Bitcoin surpassed the significant threshold of $22,000 on Monday and its value climbed to a little over $24,300 on Tuesday, March 14th. This rise follows the announcement of the rescue of depositors at Silicon Valley Bank, which has contributed to Bitcoin’s upward momentum. Despite earlier predictions of a decline and a test of the $19,500 level, these forecasts have yet to materialize.

Amid news of Silvergate Bank’s liquidation, the value of the leading cryptocurrency dropped below $20,000 on March 10. The situation was further complicated by the insolvency of Silicon Valley Bank, which was closed by the California Department of Financial Protection and Innovation on the same day due to insufficient liquidity. The FDIC was appointed to manage the institution.

The problems faced by SVB have affected its clients, including Circle, which revealed on March 11 that it had stored $3.3 billion worth of the asset’s reserve collateral with the bank. However, the company promised to cover any shortfall in reserves the very next day.

The depegging of USD Coin, along with algorithmic stablecoins, resulted in the loss of parity against the dollar. This impacted stablecoins like DAI and FRAX.

On March 12, the US Treasury, the Fed, and the Federal Deposit Insurance Corporation (FDIC) jointly released a statement outlining measures to support the banking system. According to the authorities, depositors of Silicon Valley Bank and Signature Bank, which was also closed by authorities, will receive a full refund.

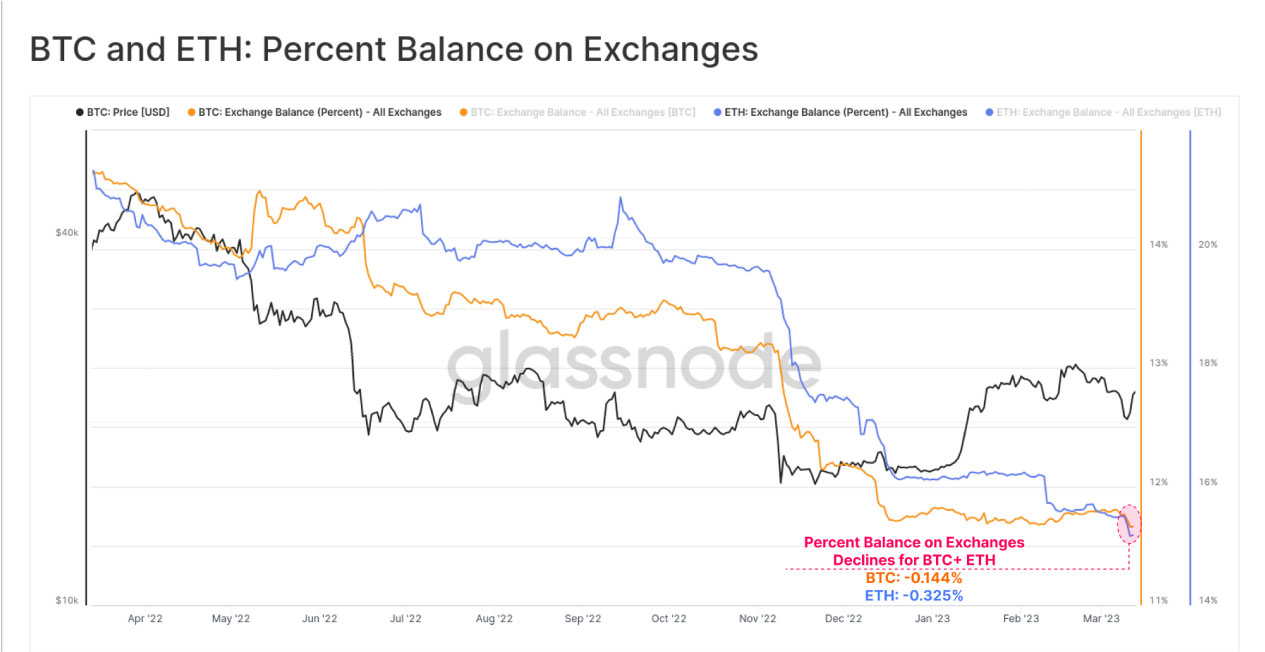

The news of SVB’s collapse has led to a surge in demand for Bitcoin and Ethereum, prompting investors to withdraw their coins from centralized platforms. This behavior mirrors the pattern observed during the FTX collapse.

Demand for Cryptocurrency

Over the past few days, the exchange balances of the two largest cryptocurrencies by market capitalization have decreased by 0.144% and 0.325%, respectively, of their available supply. This has resulted in a total outflow of $5.9 billion on a monthly basis.

Experts highlighted that investors withdrew approximately $1.8 billion worth of bitcoins and Ethereum. This amount is relatively small compared to similar incidents in the past, which indicates the confidence of market participants.

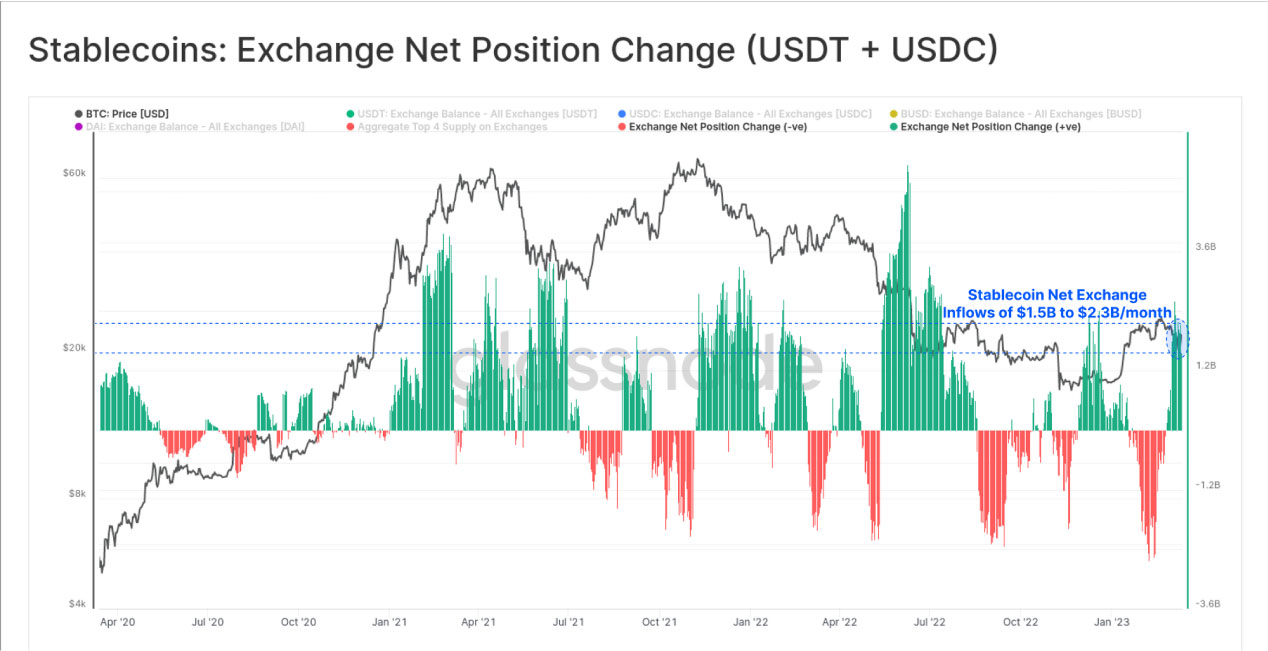

According to analysts, there was a monthly inflow of $1.5 billion to $2.3 billion in USDT and USDC into exchanges. However, the outflow rate of BUSD was higher, amounting to approximately $6.8 billion, suggesting a shift towards stablecoins.

The market response to the influx of stablecoins and the withdrawal from Bitcoin and Ethereum exchanges reflects investors’ preference for non-custodial storage of cryptocurrencies that do not require trust, according to experts.

Why Bitcoin is rising today

The reason behind Bitcoin’s current surge in value can be attributed to the launch of a government program in the United States. This program will provide local banks access to liquidity to cover deposit obligations, with the US Federal Reserve offering $25 billion in financial assistance. The decision was taken after the closure of banks such as Signature Bank and Silicon Valley Bank due to a series of bankruptcies in the banking industry.

The cryptocurrency community has reacted positively to this news, as they anticipate the launch of a printing press and the return of regulators to the policy of quantitative easing. This has led to optimism within the community that some of the funds will be allocated to the cryptocurrency market, resulting in an increase in the value of cryptocurrencies, including Bitcoin.

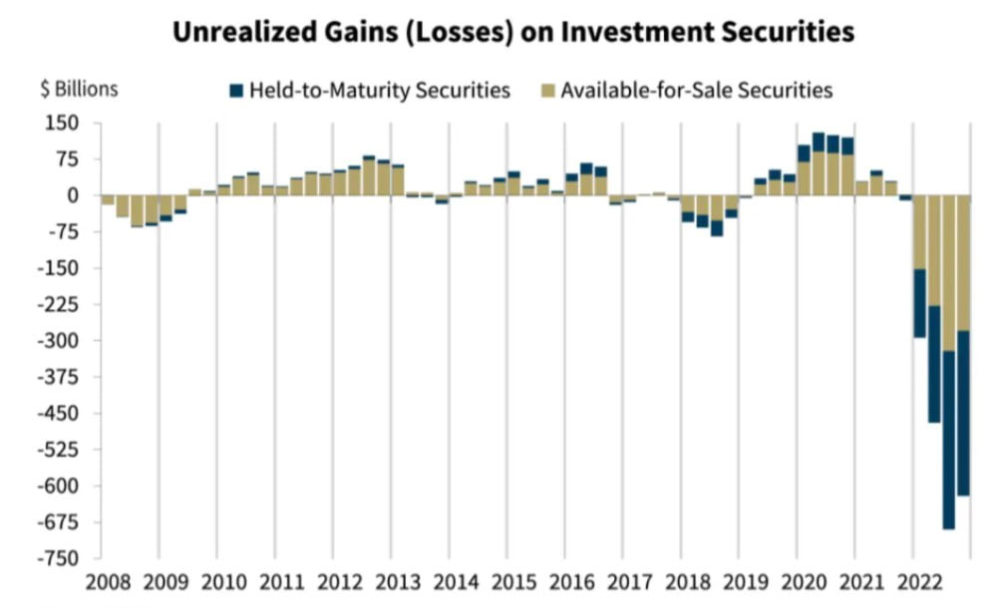

It is well-known that the launch of the printing press in the USA often results in positive trends for Bitcoin and other altcoins. Interestingly, reports suggest that American banks are facing an unrealized loss of $620 billion, with some publications even listing banks such as First Republic Bank, Sandy Spring Bancorp, New York Community Bancorp First Foundation, and others that may face bankruptcy.

Bitcoin price in the short term

Given the favorable conditions, Bitcoin has experienced an upward trend. However, what can we expect for the short-term future? It is possible that the bearish trend is coming to an end, and Bitcoin may attempt to surpass the $22,500 level. Nevertheless, it is too early to conclude that the bullish trend is fully established, and the bears have conceded their positions.

While it is not entirely ruled out, it is unlikely that Bitcoin will reach the $25,000 level. If the Fed decides to tighten monetary policy, then Bitcoin’s value may decrease, and the bears could make a comeback.