The week ahead is poised to be anything but ordinary in the world of cryptocurrencies. With major economic events on the horizon, including the Federal Open Market Committee (FOMC) meeting and bank holidays in Asia, traders are bracing themselves for a roller-coaster ride through the crypto market. Asia, often serving as a crucial influencer in daily market behavior, could see disruptions due to the upcoming bank holiday, potentially deviating from its typical trading patterns. This article explores the key events to watch and delves into a Bitcoin price analysis to provide insights into the turbulent week that lies ahead.

Key Events to Monitor

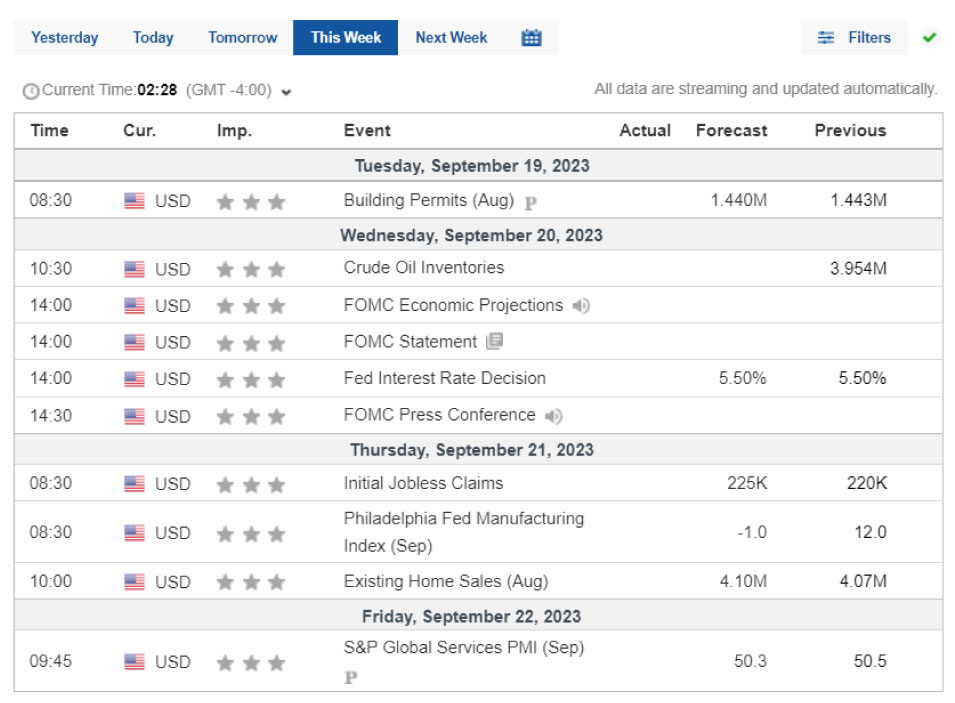

This week, traders worldwide will closely monitor a series of international events. According to Singapore’s timetable, key events include the FOMC’s economic projections, the federal funds rate decision, and subsequent press conferences scheduled for Wednesday, September 20th. Additionally, the week will witness the release of unemployment claims data and potential announcements from Japan’s monetary policy front. These events could have far-reaching implications for the global crypto market.

Asia’s role in shaping daily crypto market behavior cannot be overstated. It frequently establishes the initial highs and lows for the day, with the Asian session typically operating within a 2% margin. Any departure from this norm could signal a significant shift in market dynamics. Notably, a substantial portion of crypto trading in Asia is driven by automated trading bots, making this session particularly attractive to scalpers who capitalize on predictable range patterns.

Bitcoin Price Analysis

Turning our attention to technical analysis, we observe some concerning patterns on the daily timeframe charts. Analysts point to the narrowing gap between the 50-day and 200-day Exponential Moving Averages (EMAs). A potential bearish crossover may be looming if the blue 50-day EMA dips below the yellow 200-day EMA. This crossover could serve as an ominous signal for a potential downturn in the market.

However, there’s a glimmer of hope for a bullish outlook. To materialize this optimistic trend, Bitcoin prices would need to break above the 50 EMA, possibly around the $27,000 mark. Such a breakthrough could usher in renewed optimism among traders and investors alike.

In the event of a potential downtrend, it’s essential to identify key support levels. These levels are critical zones of liquidity and can significantly impact market sentiment. The primary support levels to watch are at $25,800, $24,800, and $23,800. The ultimate direction of the market, whether bullish or bearish, will largely depend on how Bitcoin behaves concerning the 50 EMA.

Conclusion

As we approach a week filled with economic uncertainties and significant events, cryptocurrency traders and enthusiasts must remain vigilant. Asia’s bank holiday could disrupt the crypto market’s usual patterns, while global events such as the FOMC meeting and monetary policy announcements will undoubtedly influence market sentiment. Bitcoin’s price analysis suggests a potential bearish crossover, but a bullish outlook could emerge if key resistance levels are breached. In this volatile landscape, careful monitoring, risk management, and strategic decision-making will be crucial for navigating the week ahead in the world of cryptocurrencies.