The Bitcoin halving event holds immense significance for the entire cryptocurrency industry, as it has a significant impact on market participants’ activity and miners’ profitability. With the next halving predicted to occur in just a year, experts and crypto enthusiasts alike are speculating on the potential movement of BTC price leading up to and following this crucial event. In this article, we delve into the forecasts put forth by industry professionals and the expectations of the community members.

The impact of the Bitcoin halving on the crypto market is significant, as it is a fundamental mechanism in the bitcoin protocol that can greatly influence market sentiment. The reduction in miners’ rewards for mining blocks leads to a decrease in the available coins for purchase, driving up the price of bitcoin due to increased demand.

However, the sharp price increase following a halving event is often followed by a deep correction as the market adjusts to the new dynamics of supply and demand. This is evident in the relatively modest percentage growth in the current cycle compared to past halvings.

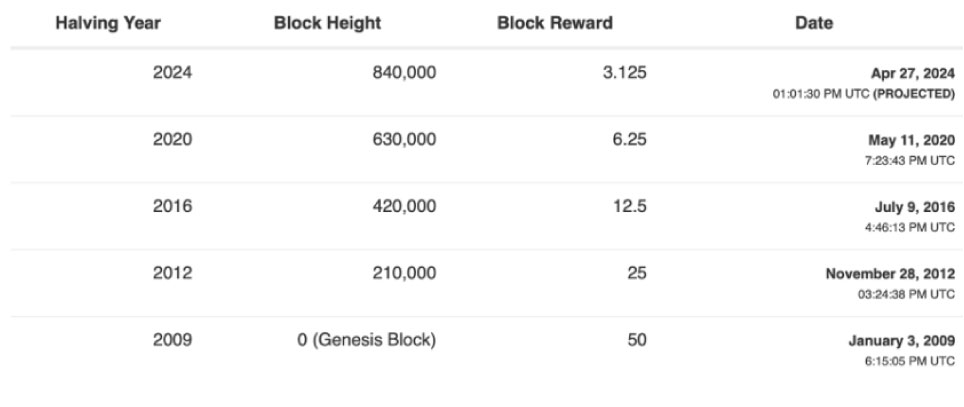

The upcoming halving will reduce miners’ rewards from 6.25 BTC per block to 3.125 BTC, requiring them to potentially make adjustments to their operations such as upgrading hardware or adopting more efficient mining algorithms. Some miners may even choose to cease operations if mining becomes unprofitable due to reduced rewards.

Furthermore, the halving event serves as an incentive for developers to create innovative solutions aimed at enhancing the efficiency and security of the network. For instance, the implementation of the Lightning Network, which facilitates fast and low-cost transactions, was partly driven by the need to address blockchain congestion and transaction fees.

Moreover, the halving can impact the evolution of cryptocurrency regulations. It may prompt discussions among investors, governments, and financial institutions about the appropriate regulatory framework for cryptocurrencies, and the need for clearer guidelines to ensure market stability, investor protection, and compliance with existing financial regulations. The halving event can therefore have far-reaching implications beyond just the mining rewards and can shape the regulatory landscape of the cryptocurrency industry.

Crypto experts hold a positive outlook for Bitcoin’s future.

Since the start of 2023, the flagship cryptocurrency has seen a remarkable 67% price surge, bouncing back from a significant dip below $16,000. Despite currently grappling to regain the $30,000 level, notable crypto analysts are forecasting substantial growth for Bitcoin.

According to Bloomberg Intelligence analyst Jamie Douglas Coutts, BTC is projected to surpass the $50,000 mark in the next year. Coutts explains, “Historically, the price of Bitcoin hits bottom roughly 12-18 months before the halving, and the structure of this cycle resembles past ones, although much has changed. The network has become much stronger, but BTC has never experienced such a prolonged and severe economic downturn.”

Similarly, Marcus Tilen, Head of Research at Matrixport, anticipates that Bitcoin could reach an estimated value of $65,623 by April 2024.

Furthermore, some renowned analysts speculate that Bitcoin’s price could witness a staggering jump, exceeding $100,000, due to financial instability in the United States and other global factors. Such bullish predictions reflect the optimism among experts regarding Bitcoin’s potential for significant price growth in the future.

The crypto community remains divided with a skeptical outlook.

While we can’t be certain about anything in this highly volatile market, the charts clearly show that we are still far from a breakthrough, making such an outcome seem plausible. On the other hand, there are those who hold a more pessimistic view, anticipating more challenges for Bitcoin’s price:

Based on historical patterns, we should brace ourselves for several more corrections throughout 2023 and even in 2024 after the halving. The bull cycle may not commence until late 2024 or even 2025, with potential profits to be realized only by the end of 2025. The cryptocurrency market has never faced a combination of recession, historical inflation, wars, and anti-cryptocurrency regulations. We are currently navigating through uncharted waters in the accumulation/selling zone.

These unique perspectives from Reddit users reflect the diverse opinions within the crypto community, with some cautiously optimistic and others bracing for potential challenges in the coming years, underscoring the unpredictable nature of the cryptocurrency market.

Follow for more:

Telegram: https://bit.ly/3KbviBe

Twitter: https://bit.ly/3Zr6h9E

Website: https://bit.ly/3FWBaMc