The value of prominent Ethereum NFT collections, such as the Bored Ape Yacht Club and CryptoPunks, has experienced a significant decline, extending the downward trend observed in prices of highly regarded “blue chip” NFTs.

The floor prices of CryptoPunks and Bored Ape Yacht Club have dropped by approximately 8% and 7% respectively within the last day. Nansen’s Blue Chip 10 index, which tracks the top 10 NFT collections, has recorded a year-to-date decrease of 31%.

Over the past few weeks, the Bored Ape Yacht Club has witnessed more substantial losses, with its “floor price” (the lowest-priced NFT listed on a secondary marketplace) plummeting nearly 19% when measured in ETH over the last 30 days. The starting price for a Bored Ape stands at 36.4 ETH, approximately equivalent to $68,200.

These recent figures reflect the lowest Bored Ape floor price in terms of ETH, as documented by NFT Price Floor since November 2021 when the project was still in its early stages. Meanwhile, Mutant Ape Yacht Club prices have experienced a 26% decline in ETH value over the past 30 days, now commencing at 7 ETH or $13,150. CryptoPunks prices have registered a comparatively modest drop of less than 3% during the same period.

In April 2022, the Bored Ape price floor reached its peak at 152 ETH, equivalent to $429,000 at the time. This occurred just before the release of NFT-based land for Yuga Labs’ Otherside metaverse game. Since then, the NFT market has generally lost momentum, though Bored Ape prices have experienced more significant declines compared to some other noteworthy projects within the space.

The Influence of Blur

Certain NFT traders believe that the crash in floor prices can be primarily attributed to the impact of the leading NFT marketplace, Blur, on trading and lending volumes.

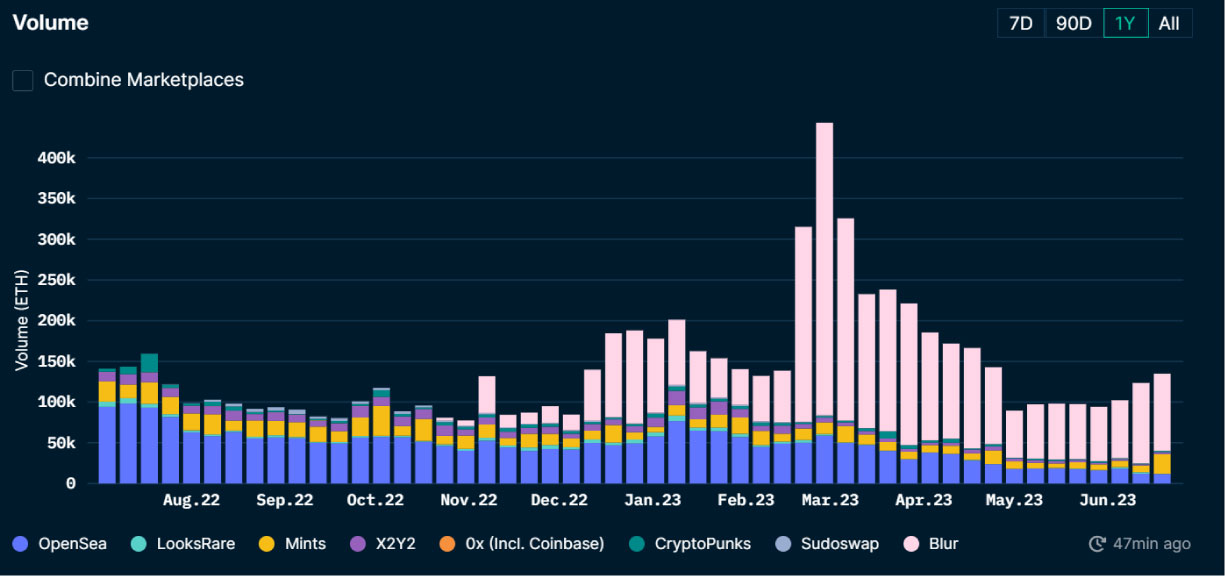

The adverse effects of Blur on NFT trading volumes and prices first became apparent in late April, approximately two months after the initial distribution of Blur tokens through an airdrop, which helped the marketplace surpass OpenSea.

The decrease in NFT trading volumes since May can largely be attributed to the discontinuation of doubled trading rewards on the Blur marketplace.

Traders are intentionally selling their NFTs at significantly reduced prices to maintain high trading volumes and maximize token farming on Blur. This practice further suppresses floor prices.

On May 1, Blur introduced its NFT lending platform called Blend, which quickly gained substantial traction as users hurried to farm BLUR tokens. The total loan volume on Blend has reached an impressive $929 million to date, dominating over 95% of the NFT lending space. The allure of Blur’s rewards encouraged users to generate a significant amount of loan volume, artificially inflating the figures.

These loans introduce a potential risk of liquidation in the market, which can drive down NFT prices. Cirrus pointed out an example of a risky leveraged position on Blend, valued at over $2 million and backed by 32 Bored Ape NFTs as collateral.

Follow for more:

Telegram: https://bit.ly/3KbviBe

Twitter: https://bit.ly/3Zr6h9E

Website: https://bit.ly/3FWBaMc