The popularity of the Ordinals project is growing rapidly, causing debates within the community about the feasibility and potential of NFTs within the first cryptocurrency network. Bitcoin enthusiasts argue that the purpose of digital gold was not to incorporate images onto the blockchain, while others believe that this new opportunity could benefit the ecosystem and miners in particular.

Although the concept of NFTs on the first cryptocurrency’s blockchain is not new, it has only recently gained significant traction, leading to increased activity in various on-chain metrics such as transaction activity, mempool load, and block fullness. Despite being in the early stages of development, many community members are actively working to create infrastructure, including new types of NFT-enabled wallets, user-friendly tools for placing digital objects on the blockchain, and solutions for integration with Ethereum.

What is Ordinals

Ordinals, which was established in January 2023, allows users to upload images and various forms of data to the blockchain of the first and largest cryptocurrency without the need for a separate token or sidechain. This is made possible through the use of satoshi numbering to serialize data to the “witness” section of a bitcoin transaction.

The development of Segregate Witness (SegWit) in August 2017 and the subsequent Taproot soft fork facilitated the emergence of the Ordinals project. These updates, including Taproot, which enhanced privacy and reduced transaction costs, aimed to address scalability issues. SegWit also altered the block structure, enabling the separation of signatures from the transfer process, eliminating the issue of transaction malleability, and laying the foundation for the Lightning Network’s growth.

Ordinals has introduced “inscriptions” as a new type of digital artifact. Unlike NFTs in other ecosystems like Ethereum or Solana that serve as tokens to verify ownership of certain items typically stored off-chain, inscriptions contain raw data directly written into the bitcoin blockchain, which makes them unique. Hosting services for NFTs often rely on various off-chain storage solutions such as cloud servers, IPFS, or blockchains dedicated to file storage.

Digital artifacts are considered to be flawless, while an NFT that refers to off-chain content on platforms such as IPFS or Arweave is deemed imperfect and therefore cannot be classified as a digital artifact.

NFT and Bitcoin

Experiments with the idea of NFTs on the blockchain of the first cryptocurrency started as early as 2012 with the introduction of solutions such as Colored Coins and Counterparty in 2014. Nevertheless, it took a considerable amount of time for the concept to gain significant popularity. It is worth mentioning that the concept of NFTs on the blockchain of the first cryptocurrency is not novel.

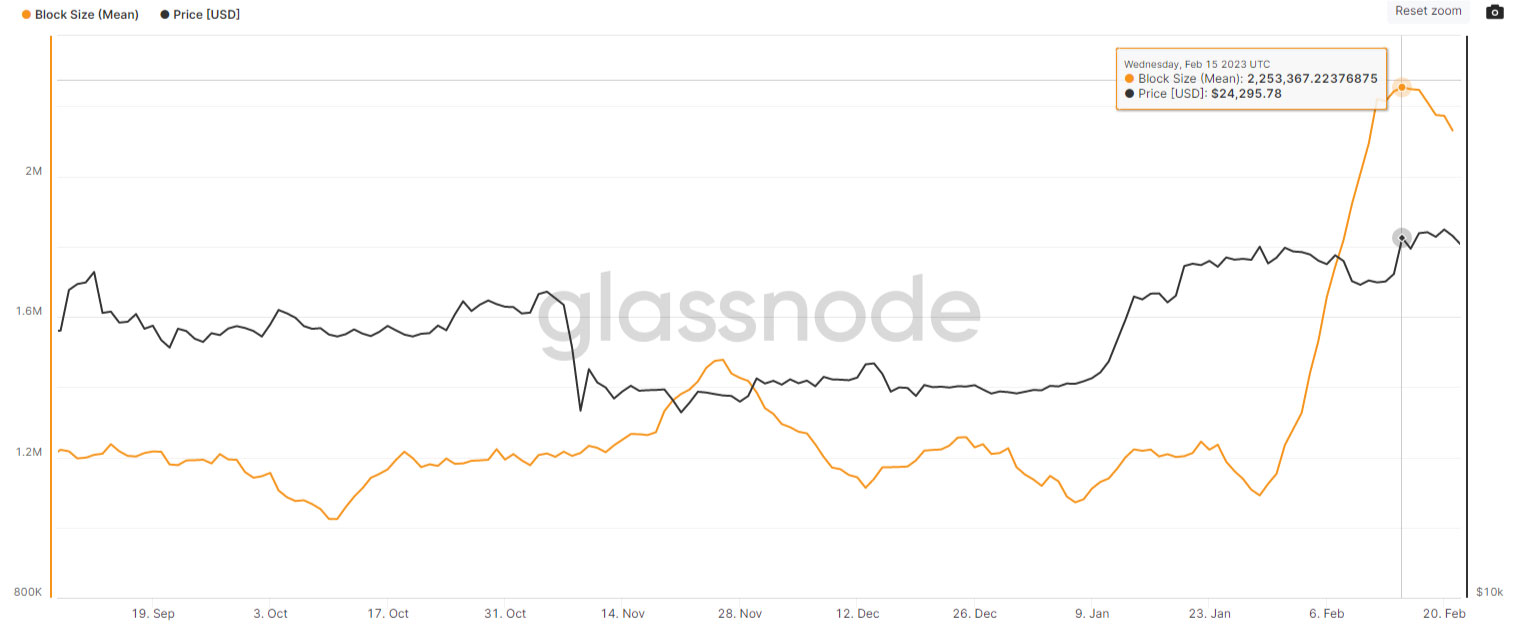

The hype surrounding the spread of information about “inscriptions” is noteworthy. The excitement surrounding the ability to record digital artifacts on the oldest and most decentralized blockchain has led to an explosive increase in transaction volume, mempool congestion, and an increase in the average block size.

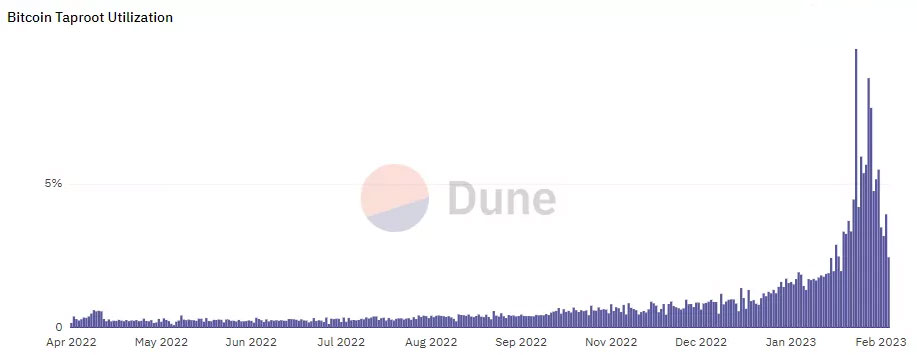

The Ordinals project’s increasing popularity has resulted in a boost in the volume of commissions per block, which is likely to increase miners’ income. Additionally, the hype around this innovation has led to the wider adoption of Taproot signatures, as evidenced by the update reaching an all-time high, as shown in the chart below.

The mean block size has grown larger due to the ability for arbitrary data such as images and other objects to fill the entire block space.

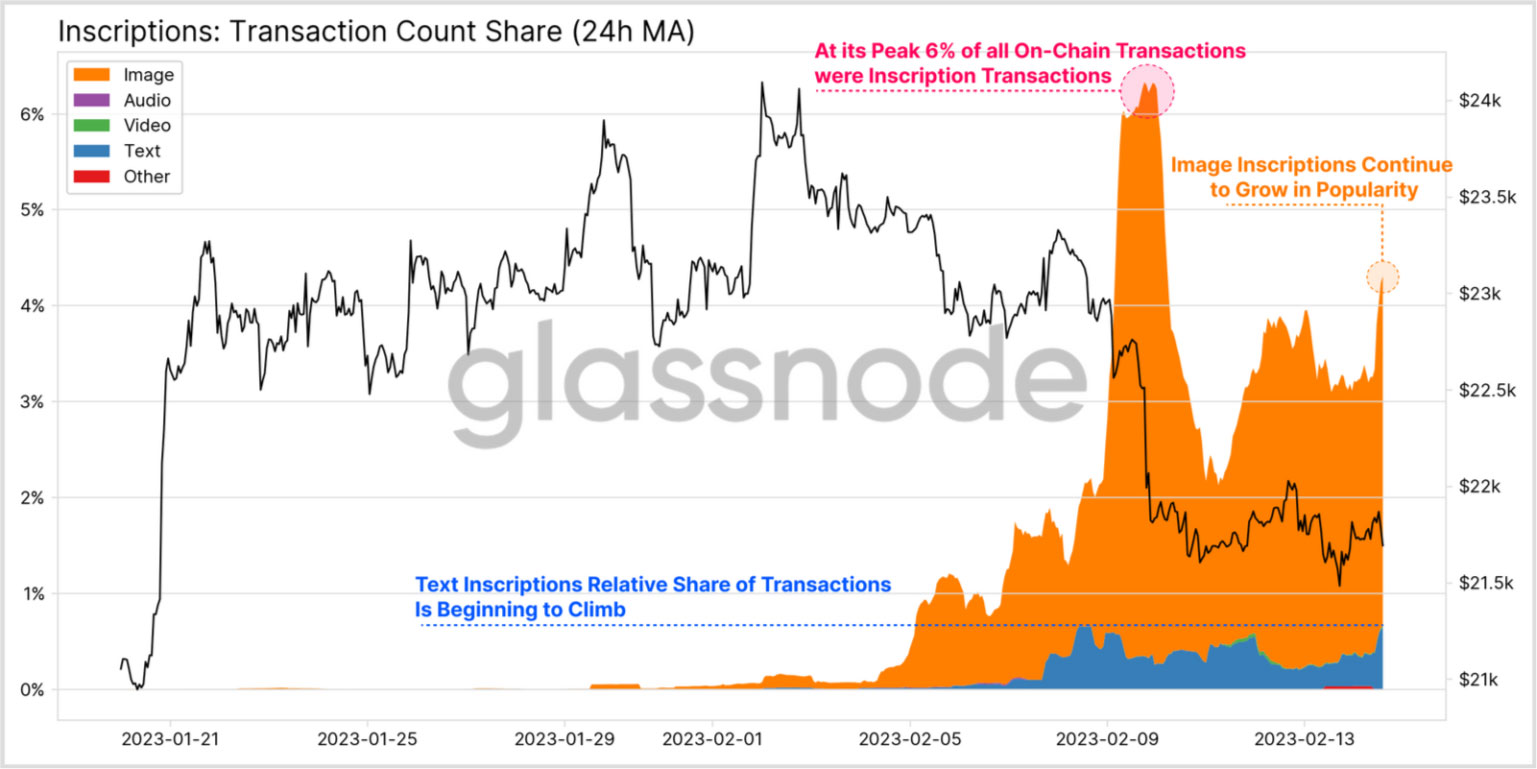

The proportion of transactions related to Ordinals peaked at 6% of total transaction volume before stabilizing at 4%. The primary factor driving this growth is the use of “labels” in the form of images.

The impact of “signatures” on the Bitcoin blockchain’s data volume, block distribution, and full node synchronization has been a topic of heated debate. Researchers have discovered that a new form of NFT has caused the amount of data on the Bitcoin blockchain to rise by 1.74 GB or 0.4% since mid-December 2022. They believe that continuing this trend will result in blocks being filled nearly to their limit in a sequential manner.

Market Segments

Although the project is still in its early development stages, many members of the community are actively working to establish infrastructure. One of the affiliated teams, CapsuleNFT, which is associated with the blockchain company Bloq, has already released the Ordinary Oranges collection. The digital artifacts from this collection are also available on the Ethereum mainnet, and there is an option to “burn” assets, which returns them to the network of the first cryptocurrency.

The great thing about these methods is that they offer a high level of security due to the use of Bitcoin, as well as the ability to program decentralized applications and L2 protocols on the Ethereum virtual machine. They also provide access to deeper liquidity through NFT marketplaces such as OpenSea.

Yuga Labs, the company behind the popular Bored Ape Yacht Club NFT collection, has recently announced the release of their TwelveFold collection on the Bitcoin blockchain. Meanwhile, a similar project to Ordinals has emerged on the Litecoin blockchain. Developers has adapted the code to work with inputs from the altcoin network, taking into account parameters such as the supply limit and block creation time that differ between blockchains.

Developer’s first object posted on the Litecoin network using this protocol was the MimbleWimble white paper, which was activated on the Litecoin network in May. According to them, unlike the Bitcoin blockchain where object placement can cost around ten dollars, the cost of this operation on Litecoin will be around two cents.

Some mining companies have welcomed this trend, such as Luxor Technologies, which has acquired the OrdinalHub platform for issuing, selling, and tracking Bitcoin-NFTs. Company representatives noted that the segment is still fragmented, with the issuance and transactions of new assets being concluded on various Discord servers. This makes it difficult for creators and collectors to track projects and the lack of an escrow system hinders trade development, leading to high commissions.

Researchers have speculated that the recent surge in popularity of Bitcoin-NFTs could potentially elevate the Stacks Network project from Blockstack to become an ecosystem with a multibillion-dollar capitalization. Stacks Network operates as a second-tier network that provides Bitcoin-compatible smart contracts, using the first cryptocurrency’s blockchain as a layer of security for transactions.

Within the past 30 days, quotes for Stacks (STX) have surged by over 150%, and the coin’s market capitalization is fast approaching the $1 billion mark.

Conclusions

The Ordinals phenomenon has been one of the most surprising events in the history of Bitcoin, sparking lively discussions around the project. With the recent surge in popularity of NFTs on Ethereum and other blockchains, it’s possible that this trend will continue, resulting in a steady demand for block space on the digital gold network.

Currently, inscriptions are loading the mempool, but there are no signs of crowding out legitimate financial transactions, and the minimum fee level for including a transaction in a block has only slightly increased.

Regardless of how the community feels about Bitcoin-NFTs, they are already having a significant impact on the network’s key metrics. It will be interesting to observe the further development of the Ordinals ecosystem and its impact on the rest of the market, as well as the dynamics of on-chain data.