Bitcoin rides the bull market as compared to gold in the commodity market. Despite that other cryptocurrencies (altcoins) may not easily reverse their high prices due to increasing volatility, Bitcoin’s performance trajectory will keep improving because of its firm foundation. This foundation causes crypto expansion into more creation of decentralized exchanges and decentralized finances.

Will Bitcoin Price Reduce?

Mark McGlone, Bloomberg’s analyst, believes that Bitcoin’s price enjoys the same economic benefits gold enjoys. These macroeconomic factors have an impact on Bitcoin’s price. Despite users’ grumble at the market dip, Bitcoin corrected very sharp, and its recovery is firmer than gold. However, extreme factors are speculating the crypto market recovery apart from Bitcoin recovery.

Is Bitcoin the Next Gold?

Mark claimed that the primary determinants of Bitcoin’s price and gold price are their limited supply, store value, and easy conversion to cash. These factors will remain since there is no quantitative judgment for their circulation and value determination. Today, Bitcoin adoption is increasing despite skepticism. And this is resulting in it becoming the digital version of gold.

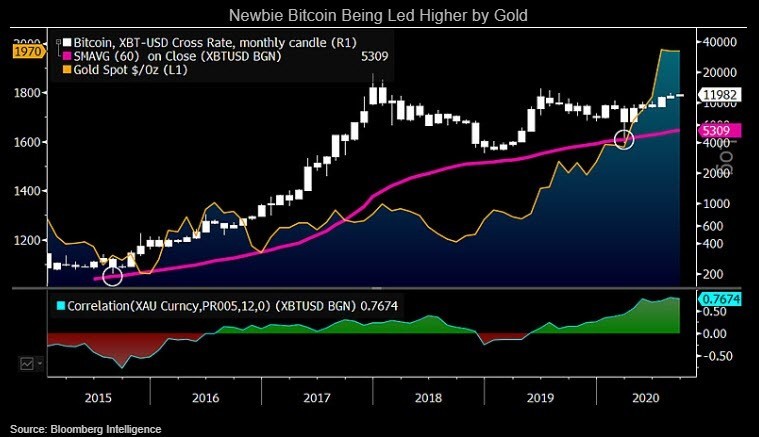

Bloomberg’s graph below depicts the Bitcoin-to-gold chart comparison that occurred over 12 months, happening around 0.77. Gold pulls along Bitcoin owning to its price advancement to around $12,000 while having a two hundred billion dollars market capitalization over 11 years of creation. Bitcoin accrues more gains during these years and is the most substantial benchmark for the crypto market.

Volatility Advantage of Crypto Over Nasdaq

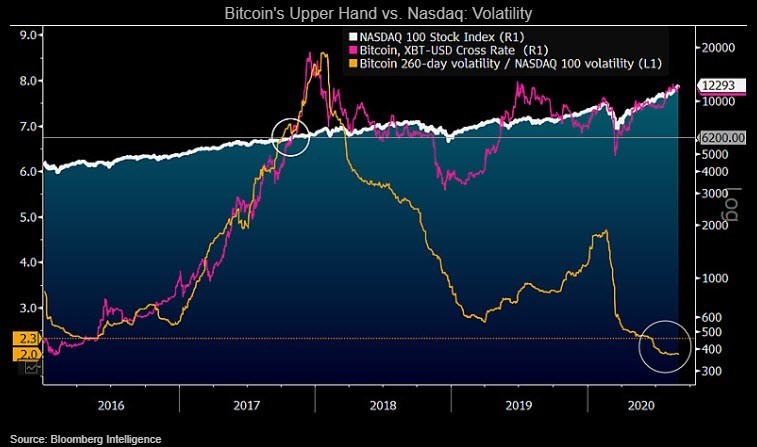

Taking a critical look at the historical comparison of Bitcoin to the Nasdaq 100 Stock Index, Bitcoin price is lower based on risk adjustment factors. But due to the crypto bull market against the equity market, the volatility of crypto over the year is a fraction of its Nasdaq comparison three years when they overlapped.

But this lowest volatility ensures that Bitcoin will keep enjoying price hikes while analyzing the three-year cryptograph. Around October 2017, Bitcoin’s price equated to Nasdaq’s around 6,200. But the price doubled in September because the crypto’s volatility reduced while stock’s volatility increased. This expressed that Bitcoin is performing well considering its risk-adjustment fundamentals.

In 2017, Bitcoin was seven times more volatile than Nasdaq, but it is now about two times more volatile than Nasdaq. This explains that risk management is conducted at a lower rate for Nasdaq than Bitcoin, where traders are cautious with choosing which risks to manage.

Tether Adoption Higher than Ethereum

The number two cryptocurrency benchmark, Ethereum, may put the entire crypto market under broad pressure. But its adoption will meet a strong force from Tether (USDT), which endures more market extremes than Ethereum. Tether is on track to becoming the second most-used crypto coin after Bitcoin.

The increasing market capitalization of Tether is making it difficult for Ethereum to match up since it not-so-increasing market cap. Tether’s market cap resulted from the increased adoption happening across the crypto market. Ethereum may stop this adoption provided it has an effective option to replace the advantage of Tether in the crypto market.

Tether is representing a stable crypt payment method since its adoption. It is becoming a precursor for central banks to build their digital currencies. Aside from its transactional value over time, crypto users or investors see it as the best coins to hold unto during market uncertainties.

Bitcoin Outperforming its Trajectory

Bitcoin’s unique price is a factor of its defined attribution and limited supply. This keeps the price at a position where it outperforms its curves against the commodity market, currency, or other crypto markets. If individuals leverage market projections while making transactions, trading cryptocurrencies will occur at broad prices despite the market pressure.

Bitcoin has experienced a hundred percent increase over one year. However, the annual Bitcoin price increase should happen below 2% while the trajectory extends downwards. This leaves us with adoption and increasing demand becoming the key factors in Bitcoin’s price determination.

The growing demand for the use of Bitcoin makes its price become firm by each year. However, Tether’s adoption may expose other crypto assets to a negative ride while having positive impacts on Bitcoin, which measures against gold in the commodity market.

Is Crypto Safe to Invest In?

Despite the doubts surrounding crypto adoption and utilization, individuals seek advice on investing in cryptocurrencies or using them as a payment option. This hasn’t stopped the adoption across different industries, and debates keep airing about cryptocurrencies becoming the future currency.