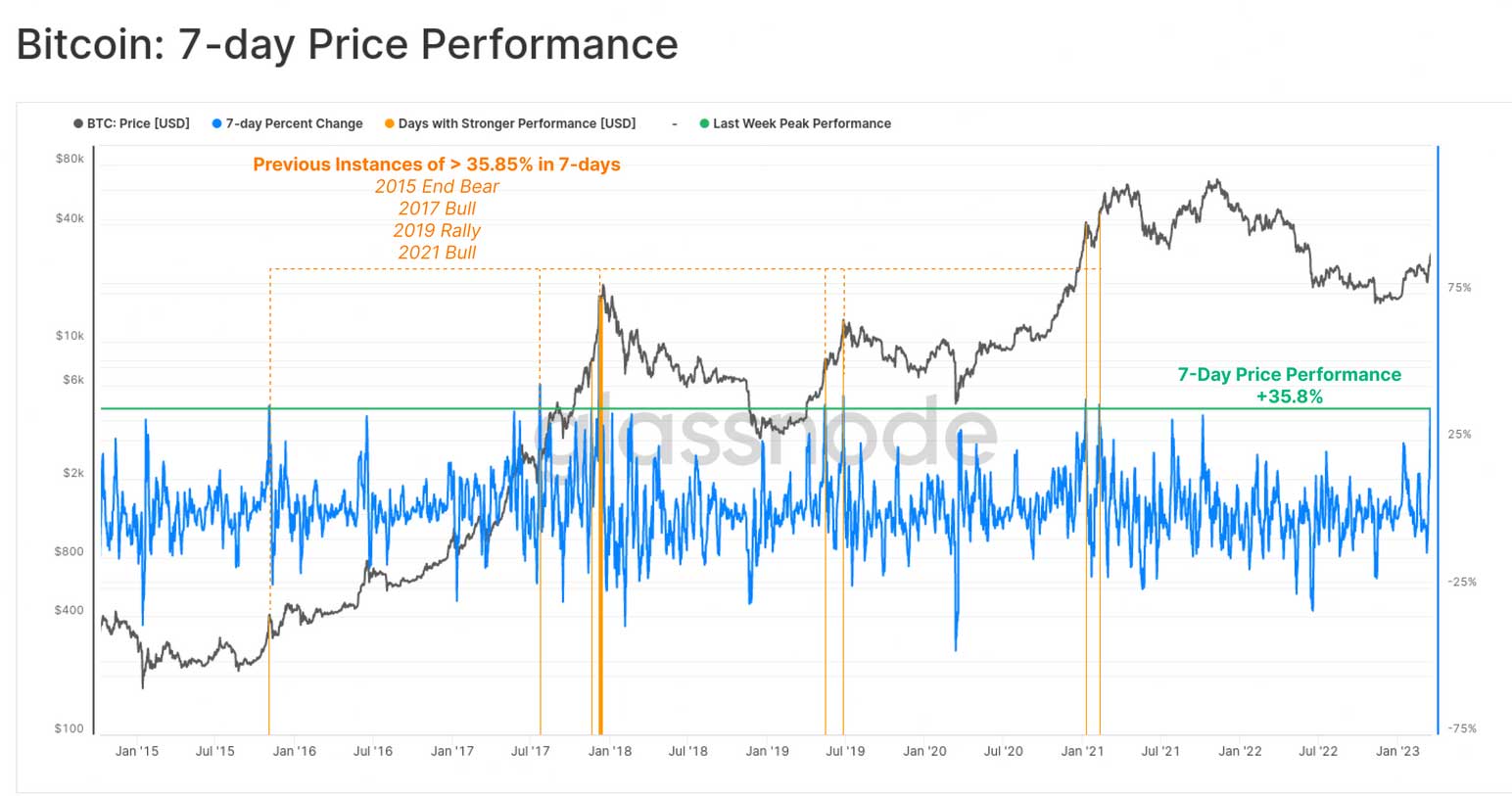

Bitcoin had an exceptional week of price performance, with a 35.8% increase, which is among the best in history. Only 124 trading days have witnessed a larger 7-day upswing, and since 2015, only 16 days have experienced a similar trend. This is typically seen in bull markets, often during the later stages.

This surge in Bitcoin’s performance coincides with challenging times for traditional finance and banking. Smaller banks are vulnerable to digital bank runs, and to counter this, the US Federal Reserve is establishing new liquidity funding facilities between US banks and Central Banks through swap lines.

Given this scenario, investors are reacting and demonstrating that the bitcoin market is moving away from deep bear market conditions towards a structure reminiscent of past early bull markets.

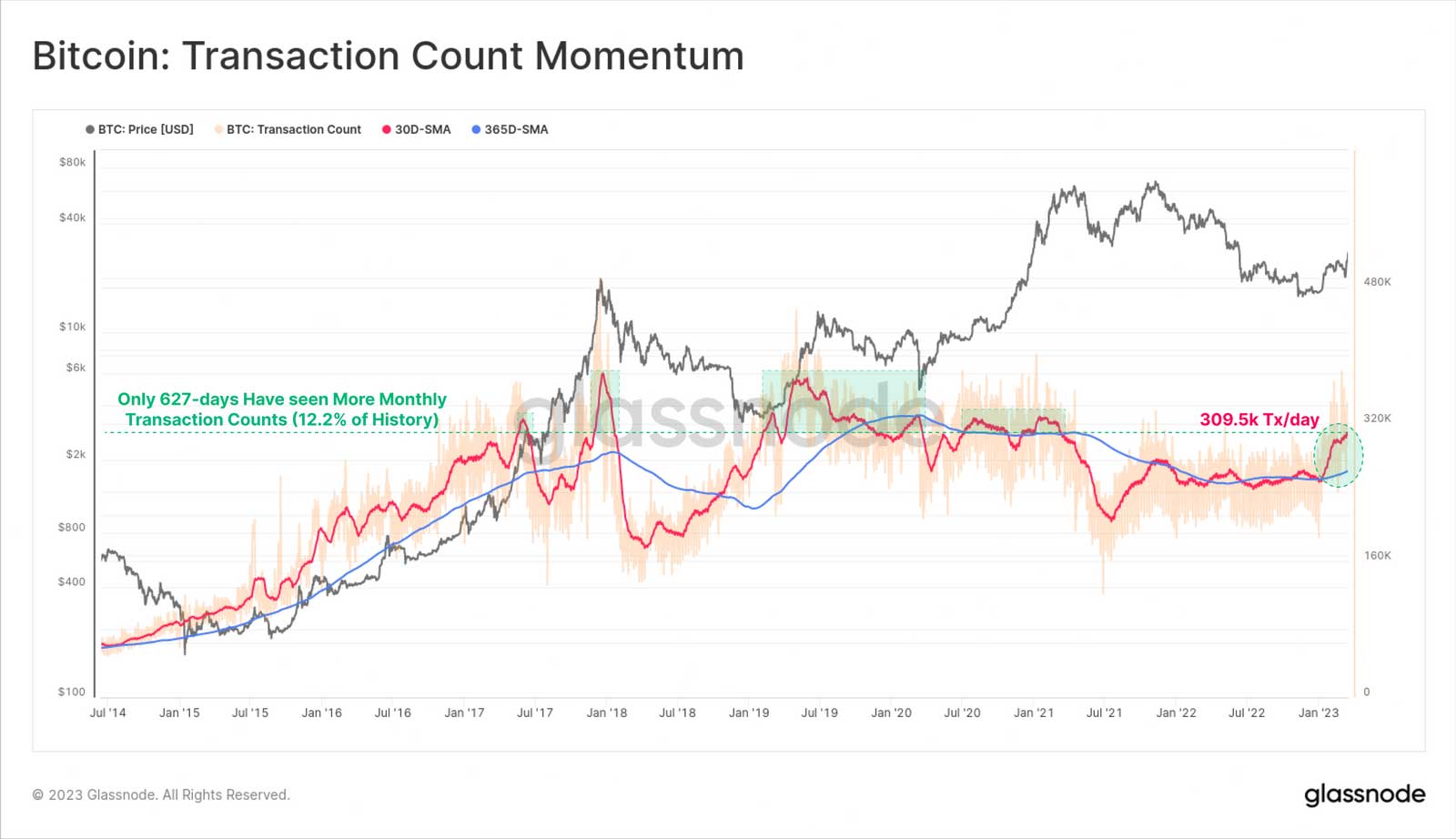

When it comes to on-chain activity space, the concept of “more is better” generally holds true. Increased interaction and transactions within the Bitcoin economy are often linked to rising adoption, network effects, and investor activity.

This week, the monthly average of transaction counts has surged to 309.5k/day, the highest level since April 2021 and a significant increase above the yearly average. This indicates a healthy sign as less than 12.2% of all days have seen higher transaction activity for Bitcoin.

By employing clustering algorithms, we can approximate the number of distinct new entities active on-chain as a close estimate for new unique users. Currently, this metric stands at 122k new entities/day, with only 10.2% of days seeing higher rates of new user adoption, such as during the 2017 peak and the 2020-21 bull run.

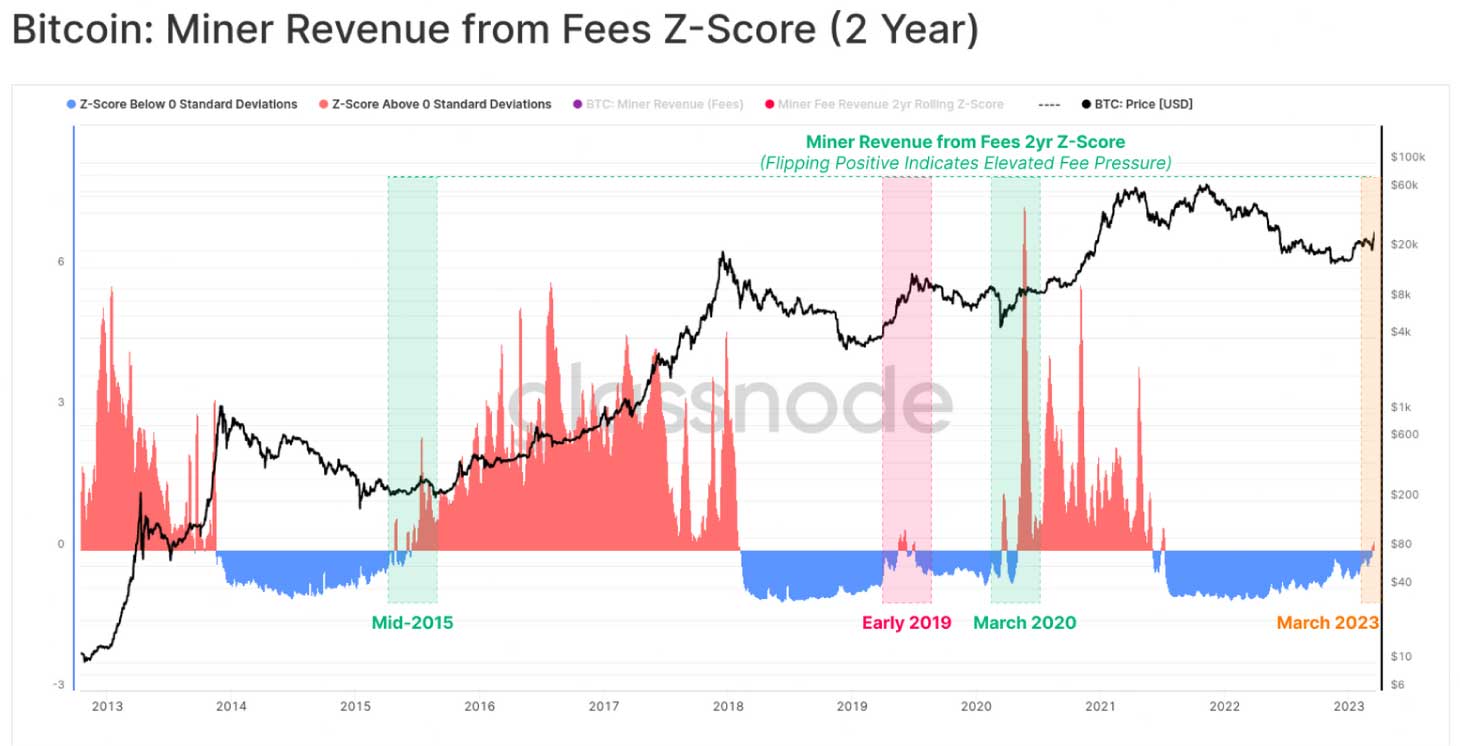

As a result, network congestion has been on the rise, exerting upward pressure on transaction fees. Additionally, bolstered by new demand from Ordinals and Inscriptions, the 2yr Z-Score for miner revenue from fees has turned positive.

Elevated fee pressure typically precedes more favorable markets, coinciding with new waves of adoption that are expressed through growing demand for blockspace.

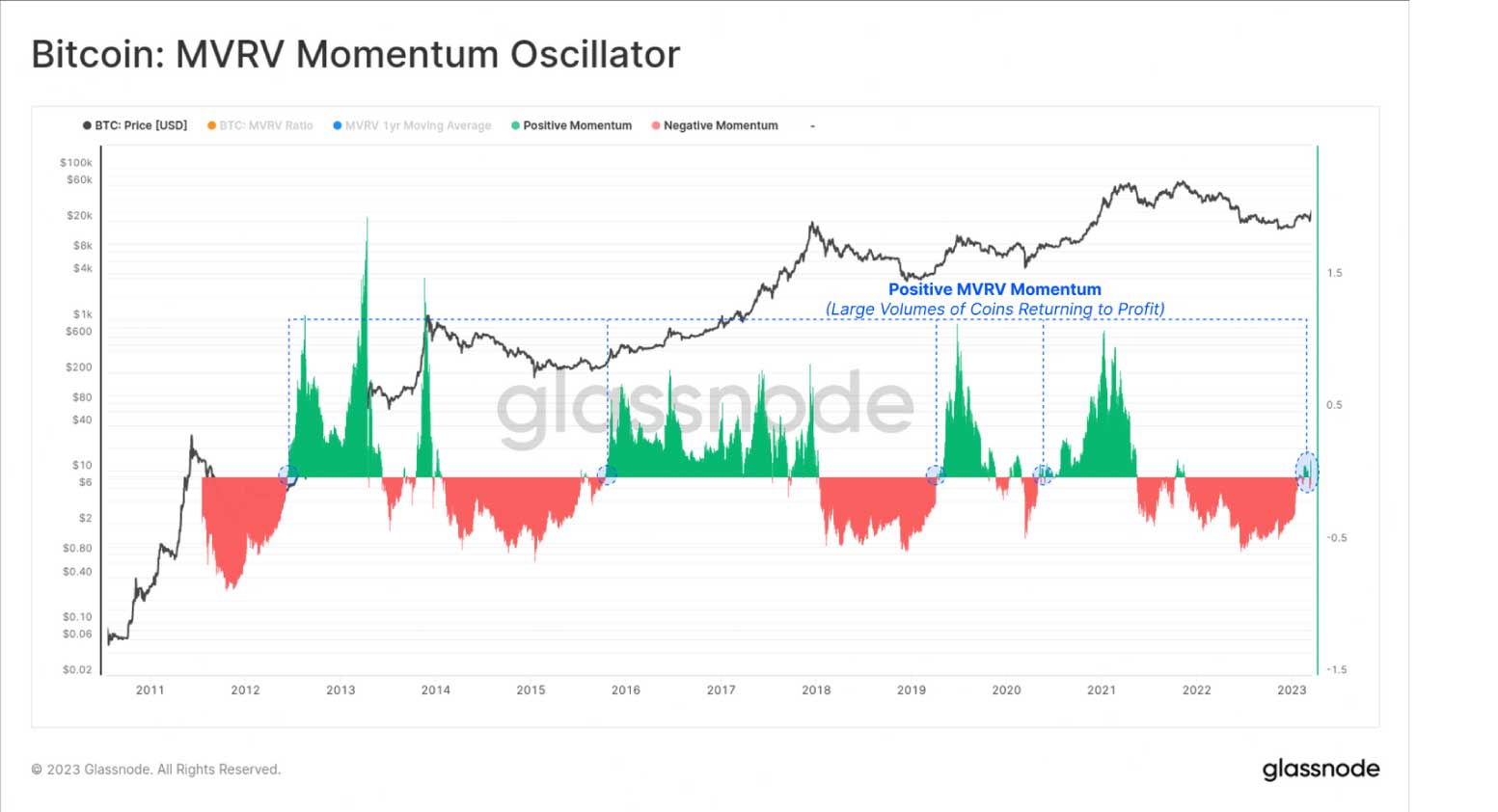

Several indicators related to the Bitcoin blockchain are showing a shift away from bearish market conditions and towards more neutral or positive territory. One such indicator is the MVRV, which measures the unrealized profit held within the coin supply. The current MVRV value of 1.36 falls between the historical average of 1.82 and the ‘oversold’ -1 standard deviation level. Throughout both late stage bear markets and early bull market recoveries, Bitcoin has historically traded within this range for around 54% of all trading days.

The MVRV Momentum Oscillator is a useful tool for identifying these macro shifts in market conditions, and it is currently breaking above 0. This indicator is responsive to events where large portions of the coin supply are bought above or below the spot price and then quickly revert to holding an unrealized loss or profit, respectively. This tends to occur near cycle inflection points.

The recent positive flip of the MVRV Momentum indicates that a significant portion of the coin supply was acquired below the current price and is now in profit. Similar to the other indicators, past positive flips have correlated with increases in network adoption and on-chain activity.

The Fed’s Key Rate Decision: Potential Implications for Bitcoin

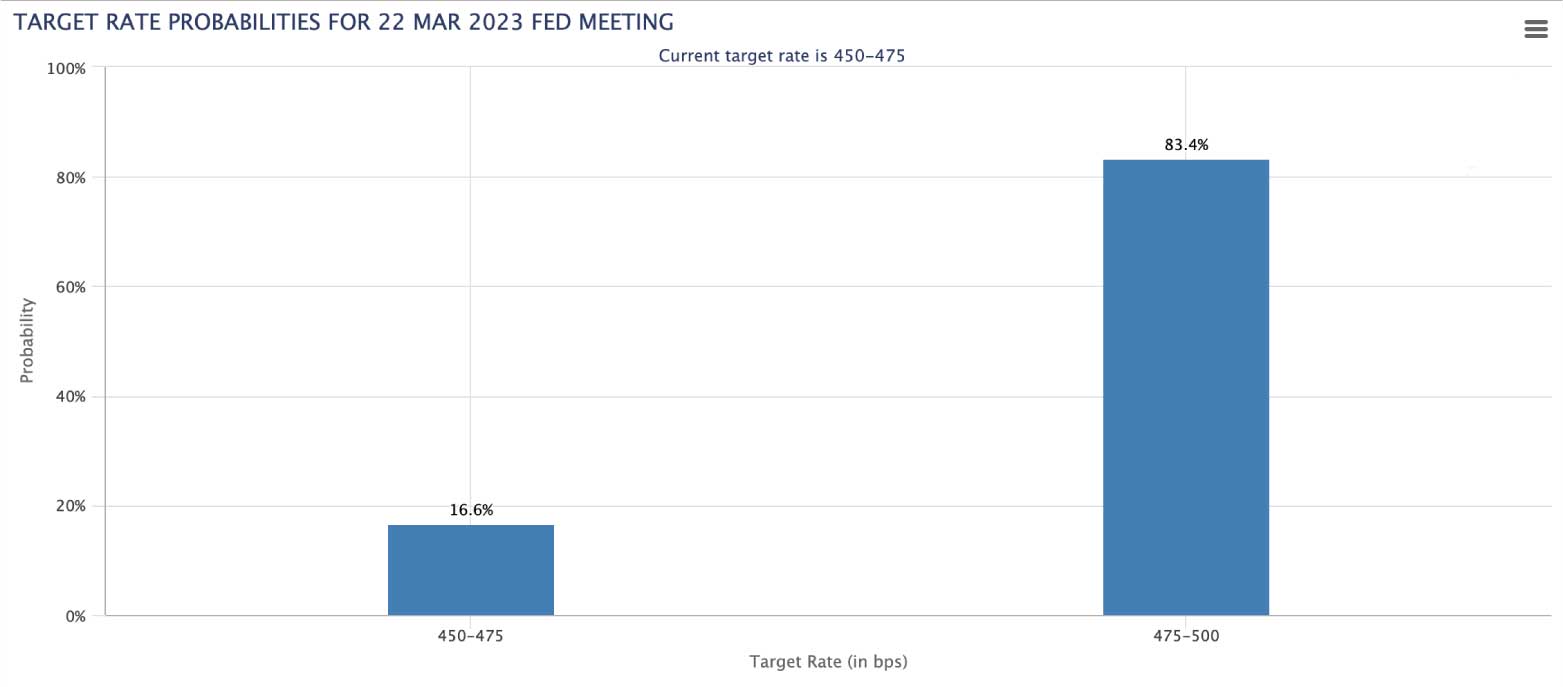

The Federal Open Market Committee (FOMC) meeting of the US Federal Reserve, scheduled to take place on March 22, is expected to be the most significant event of the week. The FOMC has been following its quantitative tightening (QT) policy for the past 18 months, which has become a major challenge due to the ongoing banking crisis. The possibility of further interest rate increases, which is a part of this policy, has been called into question due to its adverse effects on liquidity-strapped banks. While the rate hike would help contain inflation, it may bring the economy closer to a recession, similar to the banking crisis that occurred earlier.

To address the issue, the Treasury Department, the Fed, and the Federal Deposit Insurance Corporation (FDIC) have recently adopted the Term Bank Financing Program (BTFP), which marks a shift towards a quantitative easing (QE) policy. As a result, the Fed’s balance sheet has begun to grow for the first time since the COVID-19 pandemic began. This move towards money-printing could result in the injection of new money into the economy, which is causing the global bearish trend of bitcoin to turn bullish.

Experts predict a rate increase, albeit a small one of 25 basis points. Previously, there were expectations of a 50 bp increase, and at one point, the majority of voters believed that there would be no increase at all.

Bitcoin has climbed to a year high of $28,300, surpassing a psychologically significant resistance level. However, it is common for such levels to require multiple attempts before being broken, leading analysts to anticipate a correction. The upcoming Fed interest rate decision announcement and Chairman Jerome Powell’s speech are expected to cause fluctuations in Bitcoin’s price. Currently, traders are anticipating a downward movement, indicating an upcoming correction.

According to a crypto analyst, there are two possible scenarios for Bitcoin’s price: it may either form a top in the $28,500 to $29,000 area or drop to $25,000 before bouncing back. The analyst also examined where Bitcoin could go before the next bull market begins, suggesting that BTC could rise slightly above its current value and consolidate at or above $30,000 before a corrective move occurs. The forecast predicts that BTC will face an “upward rejection at $30,000” for a while, creating a “higher low” before eventually rallying higher.