NFT liquidity has experienced a significant downturn as marketplaces fiercely compete for a shrinking pool of traders and investors. In response to this concerning trend, several marketplaces are implementing strategies to entice traders and keep them engaged on their platforms.

NFT liquidity refers to the ease and availability of buying and selling non-fungible tokens (NFTs) within the market. High liquidity indicates a thriving ecosystem, where buyers and sellers are abundant, resulting in smooth and active transactions. Conversely, low liquidity signifies a decline in trading activity and the challenge of finding suitable counterparties for trades.

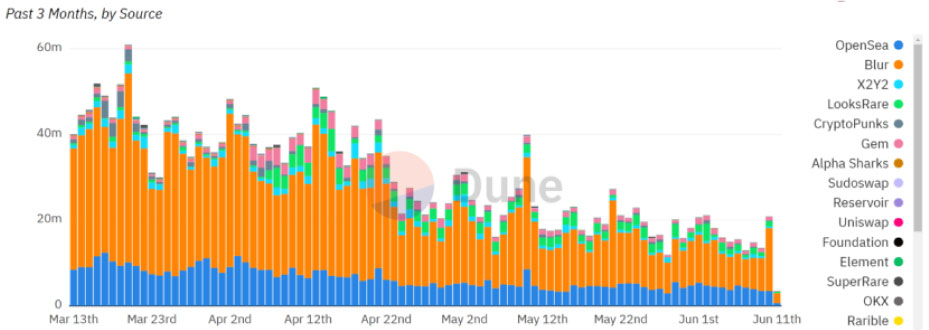

Decline in Daily NFT Trade Volume Persists

Over the past three months, the daily trade volume of NFTs has witnessed a steady decline. On March 13, the market saw approximately 44,000 NFT trades, while on June 12, that number had dwindled to around 25,000. Furthermore, in May 2023, NFT sales may have dipped below $1 billion for the first time this year. However, the situation is not as straightforward as it appears.

An analysis of the report reveals a 27% increase in active wallets associated with NFT activities in May. This growth can be attributed to the Miladys NFT collection, which received a substantial boost from none other than Elon Musk.

To counter the declining trading activity, NFT marketplaces are taking steps to enhance incentives for traders. On June 7, Blur, a prominent NFT marketplace, announced updates to its incentive system. The platform emphasized rewarding bidders who take genuine risks with the highest number of Bidding Points. In line with this, Blur will allocate $BLUR rewards to users who contribute significantly to the platform’s growth. However, certain unfair practices such as transferring NFTs for loyalty, engaging in wash trading, and spoofing bids will no longer yield the desired benefits.

LooksRare, once a thriving marketplace with daily volumes reaching hundreds of millions of dollars, has experienced a decline since May 2022. Currently, its activity consistently falls below $10 million. Nevertheless, LooksRare aims to reclaim its former glory by launching its own rewards “season” on June 1.

Undeterred by the low trading volumes, Kraken recently entered the NFT trading arena with its own platform, further intensifying the competition within the market.

As of mid-May 2023, Blur retains its position as the largest NFT marketplace, boasting an impressive 62% market share. In contrast, OpenSea lags behind at 26%. However, OpenSea maintains the highest number of traders, with 104,882 active users in the week leading up to the release of the DappRadar report, surpassing Blur’s 12,747.

In conclusion, the NFT market is currently grappling with a decline in liquidity as marketplaces vie for a smaller pool of participants. The introduction of incentives by these platforms aims to counter this trend and retain traders on their respective platforms. As the competition intensifies, market leaders must strive to adapt and innovate to maintain their market share. The future of NFT liquidity will undoubtedly depend on the ability of marketplaces to foster an attractive environment for traders and investors alike.

Follow for more:

Telegram: https://bit.ly/3KbviBe

Twitter: https://bit.ly/3Zr6h9E

Website: https://bit.ly/3FWBaMc