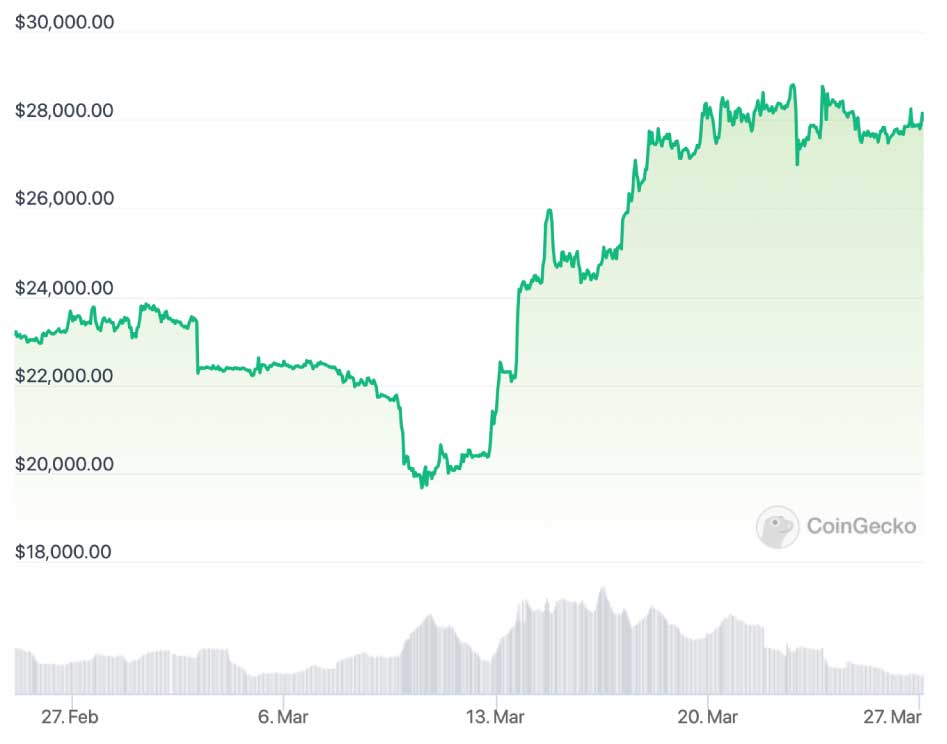

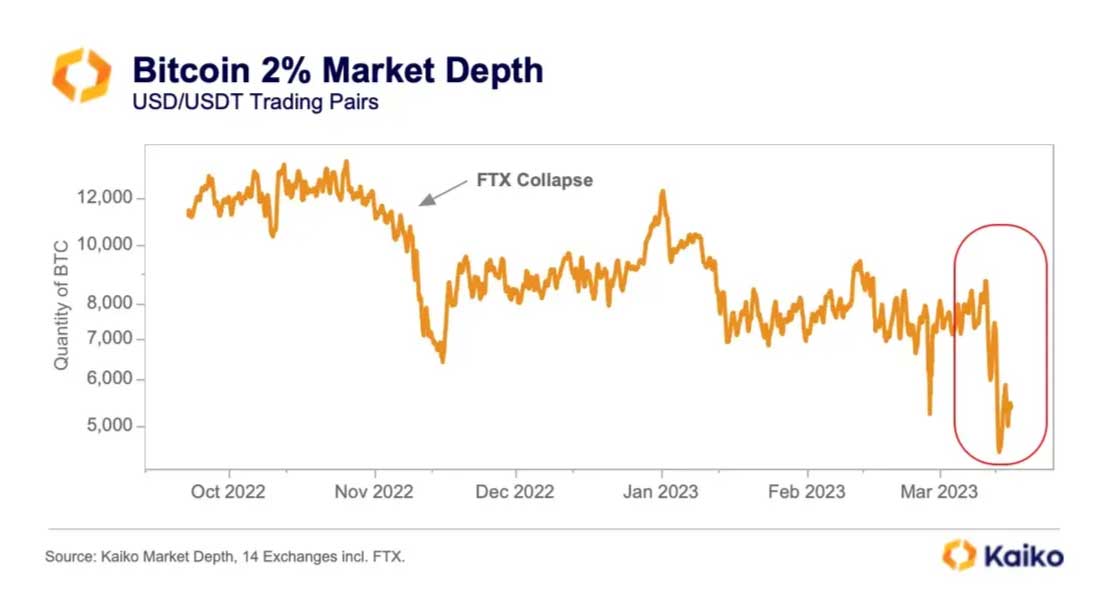

The US banking crisis has coincided with Bitcoin reaching a new yearly high this month. Despite this, cryptocurrency enthusiasts are still apprehensive as the liquidity of BTC has hit its lowest point in the past ten months. The reason for this can be attributed to the closure of the SEN and Signet payment networks, previously managed by Silvergate and Signature banks, respectively. These banks had been actively collaborating with major crypto companies, but their problems have significantly impacted the digital asset industry.

It’s worth noting that liquidity is the property of assets to be easily sold at a price that closely aligns with the market value. The higher the liquidity of the market, the more transactions can be conducted without significant price fluctuations. In the case of banks, liquidity also signifies the ease of converting crypto into traditional currencies and vice versa.

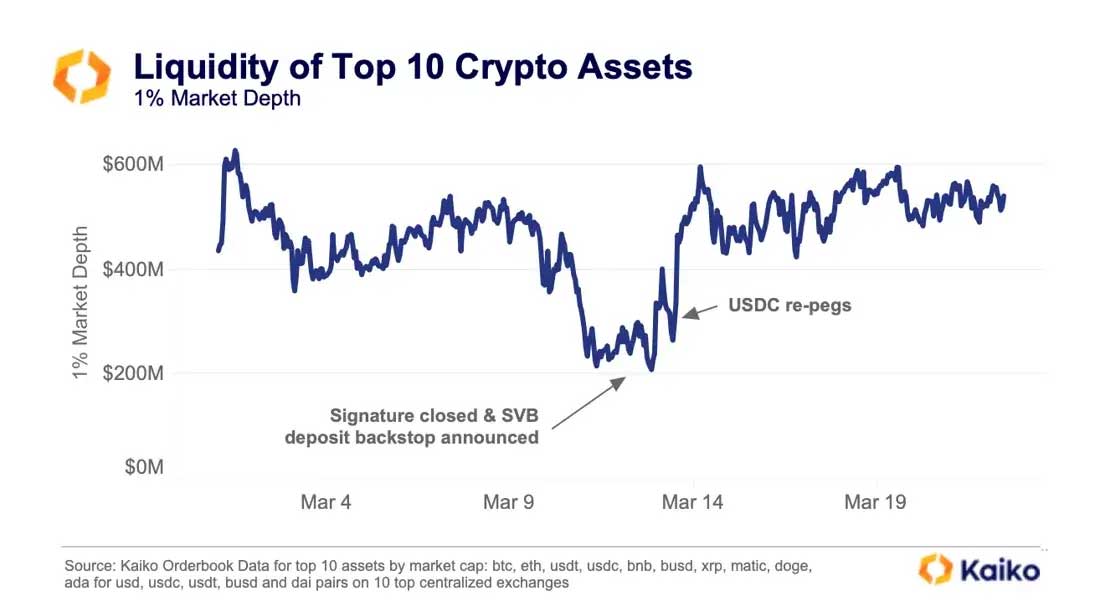

Liquidity plays an essential role in exchanging digital assets for each other. If this metric is inadequate, trade transactions may become problematic. An excellent illustration of this occurred when an anonymous trader responded to the USDC stablecoin’s separation from the dollar in the first half of March.

A look at the evolving cryptocurrency market

Insufficient liquidity in the market can give rise to a variety of issues such as slippage, large spreads, and price volatility for the asset as a whole. One crucial factor in this regard is the order book, which shows the available bids and asks for buying and selling coins.

To recall, slippage occurs when the execution price of a trader’s order differs significantly from the intended price. This metric is usually expressed as a percentage and is especially relevant for decentralized exchanges like Uniswap. Higher slippage makes it challenging to trade illiquid assets without incurring significant price impact.

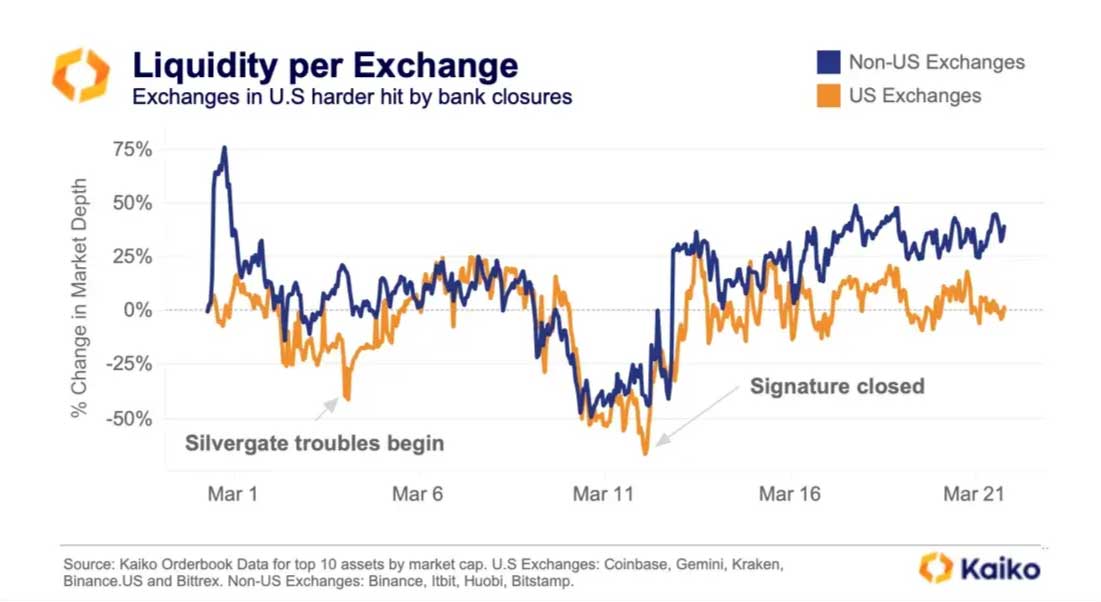

Liquidity on US crypto exchanges and non-US trading platforms

In the beginning, a decrease in liquidity may boost prices, but it can also lead to a sudden drop. When buyer demand wanes, the asset’s price can become vulnerable to significant fluctuations.

To be clear, low liquidity can indeed drive up prices more sharply when buyers are active. However, as market conditions shift, prices can also plummet just as quickly.

The impact of the liquidity crisis was initially felt following the shutdown of Silvergate’s SEN network, which facilitated the conversion of fiat currency to and from cryptocurrencies. Subsequently, the market depth fell to approximately $200 million. This metric indicates the amount of money required on average to alter the value of the top ten cryptocurrencies by market capitalization by 1%.

In other words, the decline in market depth became more apparent after the SEN network’s closure, as it made it less convenient to transact between fiat and digital currencies. The market depth metric provides an estimate of the amount of trading volume needed to move the cryptocurrency market by a given percentage.

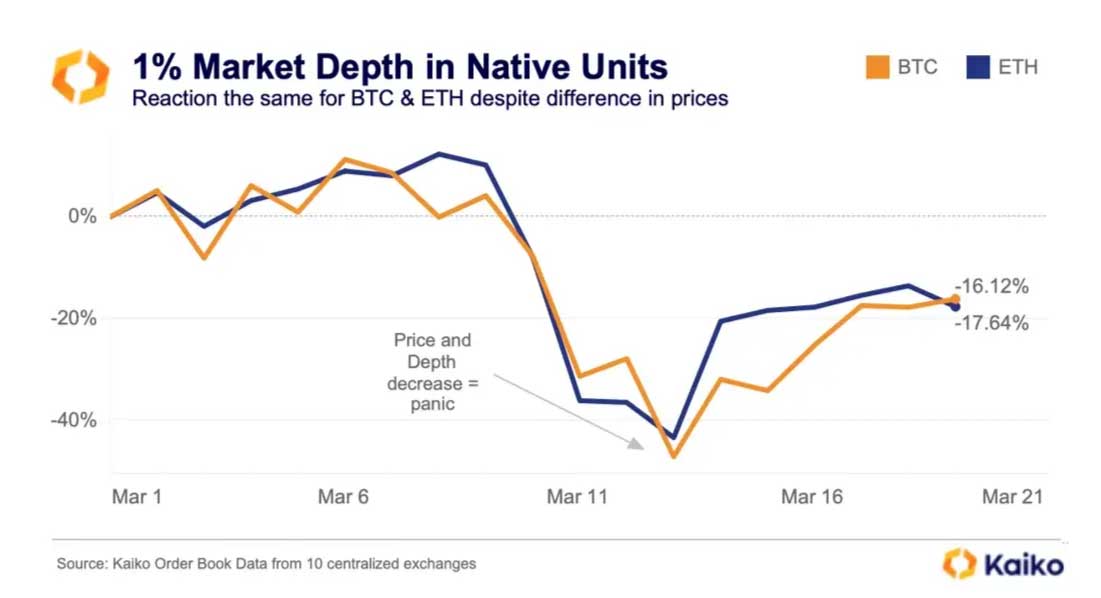

Since the start of this month, Bitcoin and Ethereum have experienced a decline in market depth by 16.12% and 17.64%, respectively. This implies that the amount of Bitcoins required to purchase or sell to alter the main cryptocurrency’s price by 1% has fallen by 16.12%, while Ethereum’s has dropped by 17.64%. This drop in liquidity creates an additional risk for the market, which is the potential for manipulation.

The Financial Stability Oversight Board under the Department of the Treasury (FSOC) held an unscheduled online meeting to discuss the state of the US economy, with Treasury Secretary Janet Yellen in attendance. It is believed that the outcome of this meeting could be positive news for the cryptocurrency market, as Federal Reserve System Chairman, Jerome Powell, also participated in the discussion on the base lending rate. Although the rate was raised by 0.25 percent the day before, analysts predict that the final rate ceiling will be lower than expected, which is good news for risky assets.

The current liquidity problems in the cryptocurrency market are thought to be caused by the bearish trend, low popularity of digital assets, and the FTX exchange collapse in November 2022. However, after the start of a bull run, digital assets are expected to become more popular among traders and investors, leading to increased trading activity on exchanges, including decentralized alternatives.