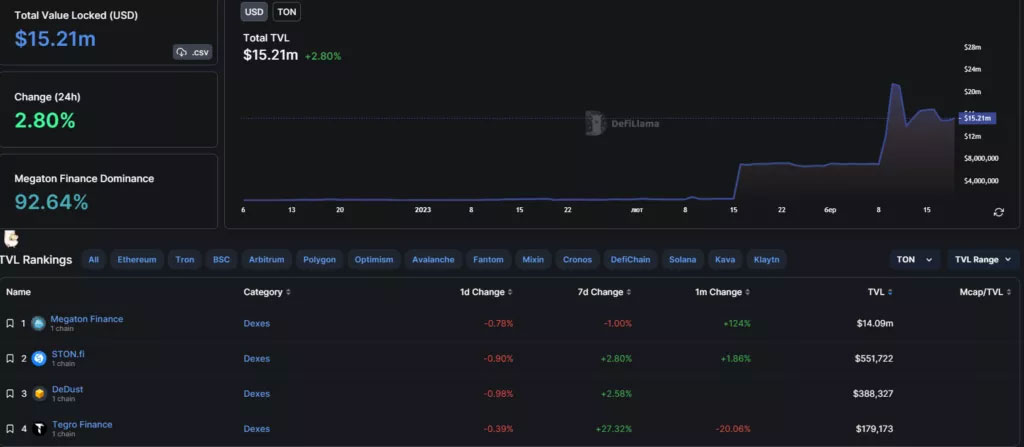

Moreover, the TON team launched Ton.vote, a voting platform for Toncoin holders to participate in decision-making for all projects in the network. As of March 19, 2023, the total TVL of the TON ecosystem apps is a little over $15 million. This is significantly lower than BNB Chain and Tron, which are worth $7.76 billion and $5.45 billion, respectively.

Most of the Total Value Locked (TVL) in the TON ecosystem, accounting for around 92%, is attributed to Megaton Finance, a decentralized exchange. According to a TON representative, the team is currently focusing heavily on DeFi products, and they anticipate that the amount of funds locked in the ecosystem will increase. Despite being compared to zero TVL in the TON ecosystem last year, the current TVL of over $15 million is considered a significant progress.

The TON team aims to achieve Web3, where DeFi plays a crucial role, and they are confident that the TVL in the ecosystem will continue to grow and have the potential to become the largest in the world. As of March 19, 2023, the market capitalization of Toncoin stands at approximately $3.5 billion, placing it alongside projects such as Cosmos Hub, Chainlink, LEO Token, and Ethereum Classic in the CoinGecko ranking.

TON Future

There is a possibility that the TON Foundation will increase its token distribution to the community and key projects in the ecosystem in order to promote the blockchain. Some of these coins may be sold on the market, which could negatively impact the asset’s value.

An expert suggests that selling or distributing tokens to other institutions could be a solution for the ecosystem. TON has already been distributing tokens through grant programs, contests, hackathons, and airdrops. Although the recent “freezing” of coins reduces the risk, the problem of centralization of token holders remains. The TON Foundation denies close ties with early miners who may be able to manipulate the token supply and rate.

The high entry threshold for developers and the centralization issue are obstacles to TON’s development, although the ecosystem’s integration with Telegram, asynchronous blockchain architecture, and strong developer base may help it compete with BNB Chain, Polygon, or Avalanche.

The TON Foundation claims that their interaction with miners is limited to donations for network development and denies being affiliated with them. They also note that the concentration of liquid assets in the hands of a few large holders is a common occurrence in crypto projects.

Finally, the impact of the “freeze” on the project’s economy is expected to be minimal since access to the relevant addresses was lost prior to the suspension vote.

When conducting a fundamental analysis of crypto projects, investors should carefully consider the issuance of the asset, as well as its future distribution plans and features. If a project has a large concentration of coins at only a few addresses, this suggests centralization and a significant risk of decision-making being in favor of a small group of participants.

This situation is evident in the recent freezing of TON addresses based on validator voting or the potential sale of a large volume of tokens on the market. Nonetheless, a strong development team, innovative technology, and integrations can create a network effect that can overcome these shortcomings.