The growing demand for owning a unit of Bitcoin intensifies the need to allow Bitcoin and other cryptos to make entry into stock exchanges. Don’t be caught unaware when cryptocurrency trade on a stock exchange very close to you. Despite the increased adoption rate, this integration faces some challenges.

The Dollar Standard Competition

The first challenge crypto may face is the US dollar resistance to allow crypto to replace it in the financial market. The US dollar is a global currency used for the transactional purpose in the international financial market. It is used as the primary currency on stock exchanges. As such, it may not be an easy task for crypto to displace it from the financial markets.

However, the continuous adoption of cryptocurrencies like Bitcoin and stablecoins makes it easier for individuals to transact globally without a regulatory body. And these transactions occur in a matter of minutes.

As a result, cryptocurrencies—like Bitcoin and Tether (USDT)—may displace the US Dollar from being the standard currency for international trade. This may change the face of the global markets and stock exchanges operations.

The Tussle for Crypto Acceptance Amongst US Stock Traders

Despite the continuous adoption of cryptocurrency, some individuals worldwide, like US investors, are not convinced that cryptocurrency can be an asset. They believe that there is a need for crypto to experience long-term financial market exposure before it can be considered an asset.

Their claim stemmed from the platforms in which crypto trading are taking place. They claimed that this innovation is only supported by computer geeks and individuals involving in illegal activities. Likewise, crypto trading occurs on exchanges where there are no absolute regulatory rules.

Risk Involved in Trading Crypto

Everybody wants security over their property, but it would be nearly impossible to secure an asset that may be lost forever due to a wrong number and letter combination or hardware malfunction. What’s more painful is you knowing that no one has access to it and it’s lost forever. This is one of the associated risks attached to crypto trading.

Another risk that gained wild publicity is trading account hacking that may occur while you are trying to send money across borders. This may lead to fraud and mismanagement issues due to hacked network or hardware failure on your exchange. As a result, financial security is becoming a significant concern for crypto.

Companies Now Bringing Crypto to Stock Exchanges

But the good news is, companies and individuals won’t stop making progress on how crypto can enter the stock exchanges. An example is the Winklevoss twins that started their unsuccessful journey of bringing crypto to stock exchanges since 2013. Their primary fear is the unpredicted Bitcoin’s price, how it is used for illegal activities and how some individuals can influence the market for personal gains.

Meanwhile, other agencies are welcoming crypto to stock exchanges. One of them is the International Stock Exchange’s (ICE) move in January 2018. They brought the cryptocurrency data feed to their users. As a result, users received basic information regarding digital currency. Then in February, they launched their crypto platform, which attracted elite investors like Microsoft.

Another one is NASDAQ massive move to support cryptocurrency projects. They partnered with crypto exchanges to provide them with tools they can use to monitor the growth of their clients on their marketplaces. Nasdaq focuses more on blockchain startups and organizations.

Can Crypto Trading Benefit the Stock Exchanges?

The primary benefit stock trading exchanges can obtain from incorporating crypto into their platforms is visibility. This can be achieved by deploying some enhancement tools on the stock exchange. As a result, there will be an increasing number of new users.

Likewise, allowing crypto on stock exchanges will increase the volumes of trade taking place on the exchange. This will attract whale investors to the crypto market. As a result, cryptocurrency’s price will stabilize, and there will be reduced volatility because users with significant investment portfolios will acquire more crypto assets.

Early 2017 experienced an influx of new traders due to the price multiplier that impacted Bitcoin. While this may look complex to understand, the cryptocurrency and stock market trading processes are the same. But cryptocurrency trading attracts more mechanical noise compared to the traditional market.

This decentralized innovation is bringing more accountability, transparency, and trust to the financial markets. As such, more players are attracted to the market, and the traditional financial market is transforming.

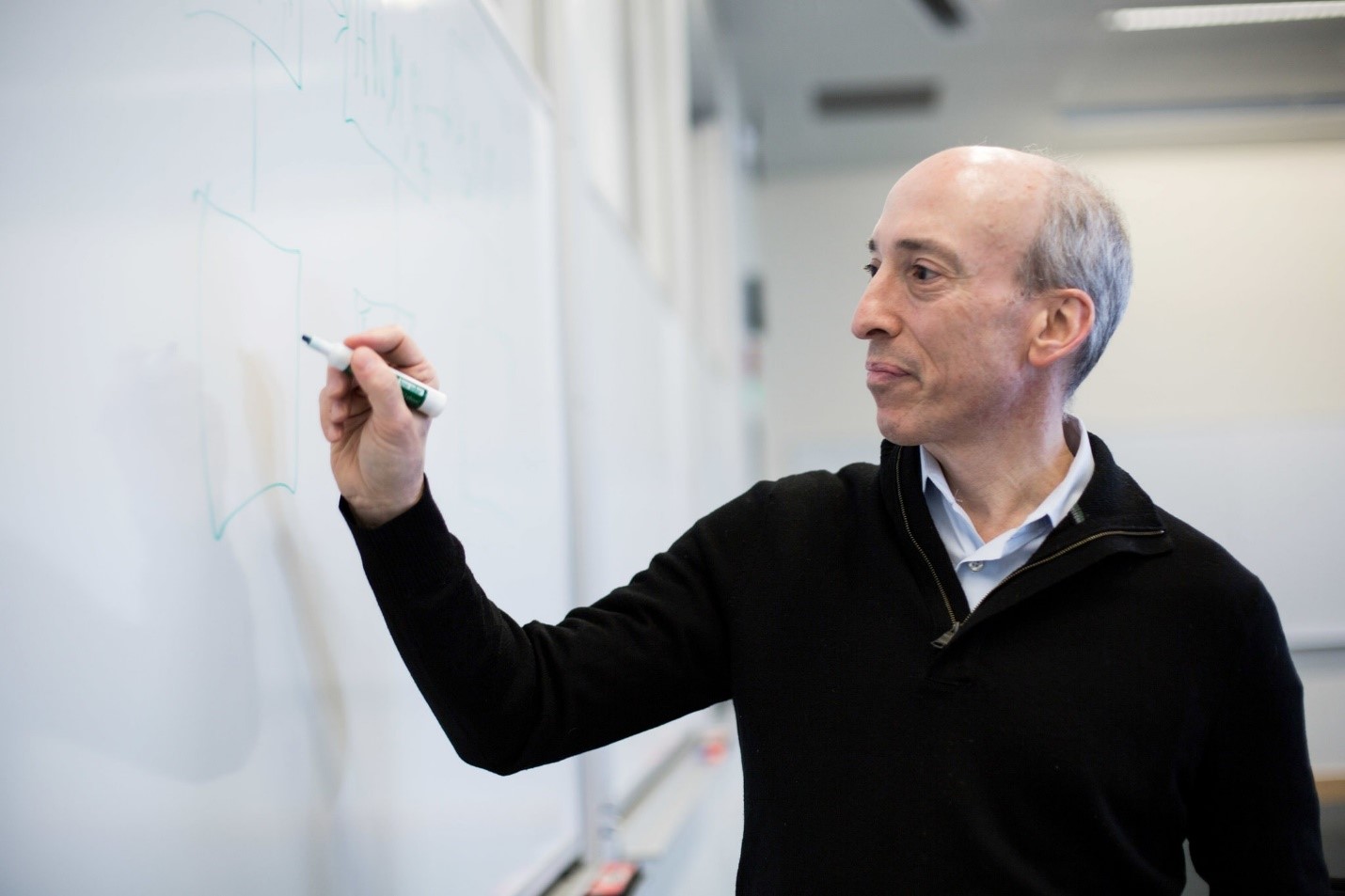

SEC Chairman Stance’s on Crypto Coming to Stock Exchanges

The odds of getting approval for crypto’s entry to stock exchanges is increasing because the SEC Chairman, Gary Gensler, is not skeptical about cryptocurrency’s potential. He once mentioned to a class he taught at MIT, Blockchain and Money, that the integration would expose the small crypto world to about six trillion US ETF universe.