The Bitcoin price may experience its most significant day of the month today, depending on the interest rate decision made by the U.S. Federal Reserve (Fed) and the subsequent press conference by the Federal Open Market Committee (FOMC). In March, the Fed increased the benchmark interest rate by 0.25 basis points (bps), and while the central bankers were unsure of their next move at the time, Fed Chairman Jerome Powell stated that any further rate hikes would be dependent on data.

25 Bps Expected

The market has already factored in the possibility of a 25 basis point rate hike, which is not expected to have a significant impact on the Bitcoin price. The announcement of the interest rate decision at 2 p.m. EST (8 p.m. CET) is not expected to cause any major volatility, with the exception of an unexpected early pause, although this is highly unlikely.

Therefore, investors will be closely watching the FOMC press conference at 2:30 pm EST (8:30 pm CET). The most significant statement from Fed Chairman Jerome Powell is expected to be whether or not the Fed will pause interest rates in June. If the Fed does pause interest rates, the Bitcoin market is likely to react positively. Conversely, if Powell denies this statement or states that it depends on the data, it could have a bearish effect on the market.

The upcoming Federal Reserve decision has the potential to sway the direction of both the US dollar and Bitcoin. If the Fed adopts a dovish stance, this could push the US dollar down and lead to a bullish trend for Bitcoin. Conversely, a hawkish approach could lead to a rally in the US dollar and a bearish trend for Bitcoin.

As the Fed decision looms, Bitcoin is currently facing challenges at the $30k mark, struggling to break past horizontal resistance while forming a possible head and shoulders pattern. Although incomplete, a break below the pattern’s neckline could lead to further weakness in Bitcoin’s price. However, if the price does dip below the neckline, buyers may be incentivized to enter the market around the $24k area, where previous resistance levels may offer support.

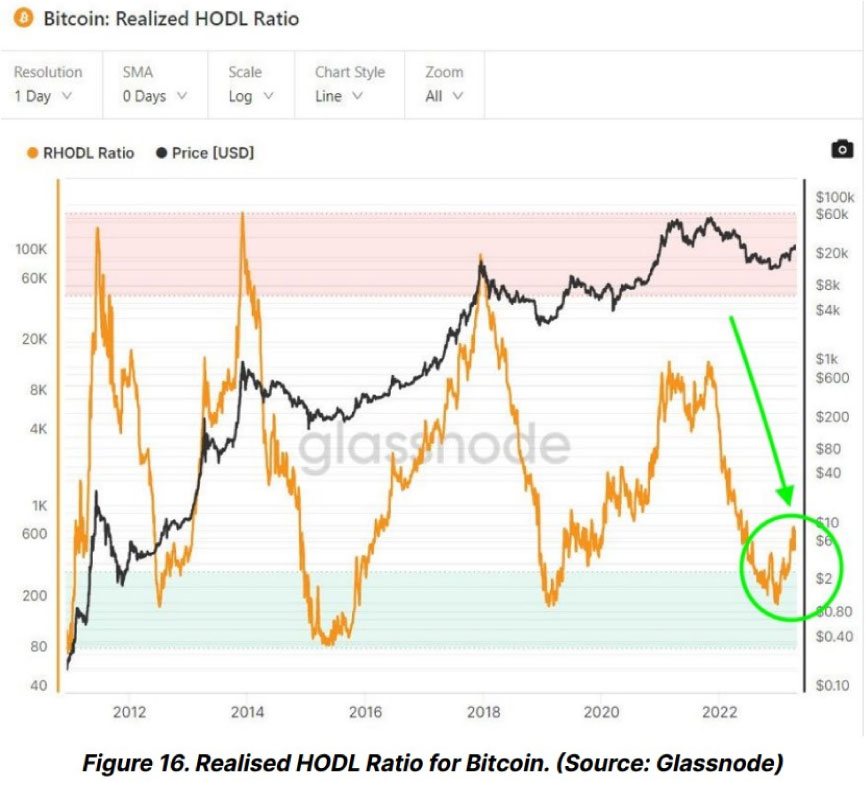

The realized HODL ratio for Bitcoin

The RHODL ratio, a metric used to gauge the health of the Bitcoin market, has recently shown favorable signs for buying future dips. This ratio, which has a simple interpretation, shows that the market was overheating whenever it reached the red band. This indicated the end of a bullish cycle and the start of a bearish one.

On the other hand, when the RHODL ratio reaches the green band, it suggests that the bearish market is coming to an end, and a bullish cycle may begin. Bitcoin experienced a rally at the beginning of 2023, as the RHODL ratio indicated the end of the bearish market and the start of a new bullish cycle.

Investors may find this metric helpful in determining the best time to buy or sell Bitcoin, as it can provide insight into the market’s overall sentiment and direction. As always, investors should exercise caution and conduct thorough research before making any investment decisions.

Follow for more:

Telegram: https://bit.ly/3KbviBe

Twitter: https://bit.ly/3Zr6h9E

Website: https://bit.ly/3FWBaMc