The cryptocurrency market has seen a period of Bitcoin (BTC) trading within a narrow range over the past few weeks. This consolidation phase comes after a consistent decline from its peak of $31,800 this year, which has also influenced the trajectory of other major cryptocurrencies. The absence of significant price fluctuations has left investors and traders eagerly anticipating a catalyst that could drive the market forward.

Open Interest, a critical gauge of market sentiment, has surged to its highest level so far this year. Notably, the historical correlation between Open Interest and Bitcoin’s price has been substantial, suggesting that this surge could signal a potential reversal in the fortunes of the leading cryptocurrency. Following a recent dip to $28,700, crypto traders have taken up long positions, instilling optimism for a resurgence in Bitcoin.

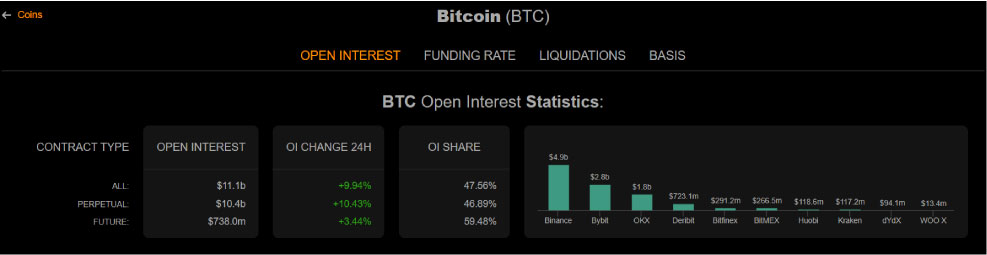

However, the count of open long and short positions on cryptocurrency derivative exchanges has surged to an impressive year-to-date peak of $11 billion. This surge in Open Interest holds significance as it indicates heightened market activity and increased involvement from traders.

An essential point to consider is the historical relationship between Open Interest and the price of Bitcoin. This connection has often been strong, with Open Interest acting as an early indicator of possible price shifts.

As Open Interest climbs to new heights, it implies that market participants are actively staking positions in anticipation of a significant market change. Despite the recent downturn in the crypto market, the spike in Open Interest to an annual high offers hope for a bullish turnaround.

Bearish Divergence Suggests Potential BTC Pullback

Bitcoin has displayed intriguing patterns of late, capturing attention from both technical analysis and on-chain analysis perspectives. On-chain analysis indicates a weakening return index performance alongside a rising Bitcoin price, possibly indicating a phase of re-accumulation that could benefit investors seeking lower prices.

Bearish divergence on the BTC Average Return Index points to a potential pullback toward $26,000. The transition of the return index into negative territory suggests a shift in market sentiment toward re-accumulation.

Re-accumulation typically occurs when long-term investors or institutions acquire Bitcoin at lower prices, foreseeing future price appreciation. This behavior can be viewed as a positive indicator for the market’s long-term health, reflecting heightened interest from strategic investors.

As of the latest update, BTC has broken out of the range that persisted since the beginning of August. It is currently trading at $29,600, marking a 2.5% increase over the past 24 hours.

However, the short-term upward movement of BTC might not be sustained unless accompanied by significant trading volume. Several notable resistance levels lie ahead, presenting challenges for BTC’s attempt to reclaim the $30,000 milestone.

To start with, the $29,700 zone poses a substantial barrier, followed by subsequent resistance levels at $30,000, $30,700, $31,200, and $31,500. In the short and medium term, BTC will require a compelling catalyst to surpass these levels. Without such a catalyst, a retracement could be possible in the upcoming weeks.