Over the past few days, Bitcoin experienced a surge in value, but this was followed by a minor decline. Yesterday, Bitcoin’s price momentarily exceeded $26,300 before correcting to $24,700. The growth in Bitcoin’s value was reportedly driven by inflation data in the United States, which was recorded at 6%.

However, this correction in Bitcoin’s price was due to hopes of a slowdown in interest rates following the news of the 0.4% inflation rate in February, which matched economists’ predictions as announced by the Bureau of Labor Statistics on Tuesday. After this news, the value of Bitcoin increased once again.

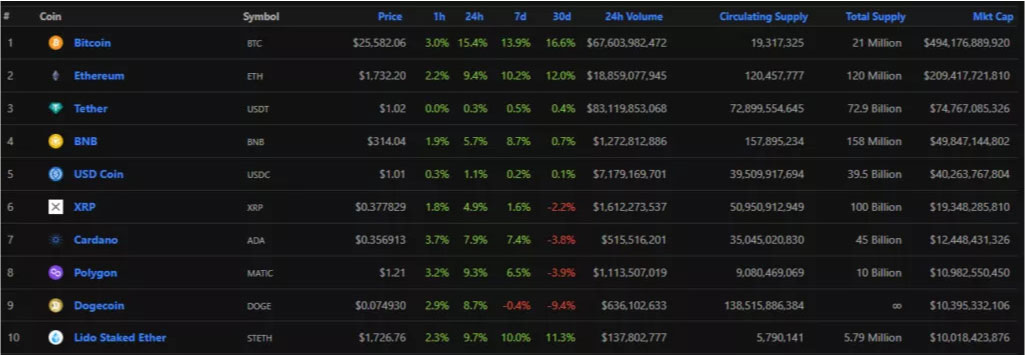

The first cryptocurrency provoked the growth of the rest of the market. This is what the top ten most capitalized cryptoassets look like:

Recently, Bitcoin fell below $20,000 but received a boost in value thanks to news from the US. Joe Biden gave assurances that the bankruptcy of Signature and SVB did not impact the US banking system, as the country had strengthened its financial industry following the fall of banks and the crisis in 2008. Depositors of both banks were able to access their savings.

Additionally, the consumer price index showed a decrease to 6.0 points, which is an improvement from past results. This decrease in inflation had a positive effect on Bitcoin, as investors became more willing to invest in riskier assets. The last recorded value of Bitcoin was $25,000 in June 2022.

Growth was replaced by a correction

Traders may consider closing their long positions near the resistance level of $25,000, which is understandable given that Bitcoin’s price has increased by more than 25% in just three days. Such a rapid surge in value is too much for a weak trend, coupled with uncertainty in the US banking system.

It’s likely that consolidation will occur around the $25,000 level before March 22, and we must wait until the end of the week to better gauge the medium-term situation.

If issues in the US banking sector persist and worsen, stock indices may decline, leading to a potential drop in Bitcoin’s value to $24,000.

The current reading of the “fear and greed” index is approximately 50 points, indicating a neutral sentiment in the cryptocurrency market. At present, players are not inclined to engage in active buying or selling of digital currencies.

Therefore, it’s unlikely that Bitcoin will experience further rapid growth, and testing the $27,000 level in the next two days is improbable. The expected short-term Bitcoin exchange rate will likely range from $24,500 to $26,500.

The bulls require significant factors to progress, while the bears aim to reduce the price to $24,000. If this occurs, the bulls will be unable to execute their strategy, and Bitcoin’s price will likely fluctuate within the aforementioned range.

Nevertheless, it’s encouraging that Bitcoin’s value has surpassed the $23,000 threshold, and skeptics’ predictions have yet to materialize.