The continuous adoption of Bitcoin is increasing it’s scaritye daily. Meanwhile, its physical equivalent — Casascius physical bitcoins — created by Mike Caldwell between 2011 and 2013 are becoming scarcer than digital bitcoin. We now have less than twenty thousand active bitcoins available for “peel.”

Casascius Physical Bitcoins Becoming Scarcer

The popularity of Bitcoin as a technological innovation leveraging blockchain technology has revealed different ways individuals can make a new product from it. An instance is the adoption of bitcoin by some individuals or groups to create new concepts referred to as “physical bitcoins.”

These physical bitcoins are created by making coins with a bitcoin symbol and etching the equivalent of digital bitcoin on the coin. This digital bitcoin is hidden within the physical bitcoin’s body. A group or an individual initiates this process.

This endeavor is regarded as a collection. But the most popular of the collections is the Casascius physical bitcoin collection made by Mike Caldwell, which was first introduced in 2011. His physical bitcoin collection is sold at a higher price compared to the Bitcoin price they hold.

One way Mike has been able to hold dignified for his collection is by placing a tamper-resistant sticker on the side of the coin. Then, the buyer will peel the sticker to reveal the private key of the digital bitcoin. From his expertise, he crafted the coins and the bars that withhold the digital bitcoin.

These physical coins can be attributed as gift cards with a bar code. As a result, it is the physical equivalent of having your digital bitcoins in your palms. Although the legitimacy of these physical bitcoins remains obscure.

U.S. Government Clamped Down Casascius Bitcoin Minting

Following a letter Mike Caldwell received in 2013 from an arm of the U.S. Treasury Department—Financial Crimes Enforcement Network, he decided to shut down his solo operations. In this letter, he understood that the federal agency saw him as a money transmitter because he minted physical bitcoins.

That explains that he would need to obtain both federal and state licenses to operate without legal tussles. But he considered his physical minting process the creation of a collectible and shouldn’t bother the feds. He mentioned this while believing that he didn’t receive any U.S. dollars or fiat currency in exchange for that.

But in his stance not to offend the feds, he decided that he may not produce the physical bitcoins because it would be stressful trying to obtain licenses across the 47 states. Aside from the physical stress involved, he worried about the financial stress that may run up to millions of dollars for money transmitting business regulation.

His statement about the occurrence revealed that he would rather have the business closing up than upset the federal institution because he felt he wasn’t doing illegal business. He said,

“It’s possible. I haven’t come to a final conclusion.”

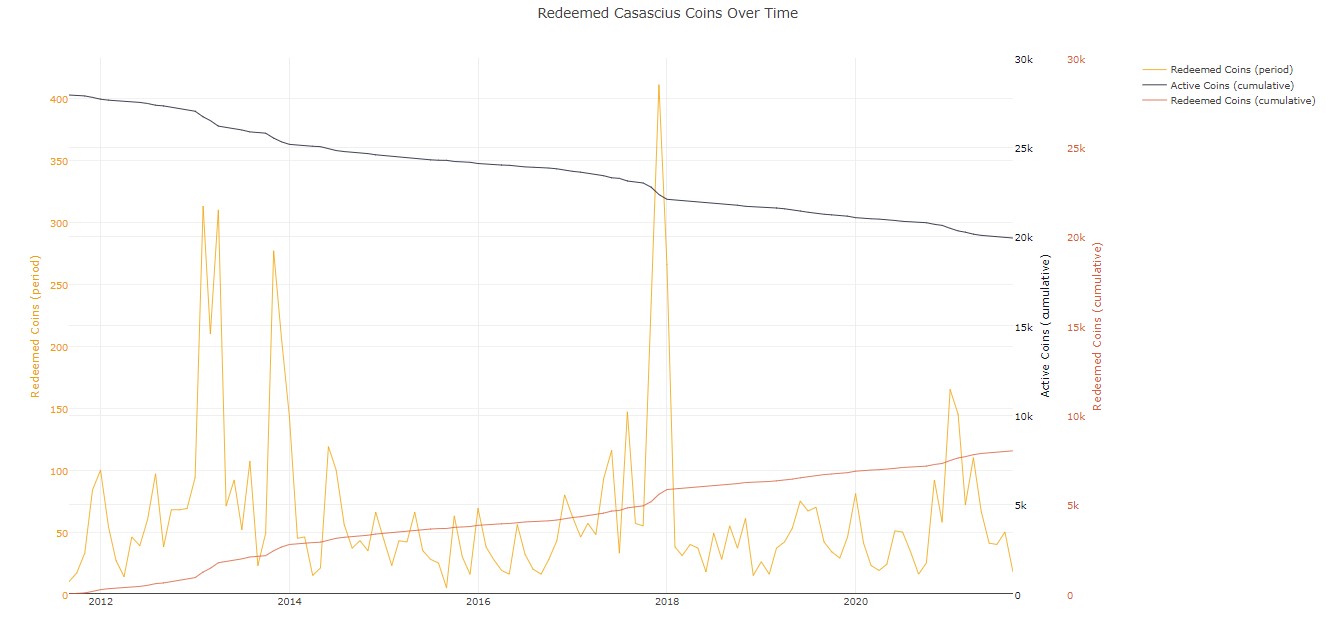

Despite the clampdown, he minted about 27,000 Casascius bitcoins while having variants BTC loaded on those coins. He created three physical bitcoins; series 1 has 1-1000 BTC units, series 2 has 0.5-500 BTC units with DIY Storage Bars, and series 3 has 0.5-1 BTC units.

However, owners keep redeeming the equivalent value of BTC loaded on the physical coins. This process is referred to as a “peel.”

Less Than 20,000 Casascius Physical Bitcoins Unpeeled

There are less than twenty thousand coins left a decade after minting the first Casascius bitcoins. According to a report from casasciustracker.com, about 8,000 coins were redeemed in ten years, while about 19,900 coins are active with loaded digital bitcoins.

These unpeeled digital bitcoins have an approximate unit of 43,000 BTC worth over two billion dollars. Meanwhile, some owners are yet to peel their coins with about 1,000 BTC coins averaging $48 million based on present exchange rates.

Regardless of the scarcity surrounding the availability of the Casascius bitcoin collection, it has grown its intrinsic value. As a result, these coins are regarded as coveted bitcoin collectibles. More reasons it is not surprising to have a peeled Casascius coin selling a 2012 piece for approximately $2,000.